Bitcoin has plummeted since hitting an all-time high of $124,000 per bitcoin earlier this month, dropping around 10% as a controversial new memecoin hits the market.

Sign up now for CryptoCodex—A free newsletter for the crypto-curious

The bitcoin price surged though the first half of 2025, doubling in price as U.S. president Donald Trump’s crypto support and Wall Street’s long-awaited adoption provide twin tail winds (while Elon Musk has quietly breaking his crypto silence).

Now, as Kanye West finally drops a long-awaited crypto bombshell, serious warnings over bitcoin treasury pioneer Strategy’s new fundraising rules have added to a 25% stock sell off that some fear could cause a “spiral of doom” for the company and the bitcoin price.

Sign up now for the free CryptoCodex—A daily five-minute newsletter for traders, investors and the crypto-curious that will get you up to date and keep you ahead of the bitcoin and crypto market bull run

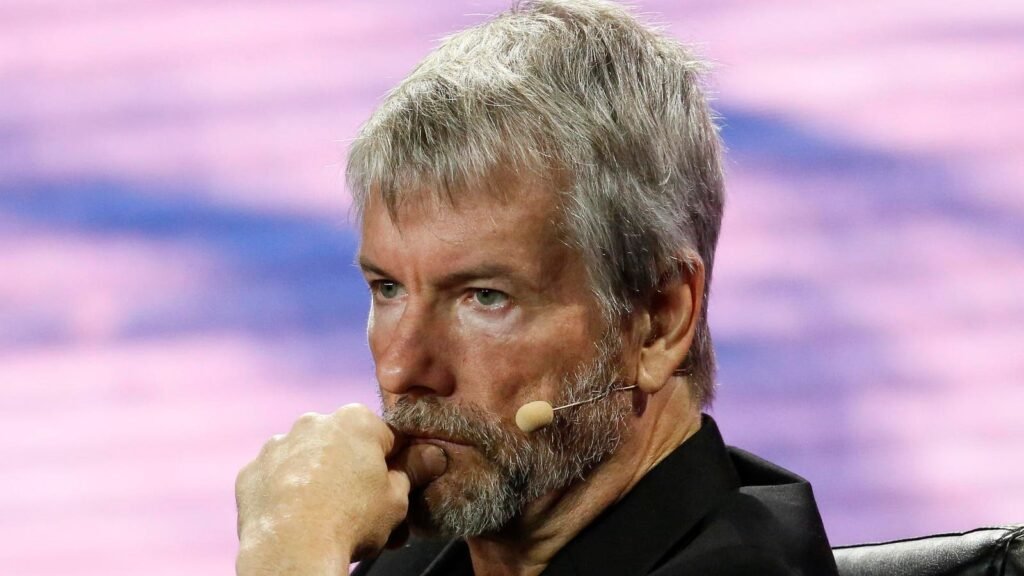

Strategy founder Michael Saylor has inspired a flood of copycat bitcoin acquisition companies, helping the bitcoin price to surge to a record high.

Getty Images

This week, Strategy, led by founder Michael Saylor, loosened its long-held rules on when it will dilute shareholders to buy even more bitcoin, with the company already holding almost 630,000 bitcoin worth $70 billion.

The announcement has been criticized by some analysts, who at worst fear it could trigger a “doom loop” for the company.

“Potential spiral of doom looming for Strategy,” EasyA cofounder and former Goldman Sachs analyst Dom Kwok posted to X, warning it could lead to Strategy being forced to sell its bitcoin to pay interest as its shares slowly decline in value.

Strategy’s share price, which has outpaced bitcoin over the last year as a dividend-paying alternative to holding bitcoin directly, has dropped 25% since hitting an all-time high in mid-July, falling alongside bitcoin but pushed lower due to the flood of rival, copycat bitcoin-buying companies that have sprung up in its wake.

Since beginning to buy bitcoin in 2020, Saylor has transformed Strategy into a bitcoin corporate giant, holding 3% of all the 21 million bitcoin that will ever exist, while its closest rival holds just $4 billion of bitcoin.

Strategy issued new “equity guidance” this week that said the company will issue stock at a lower bitcoin market-to-net asset value multiples (mNav) than was promised as recently as July.

Strategy had previously said it would not issue shares under 2.5x mNav, which calculates its market capitalisation to the value of its bitcoin holdings. If its mNav is above 1, it means Strategy stock buyers are paying a premium for bitcoin exposure, while if it’s below 1 means the stock is worth less than the bitcoin the company owns.

Strategy’s mNav is currently 1.3, according to bitcointreasuies.net, with some of the new bitcoin treasury companies such as Twenty One Capital and Nakamoto trading at under an mNav of 1.

Sign up now for CryptoCodex—A free newsletter for the crypto-curious

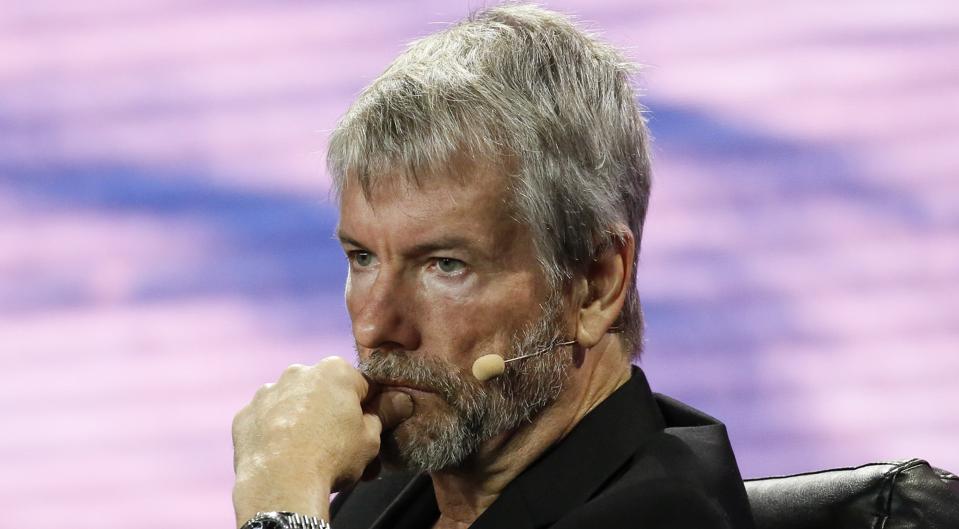

The bitcoin price has rocketed higher over the last year, helped by Michael Saylor’s Strategy and other copycat bitcoin-buying companies.

Forbes Digital Assets

“Strategy today announced an update to its MSTR Equity ATM Guidance to provide greater flexibility in executing our capital markets strategy,” Saylor posted to X.

Under the new rules, Strategy can tap equity markets at thinner premiums, giving it a broader range of options and even allowing it to issue credit to repurchase shares if its stock falls under an mNav of 1.

However, not everyone is bearish on Strategy. Earlier this month, analysts with Strive, an asset manager cofounded by U.S. politician Vivek Ramaswamy, predicted Strategy could be included in the S&P 500 as soon as September.

If Strategy is included in the index, it would “instantly give tens of millions of Americans bitcoin exposure through their pension funds, 401(k)s and brokerage accounts,” Strive analysts wrote, adding it would unleash “the ‘Uberization’ of bitcoin—integrating digital assets so deeply into American economic life that attempting to ban them becomes nearly impossible.”