The bitcoin price hovered below $90,000 near $80,000 today as traders made another late push to recover year-end losses during thin holiday trading, but the market again lacked the conviction needed for a sustained breakout.

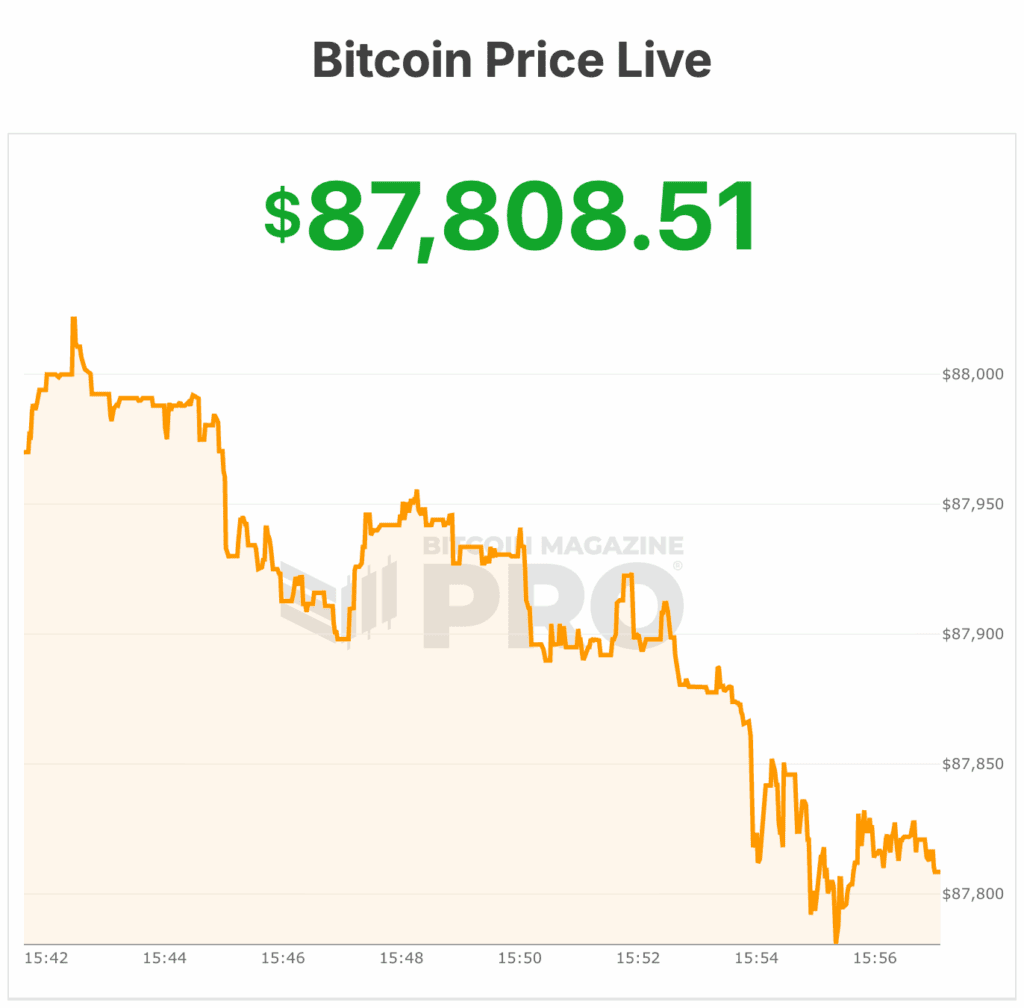

The bitcoin price stood at $88,063 at the time of writing, up about 1% over the past 24 hours, according to market data. Trading volume totaled roughly $40 billion, reflecting muted participation as December draws to a close.

Bitcoin is now about 1% below its seven-day high of $89,201 and roughly 1% above its seven-day low of $86,855.

The world’s largest cryptocurrency has a circulating supply of 19,969,296 BTC, with a hard cap of 21 million coins. Bitcoin’s total market capitalization is approximately $1.76 trillion, up 1% from a day earlier.

Bitcoin pushed toward the $90,000 level yesterday for a second straight session before the rally stalled once again. Price action remains confined to a broad range between roughly $85,000 and $95,000, a structure that has defined the market since a sharp October sell-off.

That drawdown followed Bitcoin’s all-time high in early October, when prices were up nearly 30% on the year.

Since then, sentiment has shifted. The bitcoin price is now down about 5% from last December, putting it on track for its first annual loss in three years.

“I’d continue to expect exaggerated moves on light flow through New Year’s,” Jasper De Maere, desk strategist at Wintermute, said in a note to Bloomberg.. He cautioned traders against relying too heavily on short-term signals until liquidity returns to normal levels.

The recent price stagnation contrasts with the broader recovery in traditional risk assets. Bitcoin began the year with a strong rally fueled by optimism around crypto-friendly policies under the second Trump administration.

That enthusiasm faded as uncertainty surrounding President Donald Trump’s tariff agenda rattled global markets.

Bitcoin price battling with leveraged traders

While U.S. equities have largely rebounded from those shocks, Bitcoin has struggled to regain momentum. The October downturn was compounded by a wave of liquidations after leveraged positions reached record levels. On Oct. 10, a sharp sell-off flushed out long exposure and reset market positioning.

Demand for spot Bitcoin exchange-traded funds has also weakened. According to data by Bloomberg, ETF outflows have reached roughly $6 billion in the fourth quarter, adding steady pressure as Bitcoin failed to reclaim the $90,000 threshold.

Holiday trading conditions have further distorted price action. Earlier this week, the bitcoin price swung sharply around $90,000 during low-liquidity sessions, posting fast gains and losses that lacked follow-through.

Prices briefly rose about 2.6% during thin trading and held above $86,000 over the week, but again failed to sustain levels above $90,000 during Asian hours.

QCP Capital said recent moves reflect a market short on participation. In a note, the firm pointed to a steep decline in derivatives activity following last Friday’s record options expiry. Open interest dropped by nearly 50%, signaling that many traders moved to the sidelines.

That options expiry also altered short-term market dynamics. According to QCP, dealers who were long gamma ahead of the event are now short gamma on the upside. In such conditions, rising prices can force hedging activity that amplifies short-term moves, particularly when liquidity is thin.

A similar setup emerged earlier this month when the bitcoin price briefly approached $90,000. Funding rates climbed quickly as traders crowded into bullish positions, creating short-lived upward pressure.

Deribit’s perpetual funding rate surged above 30% following the latest expiry, up from near-flat levels beforehand. Elevated funding rates often indicate overheated positioning and raise the cost of maintaining long exposure.

From a technical perspective, Bitcoin Magazine analysts said the market continues to reject lower levels within a broadening wedge pattern, suggesting downside momentum is weakening. Key resistance sits at $91,400 and $94,000. A weekly close above $94,000 could open a path toward $101,000 and $108,000, though resistance remains heavy.

On the downside, $84,000 remains critical support. A break below that level could send the bitcoin price toward the $72,000 to $68,000 range.