Lending Rebounds Sharply as Rates Stabilize and Spreads Tighten

U.S. commercial real estate lending accelerated in the third quarter of 2025 as calmer interest-rate conditions and narrowing credit spreads helped close the pricing gap that has stalled investment activity for much of the past two years. The pickup is drawing capital back into core property sectors and reviving deal flow across the country, according to new research from CBRE.

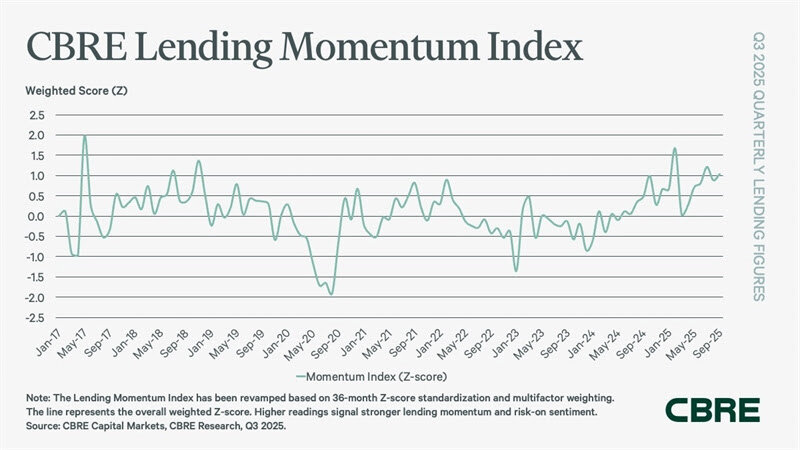

CBRE’s Lending Momentum Index — which measures the pace of loan closings the firm originates — jumped 112% from a year earlier to 1.04 at the end of the quarter, its highest reading since 2018. The firm attributed the surge largely to a 36% increase in permanent financing, with September posting some of the strongest origination volumes in years.

Borrowing costs remain well off their cycle peaks, but spreads diverged by asset class. Average spreads on commercial mortgages widened modestly to 197 basis points in the third quarter, up 4 basis points from the prior quarter and 14 basis points from a year earlier. Multifamily spreads moved the opposite direction, tightening 27 basis points year-over-year to 141 basis points amid intensifying competition among agency lenders. The metrics are based on seven- to 10-year fixed-rate loans with loan-to-value ratios between 55% and 65%.

“We’re seeing a broad recovery in investment sales across all major asset classes, led by high-conviction sectors like multifamily and industrial,” said James Millon, president and co-head of U.S. and Canada Capital Markets at CBRE. “Core capital is beginning to return selectively, shaping equity pricing in key markets and building real momentum. Stabilizing financing costs — with the five-year Treasury holding in the mid-3% range — coupled with tightening spreads and a shift toward floating-rate structures are narrowing the bid-ask gap and unlocking transactions.”

Millon added that office financing and sales volumes have “surged by multiples, not percentages,” as investors concentrate on the strongest buildings in the fastest-growing markets. Construction lending also remains active, particularly for build-to-core multifamily and hyperscale data-center projects. He expects the improving trajectory to extend into 2026.

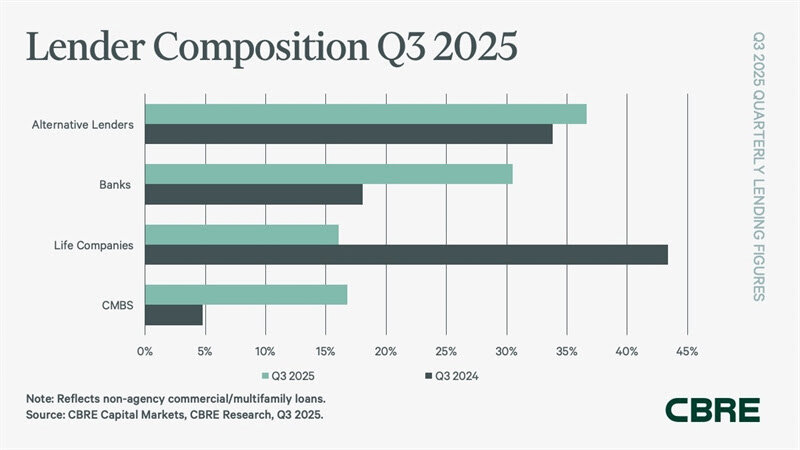

Alternative lenders again accounted for the largest share of CBRE’s non-agency loan closings in the third quarter, capturing 37% of volume, up from 34% a year earlier. Debt funds were the main driver, boosting originations 68% year-over-year. Banks regained significant ground as well, raising their market share to 31% from just 18% a year ago as their lending volume surged 167%, marking a notable re-entry into the market after a prolonged pullback. CMBS lenders also posted striking gains, lifting their share to 17% from 5% as securitized issuance climbed more than fivefold. Life companies, by contrast, saw their share fall sharply to 16% from 43% last year.

Multiple indicators point to a gradually easing credit environment. Loan constants fell 20 basis points from the second quarter, while average mortgage rates dropped 28 basis points. Lenders also took on marginally more risk: average LTV ratios ticked up to 63.8%, from 63.3% in the prior quarter.

Agency lending for multifamily properties strengthened considerably, with government-backed originations reaching $44.3 billion — a 53% increase from the second quarter and 57% from a year earlier. CBRE’s Agency Pricing Index, which tracks fixed mortgage rates for seven- to ten-year permanent loans, fell to 5.6%, down 13 basis points quarter-over-quarter and 27 basis points year-over-year.