Crypto market crash is getting increasingly severe as the market cap continues to tumble, falling to $3.89 trillion today from a recent high of $4.10 trillion. Moreover, the Crypto Market Fear & Greed Index signals the sentiment has now slipped to 45 (fear) from 53 (neutral) last week.

Bitcoin (BTC) loses strength and plunges more than 3% to below $113,000 today, while Ethereum (ETH) fell 7% to $4,150. ETH is witnessing exceedingly higher liquidations than BTC in the last 24 hours.

Meanwhile, top altcoins XRP, BNB, Solana (SOL), Cardano (ADA), and Hyperliquid (HYPE) fell 6-10% over the past 24 hours. Meme coins Dogecoin (DOGE), Shiba Inu (SHIB), and Pepe Coin (PEPE) fell over 10%, with DOGE now down more than 14% in a week despite the REX-Osprey Dogecoin ETF launch.

Macroeconomic Impact Causes Crypto Market Crash Again

Bitcoin and the crypto market react immensely to macroeconomic events and conditions in the U.S., Japan, the European Union, and other key regions. The U.S. FED’s first interest rate cut this year has started impacting the markets, as evident from rising Treasury yields and gold price rally.

The Fed rate cut is driving the Treasury market to its biggest annual gains since the COVID pandemic, as per Bloomberg data. The 10-year US Treasury yield climbs to around 4.15% for the fifth consecutive day ahead of fresh commentary from Federal Reserve officials, including Jerome Powell, and PCE inflation data due this week. Also, the U.S. Dollar Index (DXY) is rising above 97.80 today.

Japan Prime Minister contender Yoshimasa Hayashi backs the Bank of Japan’s (BOJ) rate-hike strategy. This happens as Japan’s 10-year Government Bond yield (JP10Y)and the 2-year Government Bond yield rise to the highest level since 2008.

Money managers and strategists are betting that the FED and BOJ’s shift will bring a massive bond rally in years. Bloomberg Intelligence’s senior strategist Mike McGlone said crypto assets and Bitcoin may signal a bigger risk-assets bubble than internet stocks in 1999, amid the latest risk-off sentiment.

21-million numbers on a screen tracking little of substance vs. one in 2009 — cryptocurrencies may signal a bigger risk-assets bubble than internet stocks in 1999. The S&P 500 total return flatline vs. gold started in 1997 and in 2017 for the Bloomberg Galaxy Crypto Index vs.… pic.twitter.com/fKnuUZjpoV

— Mike McGlone (@mikemcglone11) September 21, 2025

Largest Bitcoin, ETH Options Expiry Driving Crypto Market Crash Fears

As reported first by CoinGape, on-chain options data signaled “Triple Witching” crypto options expiry, which combines weekly, monthly, and quarterly maturities, could cause a Bitcoin crash to $105.5K. Moreover, profit booking risk is significantly higher as 95% of holders are in profit, according to Glassnode data.

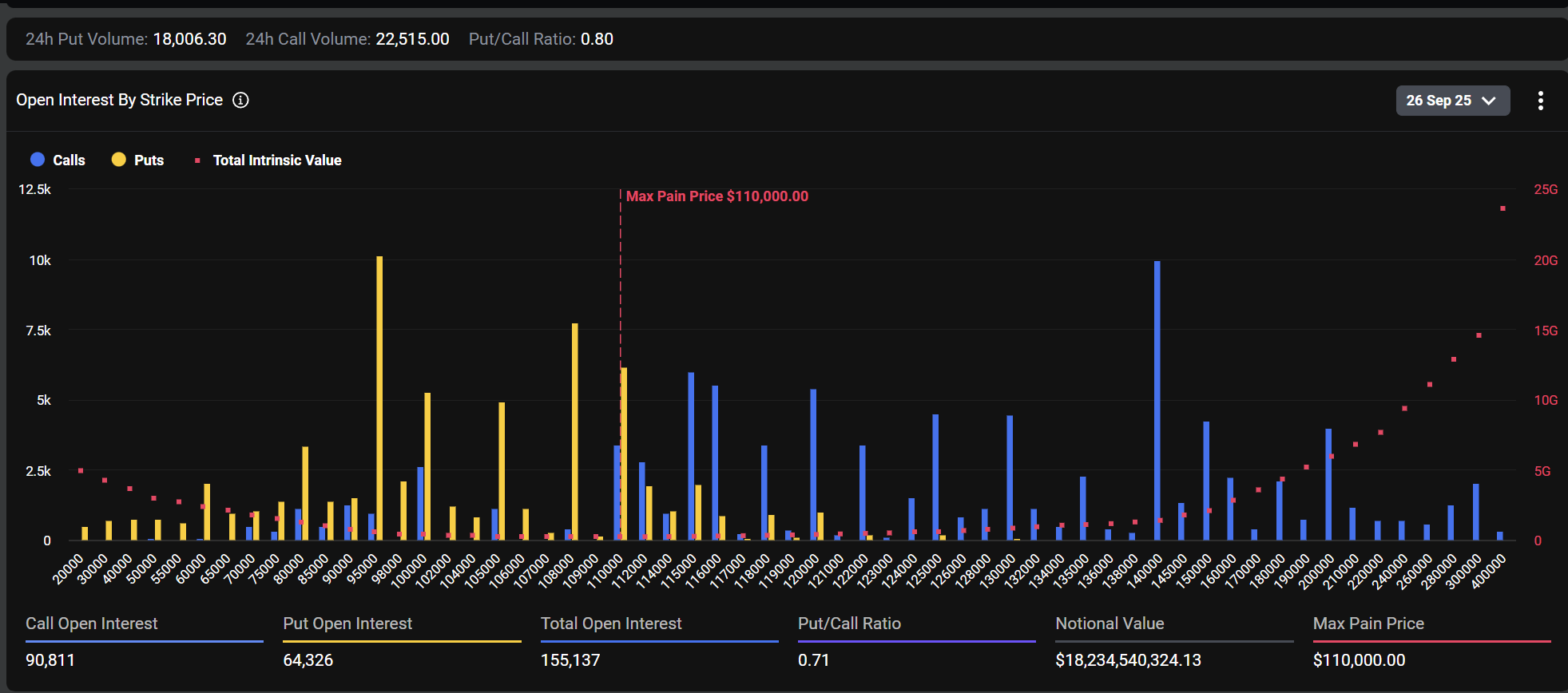

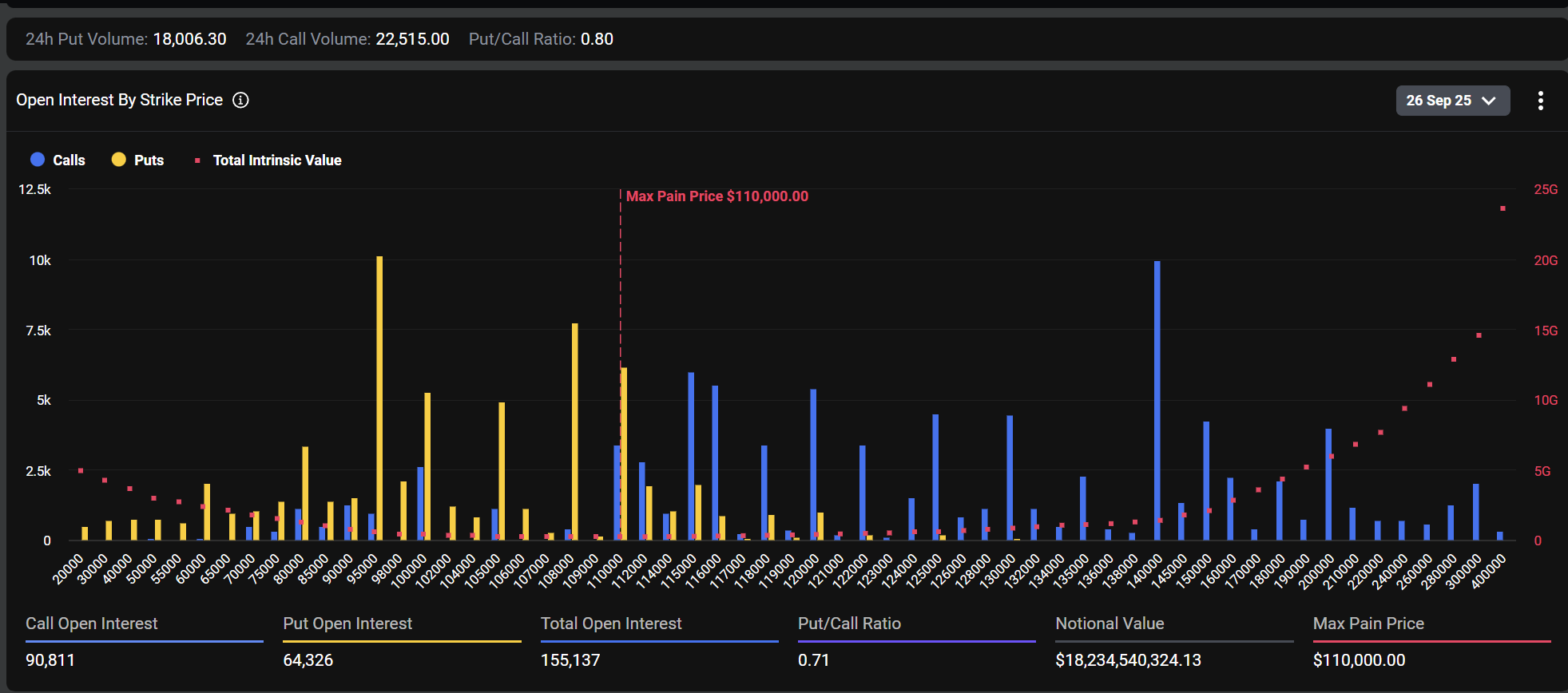

Notably, over $17.5 billion in BTC options and $5.5 billion are set to expire on Deribit this Friday. The max pain price for Bitcoin and Ethereum are $110,000 and $3,700, respectively.

Notably, the notional value for BTC options was more than $18 billion last week. This indicates traders are already liquidating and adjusting their positions, pricing in the largest-ever $23 billion crypto market expiry.

Massive Bitcoin, ETH, XRP, SOL, ADA Crypto Liquidations

The crypto market correction worsens as it saw a massive $1.70 billion in liquidations in the last 24 hours. Notably, nearly $1.6 billion in long positions and $85 million in short positions were liquidated over the last 24 hours. This is the largest-ever crypto market liquidations, with over $966 million in longs getting liquidated in just an hour, according to Coinglass data.

Huge 410K traders were liquidated in the last 24 hours, with the largest single liquidation order of BTC-USDT swap worth $12.74 million on crypto exchange OKX. As per data, ETH, BTC, SOL, XRP, DOGE, ADA, ASTER, ENA, and UNI recorded the largest liquidations, causing a broader crypto market crash.