In the past, we only had access to outdated transaction numbers which made it hard to connect property prices with real demand in the property market. Now, the data from Chris Watkin and TwentyEA gives us a much clearer view of what’s happening when it comes to transactions and how buyers and sellers react to economic and other news, such as property tax changes.

In the past, we only had access to outdated transaction numbers which made it hard to connect property prices with real demand in the property market. Now, the data from Chris Watkin and TwentyEA gives us a much clearer view of what’s happening when it comes to transactions and how buyers and sellers react to economic and other news, such as property tax changes.

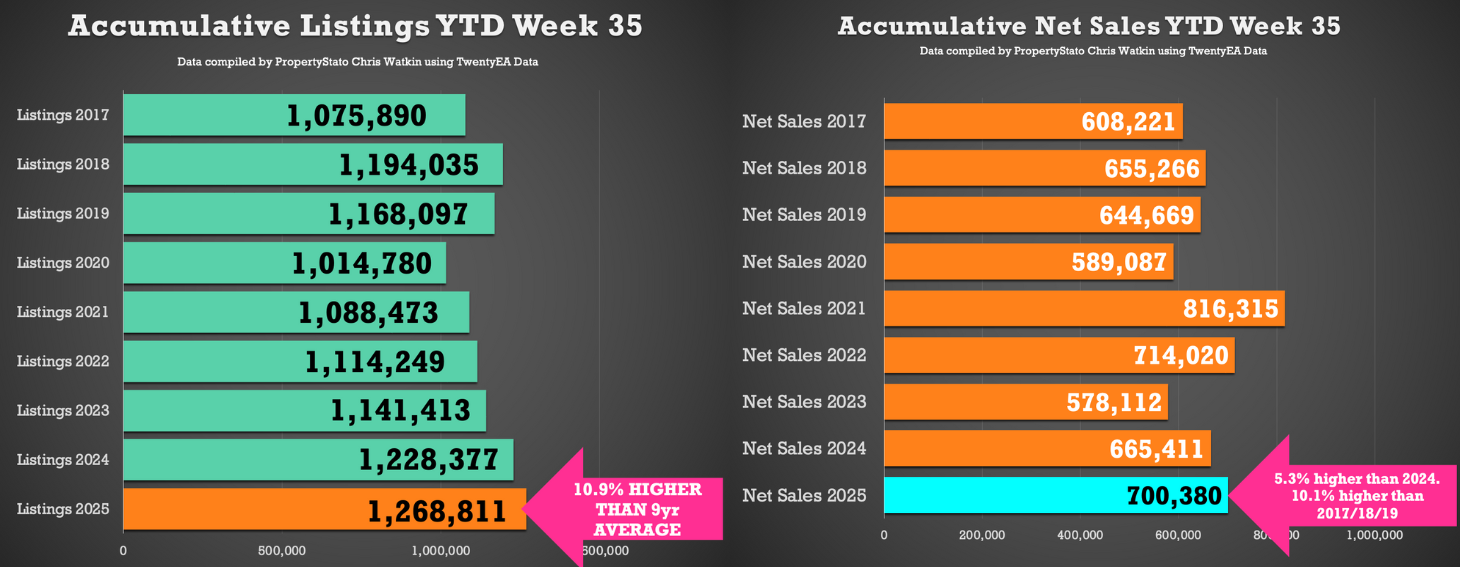

Currently, property listings are up 10.9% compared to the long-term average and 3% higher than last year. This points to a more active market than last year and we’ve seen for some time.

Looking ahead, forecasts suggest the UK should still reach around 1.2 million transactions by the end of 2025. That’s a healthy result, especially given Bank Base Rates are still above the expected ‘new’ long-term norm at 4%.

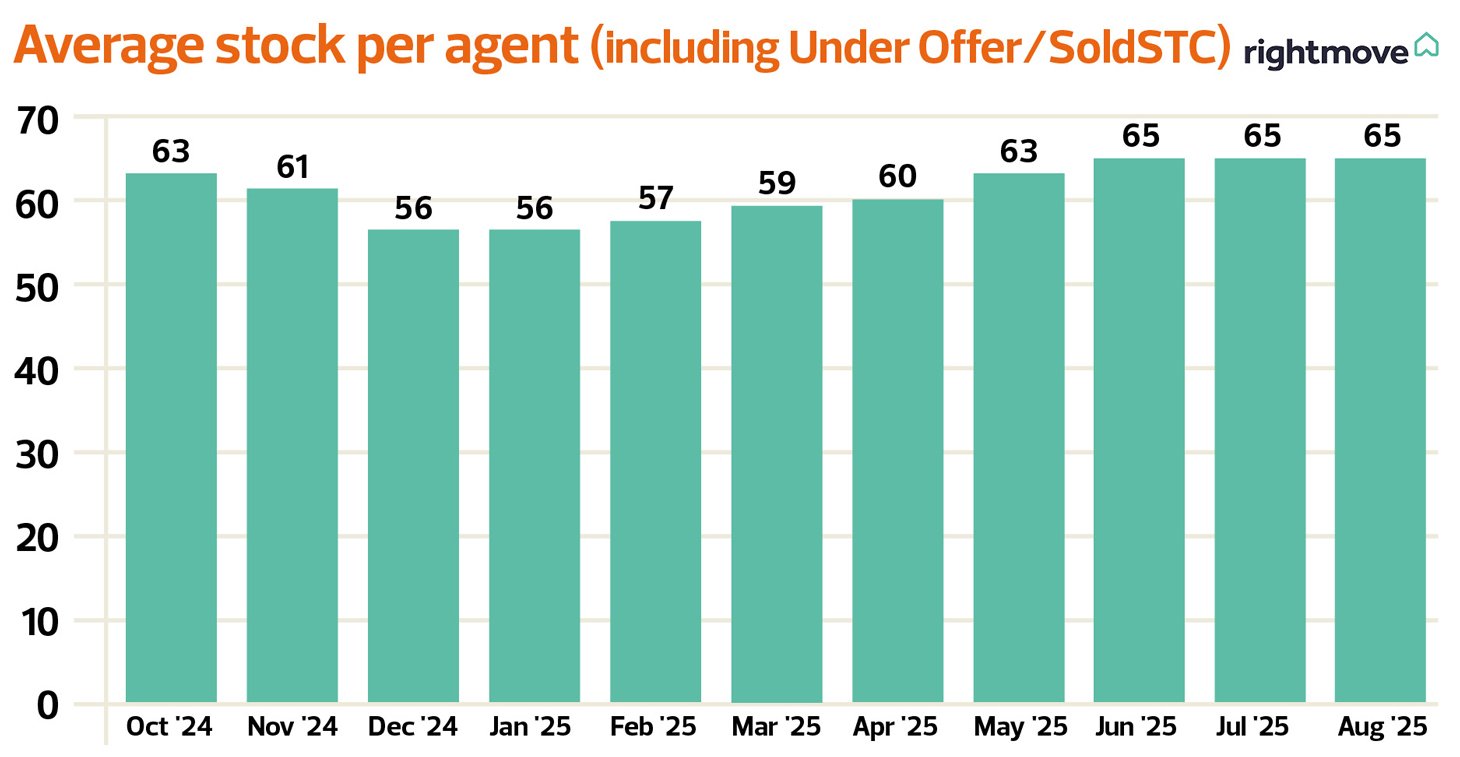

From an index perspective, Rightmove’s data shows that the average stock per agent has remained steady since the end of the SDLT holiday in March. Encouragingly, this stability appears to be driving more sales, with net sales up 10.1% compared with pre-pandemic levels (Chris Watkin and TwentyEA).

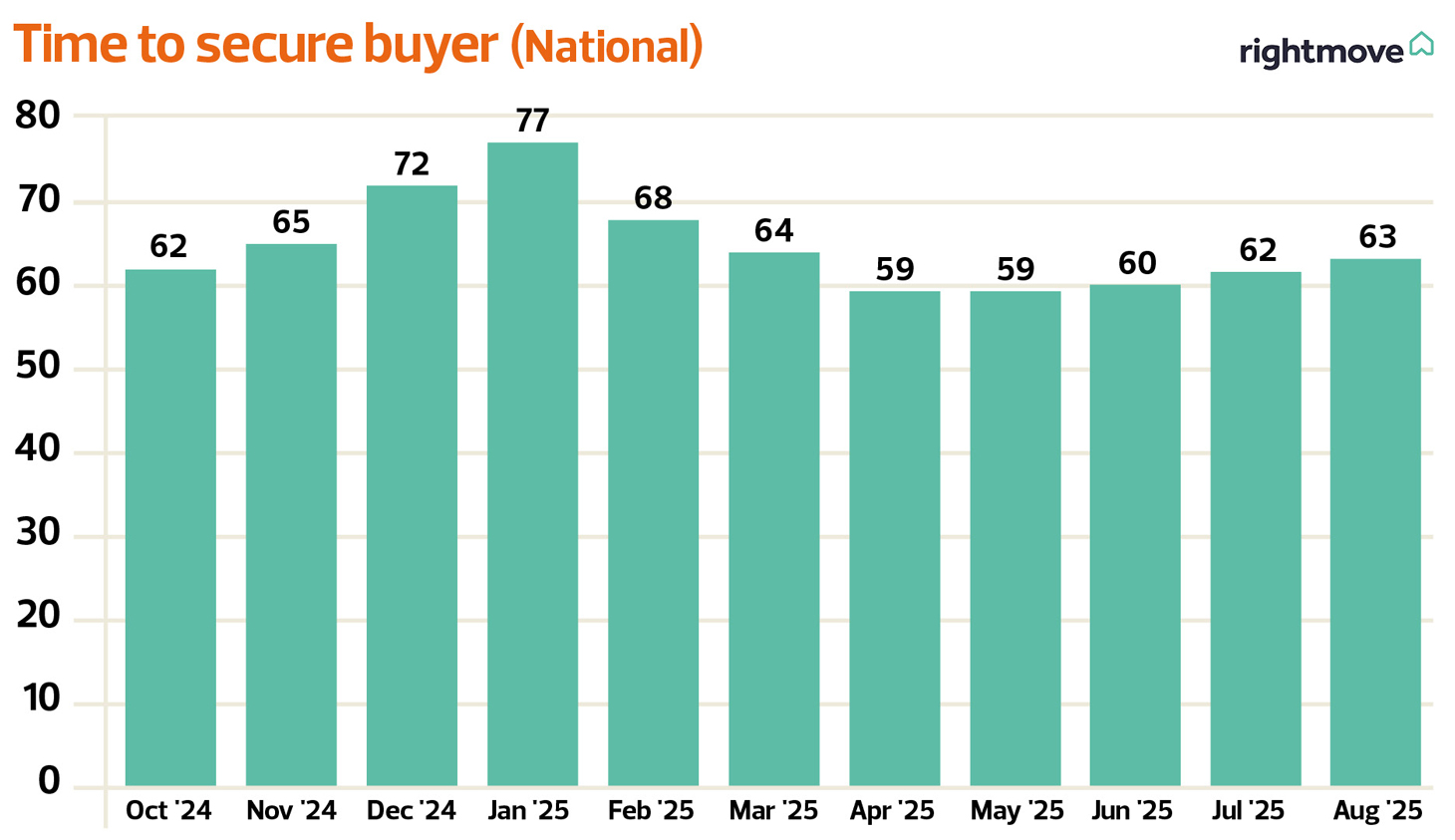

Even though SDLT is back at normal levels, the time it takes to find a buyer doesn’t seem to have been affected – likely helped by the recent base rate cut.

Meanwhile, it’s also good to see that despite the SDLT rising back to normal levels, this doesn’t appear to be impacting on how long it takes to secure a buyer, which is likely to have been helped by the recent fall in the Bank Base Rate.

Of course, selling times in the UK property market still vary by region as the data from Rightmove shows. In Scotland – where upfront property information speeds up the process – the average is 33 days, compared to 54 days in the North East, and over 70 days in London and Wales.

Summary of the latest supply and demand data

“It is this attractive pricing which has continued to drive stronger buying activity in the high supply market, with the number of sales being agreed now 4% higher than at this time last year. Beneath the overall national average, it’s London and the more muted south of England which are driving the annual dip in prices, while prices across other regions in Great Britain are more robust. Activity trends in the south of England are underperforming the rest of Great Britain, and while there’s a long way to go until the Autumn Budget on November 26th, if the mooted property tax changes become reality, they could exacerbate this underperformance.”

“HMRC monthly property transaction data show UK home sales increased in July 2025. UK seasonally adjusted (SA) residential transactions in July 2025 totalled 95,580 – up by +1.1% from June’s figure of 94,540 (up +4.6% on a non-SA basis). Quarterly SA transactions (May 2025 – July 2025) were approximately -22.6% lower than the preceding three months (February 2025 – April 2025). Year-on-year SA transactions were +4.3% higher than July 2024 (+3.9% higher on a non-SA basis). (Source: HMRC).

“Latest Bank of England figures show the number of mortgages approved to finance house purchases increased in July 2025 by +1.2% to 65,352. Year-on-year the figure was +4.6% above July 2024. (Source: Bank of England, seasonally-adjusted figures).

“The RICS Residential Market Survey results for July 2025 show buyer demand and agreed sales falling back into negative territory. New buyer enquiries recorded a net balance of -6% (down from +4%) and agreed sales – 16% (down from -4%). New instructions recorded a net balance of +9% (+3% previously). (Source: Royal Institution of Chartered Surveyors (RICS) monthly report).”

“An increase in supply and continued affordability constraints are shaping the slowdown in growth. Earnings are rising at 4.7%, outpacing house prices for the third year in a row. This ongoing trend is helping boost affordability and supporting both buyer demand and sales.

“While buyer demand and sales agreed are up by 4% and 5% respectively, the number of homes for sale is 10% higher than last summer. With more stock in the market, buyers can be selective when choosing a property.”

“Despite the number of buyers coming to market taking a slight dip this month, the overall number of transactions and appraisals remains buoyant, indicating that consumer confidence is not shaken by wider economic factors. With interest rates improving slightly, this should also be playing a key role in improving home movers’ affordability.”