China’s economy expanded at 4.8 percent in the third quarter—the slowest rate in a year—according to data released on Monday by its National Bureau of Statistics (NBS), as ongoing trade tensions with the United States continue to weigh on growth.

Why It Matters

The world’s second-largest economy is contending with a mix of challenges, including an ongoing property sector slump, deflationary pressures, and weak domestic demand. Adding to these headwinds is the trade war launched by President Donald Trump during his first term and continued in his second..

While both countries hope to reach an agreement, a breakthrough remains elusive. Earlier this month, China announced tighter controls on rare earth elements, leveraging its dominance over the critical minerals. Trump responded by pledging a 100 percent tariff on all Chinese imports starting next month.

Newsweek reached out to China’s Foreign Ministry by email with a request for comment.

What To Know

The 4.8 percent growth rate matches analyst expectations and puts the country on track to meet Beijing’s target of around 5 percent GDP growth for the year. While this figure marks a 0.4 percentage point slowdown from the previous quarter, overall GDP from January to September grew by 5.2 percent, the government’s report said.

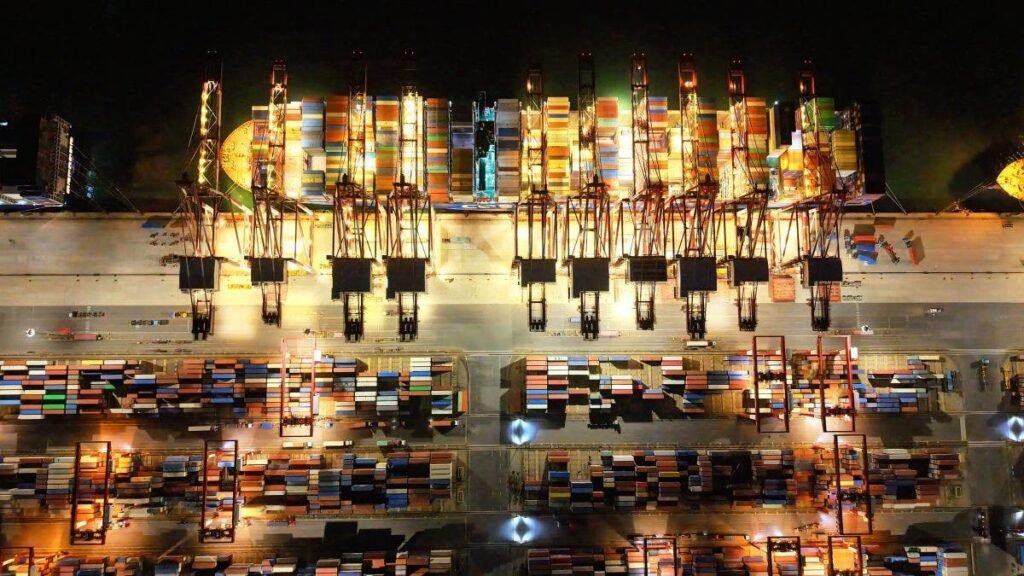

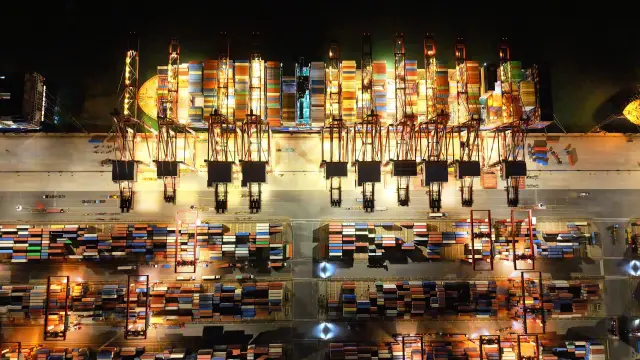

That uptick came on the back of a rebound in exports, which in September rose to a six-month high with an 8.3 percent year-on-year increase, as the country courts to alternative foreign markets to offset lost sales due to Trump administration tariffs.

Exports to the U.S., China‘s largest single trading partner, fell by 27 percent last month.

“Diversified markets have become a strong support for export growth, new momentum in foreign trade has grown, and exports of ‘new three’ products have grown by double digits,” an NBS spokesperson told reporters.

China has been doubling down on production of its “big three” high-tech goods—lithium-ion batteries, solar cells, and new energy vehicles—as it repositions itself from the world’s traditional manufacturing base to a high-value tech producer.

The U.S. and a number of other countries have pushed back, accusing the manufacturing giant of flooding markets with underpriced goods in a bid to counter sluggish domestic demand.

That headwind persists, with the national consumer price index falling by 0.1 percentage points in the first three quarters compared to the same period last year.

What People Are Saying

a Chinese National Statistics Bureau spokesperson told reporters: “Since the third quarter, certain countries have wantonly imposed tariffs, impacting the global economic and trade order. Unilateralism and protectionism have been rampant, increasing instability and uncertainty in global economic and trade growth. The external environment for development has become even more complicated.”

Lynn Song, chief economist for greater China at ING Bank, told Reuters: “With China on track to hit this year’s growth target, we could see less policy urgency. But weak confidence translating to soft consumption, investment, and a worsening property price downturn still need to be addressed.”

Poe Zhao, a Beijing-based technology analyst and founder of China-tech commentary service Dailyio, wrote on X about Beijing’s Q3 report: “The gap is widening between traditional and advanced sectors. China is no longer just scaling up production. It’s automating, digitizing, and electrifying its industrial base. Robotics and EVs are now core growth engines, not side bets.”

What Happens Next

It may be too early to assess the impact of Beijing’s latest stimulus package introduced in September, which includes further monetary easing and targeted support for the housing sector.

Trump has confirmed he will meet with Chinese President Xi Jinping on the sidelines of the Asia-Pacific Economic Cooperation summit in Seoul, scheduled to run from late October through early November. Trump told reporters Monday he anticipates a “fantastic deal” with China.