Spot Bitcoin ETFs saw nearly $3.3 billion in net inflows last week, the 2nd largest inflows in a week. Massive buying by institutional investors was the primary reason BTC price hit a new all-time high of $125.69K amid the “debasement trade,” claims Bloomberg analysts.

Spot Bitcoin ETFs Saw $3.3 Billion in Weekly Inflows

As investors turned towards safe-haven assets amid the U.S. government shutdown, spot Bitcoin ETFs are recording massive inflows. Notably, Bitcoin ETFs in the United States saw $3.3 billion last week amid this “debasement trade” as the US dollar weakens.

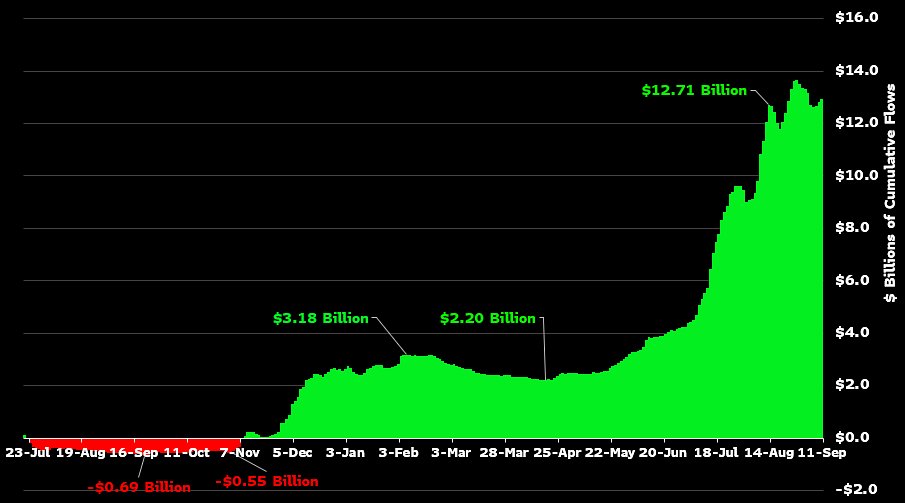

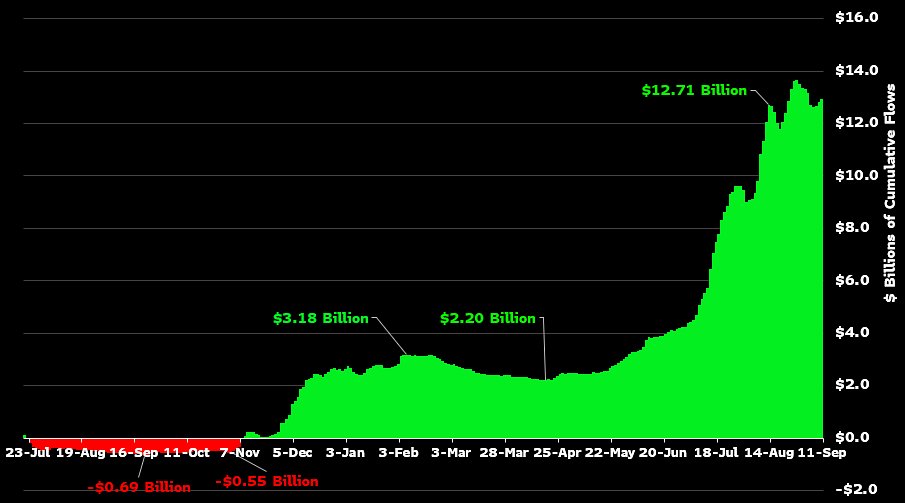

ETF experts Bloomberg’s Eric Balchunas and The ETF Institute’s Nate Geraci highlighted massive inflows into spot Bitcoin ETFs. Geraci quoted the 2nd best inflow week ever as “ridiculous numbers” as net inflows since launching reached over $60 billion.

Eric Balchunas said, “Bitcoin hit ATHs after the ETFs went wild last week with $3.3 billion in a week.” He added that inflows into BlackRock’s IBIT and ETHA have now surpassed $10 billion in a month, ranking 3rd and 4th overall.

Bitcoin hit ATHs last night after the ETFs went wild last week with +$3.3b in a week, $24b for year (also notable $IBIT and $ETHA w $10b for month, rank 3rd and 4th overall) and now $60b lifetime (new high water mark). Pretty good. No way @WhalePanda can still be pissed, right? pic.twitter.com/xHH3yjp4U7

— Eric Balchunas (@EricBalchunas) October 5, 2025

Bloomberg Analysts More Bullish on Bitcoin

The most bullish aspect of BTC price’s new ATH is that it was driven by spot ETF buying rather than treasury companies or perpetual degens. Macro portfolio managers and funds are now viewing Bitcoin as a rotation from commodities and small caps.

Bloomberg ETF analyst James Seyffart confirmed holdings in some Bitcoin ETFs and Ethereum ETFs, along with other ETFs. He added that spot Bitcoin ETFs will continue to outperform spot Ethereum ETFs as long as they are positive on a net basis.

Eric Balchunas claimed Bitcoin has more stable holders now, despite more frequent BTC buying pauses from Michael Saylor’s Strategy. “So more grind up, no god candles but less volatility. The asset class is maturing into an alternative,” he claimed.

BTC price is trading at $123,952 at the time of writing, up 11% in a week. In the last 24 hours, Bitcoin hit a new ATH of $125,559 from an intraday low of $122,459. Trading volume jumped over 65% over the last 24 hours, indicating massive interest among traders.