Join Our Telegram channel to stay up to date on breaking news coverage

Fears that Michael Saylor’s MicroStrategy (MSTR) may be forced to sell Bitcoin if it is delisted from MSCI indexes is “flat wrong,” said Bitwise CIO Matt Hougan.

“I understand why bears want to embrace the MSTR ‘doom loop’ idea,” he said in a Dec. 3 note to clients. “It would indeed be very bad for the bitcoin market if MSTR had to sell its $60 billion of bitcoin in one go. But with no debt due until 2027 and enough cash to cover interest payments for the foreseeable future, I just don’t see it happening.”

He noted that with Bitcoin’s price at $92k, and it’s trading at $92.9k as of 11:52 a.m. EST, it’s 24% above the average price at which Strategy acquired its stash, Hougan said.

”There are lots of things to worry about in crypto,” he added. ”Michael Saylor and Strategy selling bitcoin is not one of them.”

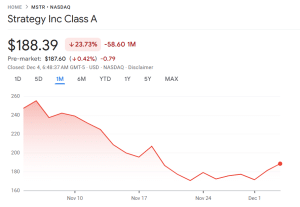

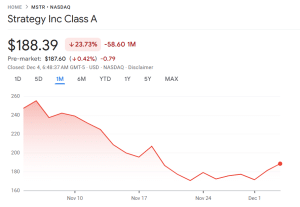

The concerns come as MSTR finds itself in a funk. Google Finance data shows that MSTR has plummeted over 23% in the past month, and almost 50% in the last six months.

MSTR price (Source: Google Finance)

MSCI And Other Index Removals Won’t Have Such A Big Impact, Hougan Says

MSCI announced on Oct. 10 that it was considering removing digital asset treasury (DAT) companies from its investable indexes, with a decision due next month.

JPMorgan estimates that such a delisting would likely result in up to $2.8 billion of MSTR stock being sold, and much more if other index providers followed suit, with some $9 billion of MSTR held by passive fund managers.

“I’m not convinced that removal would be a big deal for the stock,” Hougan said. “$2.8 billion is a lot of selling, but my experience from watching index additions and deletions over the years is that the effect is typically smaller than you think and priced in well ahead of time.”

When MSTR was added to the Nasdaq 100 Index last December, funds tracking the index had to buy $2.1 billion of MSTR, Hougan said, adding that the company’s stock price “barely moved.”

“Long-term, the value of MSTR is based on how well it executes its strategy, not on whether index funds are forced to own it,” he argued.

In response to fears of the delisting from MSCI indexes, Saylor said, ”We’re a publicly traded operating company with a $500 million software business and a unique treasury strategy that uses Bitcoin as productive capital. Index classification doesn’t define us.”

Response to MSCI Index Matter

Strategy is not a fund, not a trust, and not a holding company. We’re a publicly traded operating company with a $500 million software business and a unique treasury strategy that uses Bitcoin as productive capital.

This year alone, we’ve completed…

— Michael Saylor (@saylor) November 21, 2025

Math Shows That Strategy Has No Reason To Sell Bitcoin

Hougan also said the simple math does not support the idea of doom loop for MSTR.

“MSTR has two relevant obligations on its debt: It needs to pay about $800 million a year in interest and it needs to convert or roll over specific debt instruments as they come due,” Hougan said. ”Both of these obligations are not a near-term concern for Strategy.”

The interest payments are not a near-term concern because the company has $1.4 billion in cash, meaning it can make its dividend payments easily for a year and a half, he said.

Strategy’s first debt instrument does not come due until February 2027, and the amount is only about $1 billion, which Hougan said is “chump change” for a company that currently holds $60 billion in Bitcoin on its balance sheet.

Could insiders pressure MSTR to sell bitcoin if its stock continued trading lower, Hougan asked.

”Doubtful,” he said. ”Michael Saylor himself controls 42% of the voting shares, and you’d be hard pressed to find a human being with more conviction on bitcoin’s long-term value. He didn’t sell the last time MSTR stock traded at a discount, in 2022.”

Related Articles:

Best Wallet – Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage