Gold, like the stock and currency markets, had been experiencing lower volatility due to the holiday period, but this is changing with the onset of a new month. Driven by strong demand, gold has reached new historic highs, now priced at $3,600 per ounce.

This rise is fueled by several fiscal, monetary, and trade policy factors that benefit buyers. Key among these is the anticipated continuation of monetary easing by the Federal Reserve and the increase in federal government debt. Additionally, President Donald Trump’s controversial decision to remove Fed member Lisa Cook is seen as an attempt to undermine the Central Bank’s independence, increasing risk aversion in the market.

Gold Poised for $4,000?

As September began, markets suddenly acknowledged several factors previously overlooked, which continue to significantly impact gold. The Federal Reserve is a key player, with its narrative clearly shifting toward at least two by the year’s end. This monetary easing exerts pressure on the US dollar’s valuation and bond yields, creating a favorable environment for gold buyers.

In the medium and long term, the US federal government’s growing deficit remains a supporting factor, especially following the recent credit rating downgrade and the potential for more downgrades ahead, which could further drive gold prices upward.

Additionally, ongoing geopolitical tensions add to gold’s appeal. The stalled peace negotiations regarding the Ukraine conflict and the US’s aggressive tariff policies, now targeting India, seem to lead to more conflict rather than resolution, reinforcing gold’s role as a safe-haven asset.

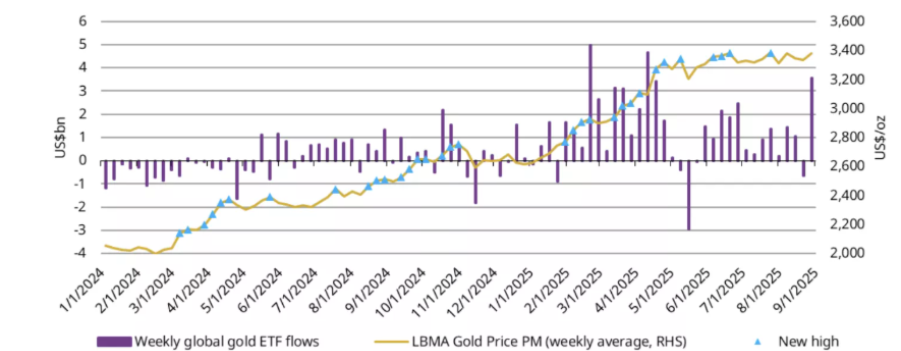

Gold ETFs Attract Significant Inflows

One important indicator impacting the valuation of gold is the inflow of funds into ETFs. Recent data reveals a significant increase after lower volumes during the holiday season, reaching the highest levels since April this year.

If the inflows match or surpass this year’s records, as suggested by the correlation with gold prices, the uptrend is likely to maintain its momentum. This aligns with the medium-term target of $4,000.

Gold Breaks Triangle Formation

From a technical perspective, gold prices have developed an ascending right-angled triangle formation over the past few months. Breaking through the upper boundary at $3,500 per ounce has initiated an upward trend, reaching the first target of $3,600 per ounce.

For those looking to connect with the uptrend, a classic strategy is to watch for a potential retest of the broken upper limit, where buyer reactions might occur. In such scenarios, subsequent round levels serve as natural target areas.

****

InvestingPro provides a comprehensive suite of tools designed to help investors make informed decisions in any market environment. These include:

- AI-managed stock market strategies re-evaluated monthly

- 10 years of historical financial data for thousands of global stocks

- A database of investor, billionaire, and hedge fund positions

- And many other tools that help tens of thousands of investors outperform the market every day!

Not a Pro member yet? Check out our plans here.

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk belongs to the investor. We also do not provide any investment advisory services.