Bitcoin Price Weekly Outlook

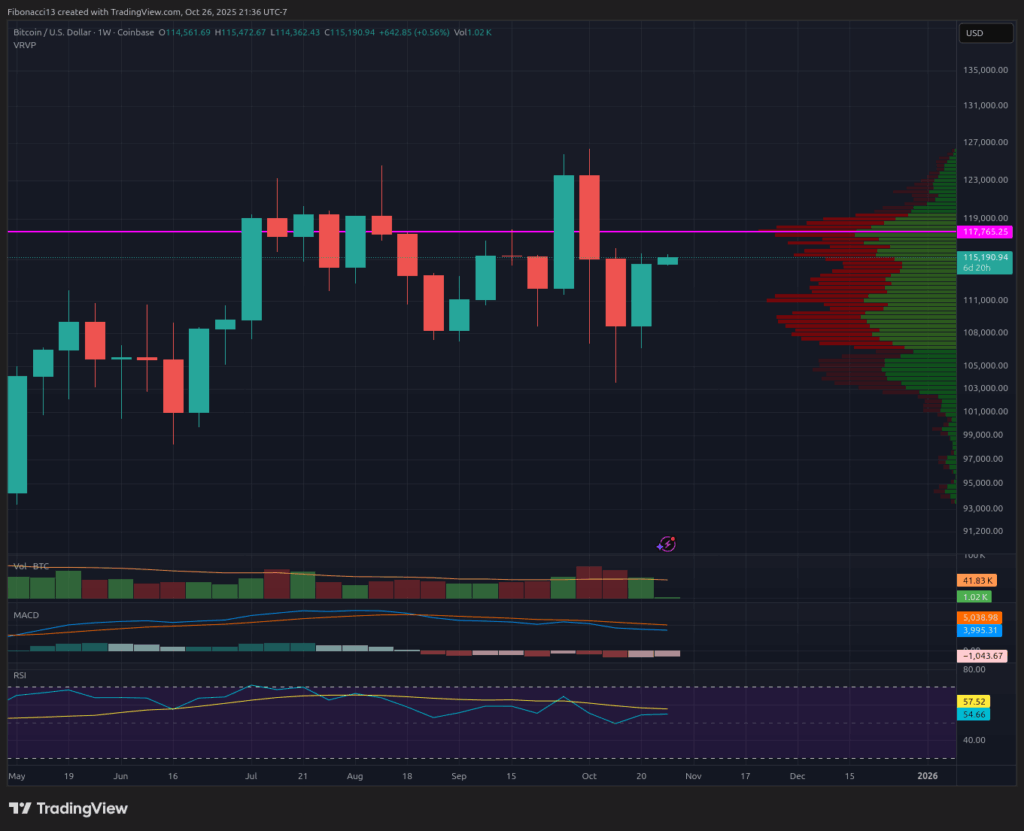

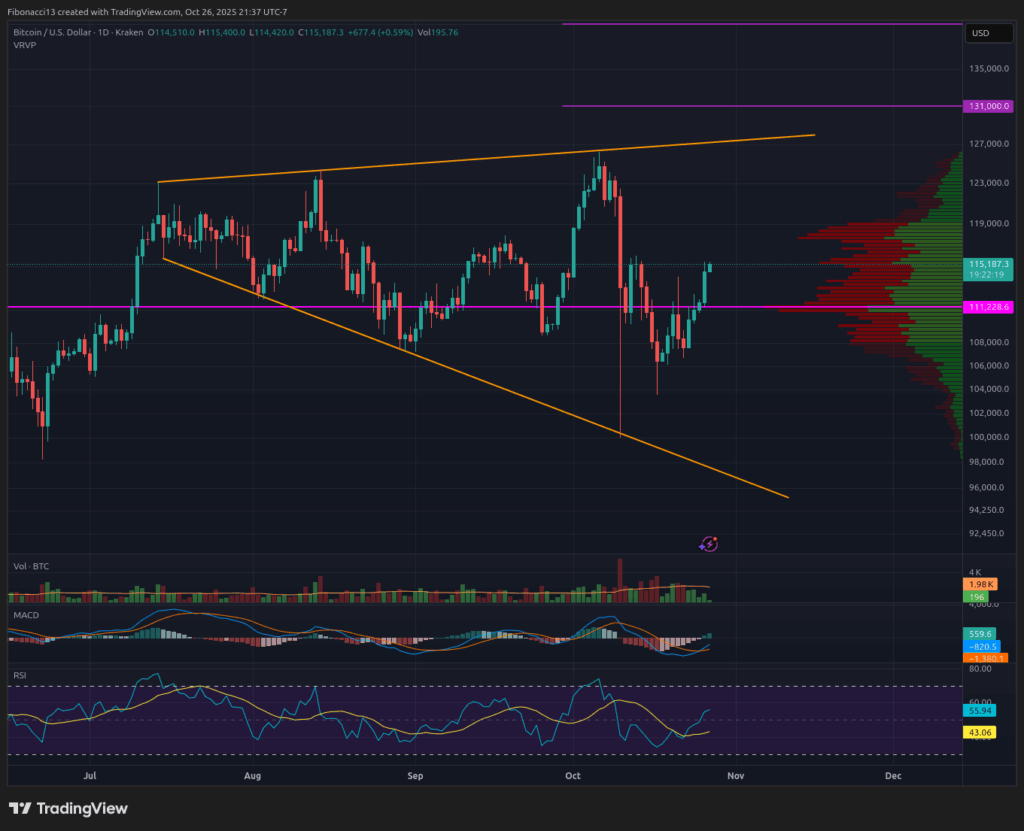

Bitcoin’s price action was rather subdued last week, keeping traders guessing whether or not we would see another large drop in price entering the weekend. Price held above the lows, however, slowly plodding a little bit higher to close out the week at $114,530. Bulls should not be overly disappointed with this price action, as they did reclaim the $112,200 resistance level, and are now closing in on conquering the next resistance level at $115,500. The bears are still sitting comfortably in control, though, with stronger resistance levels hanging overhead that the bulls have yet to challenge. This may be an interesting and volatile week ahead, with the FOMC meeting on Wednesday and a slough of large companies reporting third-quarter earnings.

Key Support and Resistance Levels Now

Nothing has materially changed from last week’s resistance levels as the bulls have made little progress. Heavy resistance is still sitting at $117,600 and $122,000 above there, so the bears aren’t feeling any real pressure yet. If by chance this week gets above $122,000, we will look to the upper boundary of our broadening wedge pattern at $128,000.

Holding above the prior week’s low is a positive sign for the bulls, while they managed to maintain price above the key short-term support of $106,900 last week as well. This level must hold going forward, as closing below $106,900 opens the door back down to the $105,000 to $102,000 support zone that has already been tested twice. A third test of this support zone would be more likely to break it than to hold it. $96,000 is the long-term bull market support below here, a do-or-die support level if the price were to slide down and test it.

Outlook For This Week

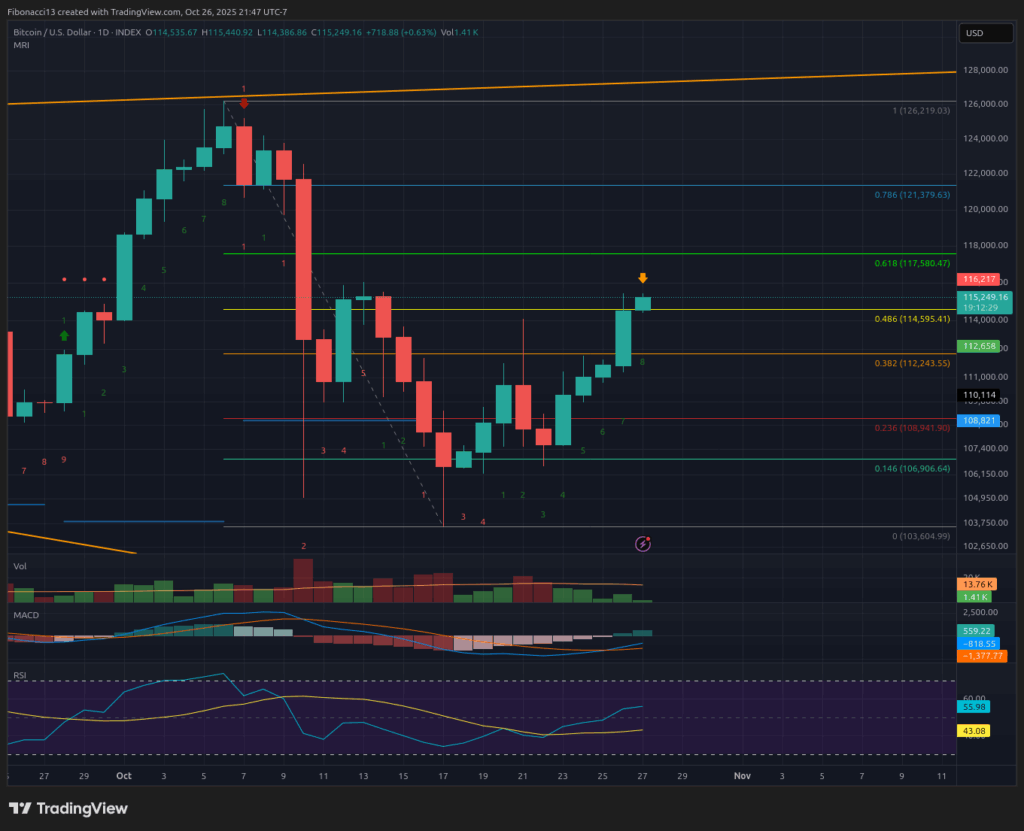

Expect significant volatility this week, especially on Wednesday, as we have the Federal Reserve’s interest rate decision and ensuing Powell speech, followed by major earnings reports from Microsoft, Meta, and Google after market close. Bulls will look to hold $109,000 as a floor into this week, as doing so would position them to maintain upward momentum. Looking at the Momentum Reversal Indicator, we are currently sitting on an 8-count entering Monday. This is a warning candle that we may see momentum begin to fade. Tuesday should bring the 9-count at which point we should expect at least a pause on upward momentum and a 1 to 4 day correction in price. So if bulls can push price up to the 0.618 Fibonacci Retracement at $117,600 by Monday night or Tuesday morning, we should expect to see a rejection ther,e and we can re-assess after Wednesday’s FOMC and earnings reports play out.

Market mood: Bearish – While the bulls gained some ground last week, the bears remain stoic and strong. The bulls must push the price past $122,000 to take back control.

The next few weeks

If bulls can manage to survive through this week, there are still some potential headwinds on the horizon. The US-China tariff dispute may or may not be resolved by the end of next week; a negative outcome will likely send all markets lower. Additionally, the US courts’ ruling on the legality of Trump’s tariffs is expected by November 5th. If these tariffs are reinstated, we should expect markets to head lower to price this impact in.

Terminology Guide:

Bulls/Bullish: Buyers or investors expecting the price to go higher.

Bears/Bearish: Sellers or investors expecting the price to go lower.

Support or support level: A level at which the price should hold for the asset, at least initially. The more touches on support, the weaker it gets and the more likely it is to fail to hold the price.

Resistance or resistance level: Opposite of support. The level that is likely to reject the price, at least initially. The more touches at resistance, the weaker it gets and the more likely it is to fail to hold back the price.

Fibonacci Retracements and Extensions: Ratios based on what is known as the golden ratio, a universal ratio pertaining to growth and decay cycles in nature. The golden ratio is based on the constants Phi (1.618) and phi (0.618).

Broadening Wedge: A chart pattern consisting of an upper trend line acting as resistance and a lower trend line acting as support. These trend lines must diverge away from each other in order to validate the pattern. This pattern is a result of expanding price volatility, typically resulting in higher highs and lower lows.

Momentum Reversal Indicator (MRI): A proprietary indicator created by Tone Vays. The MRI indicator tracks buyer and seller momentum and exhaustion, providing signals to indicate when to expect momentum to fade and accelerate.