The Finance Ministry in Chiyoda Ward, Tokyo

15:53 JST, May 12, 2025

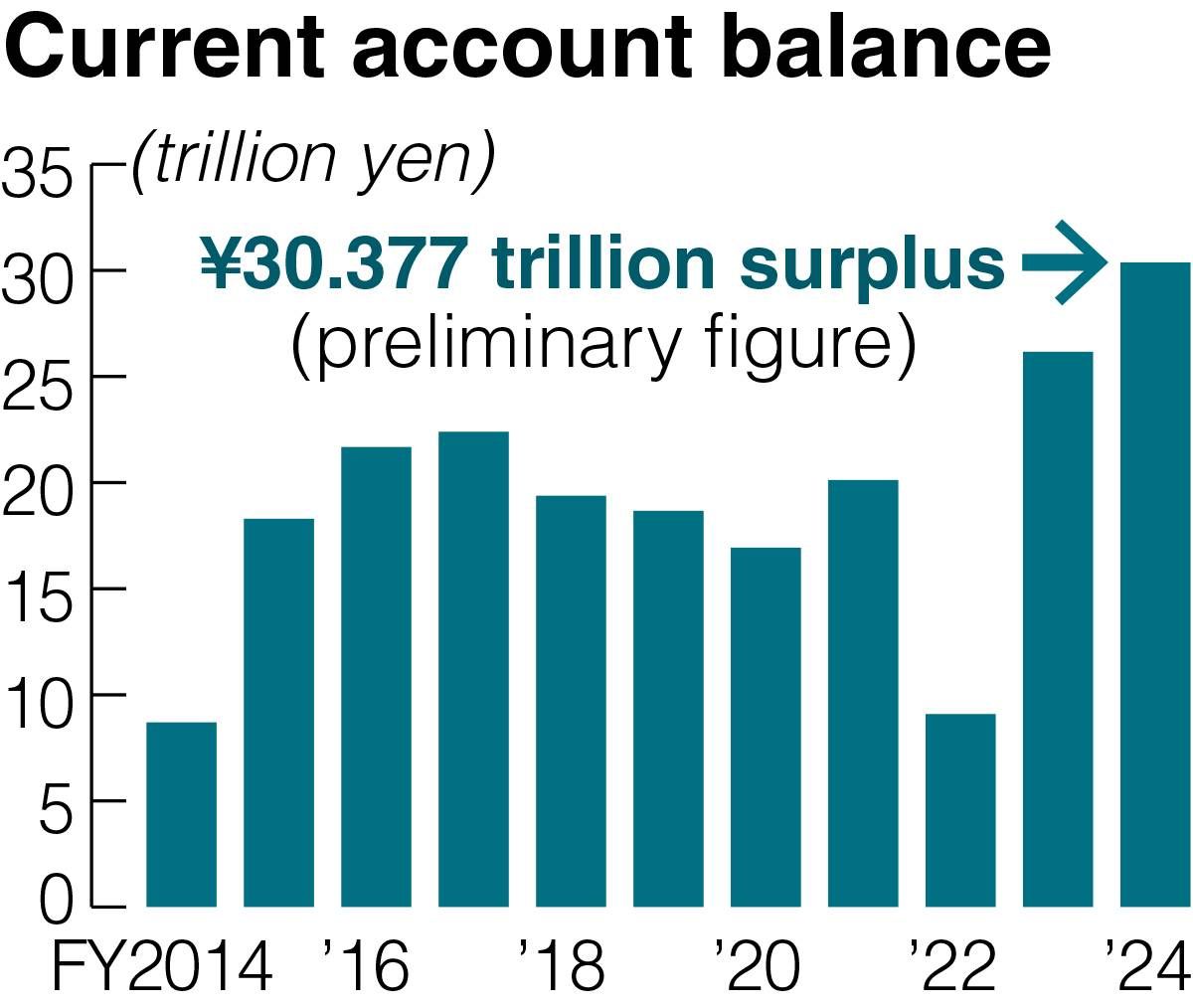

The current account surplus of fiscal 2024 was ¥30.377 trillion, up 16.1% from the previous year, according to the preliminary international balance of payments statistics for the fiscal year that was announced by the Finance Ministry on Monday.

The current account balance, which shows the status of the transactions of goods and services with foreign countries, was a record for the second consecutive year.

The primary income balance, which includes interest and dividends generated from foreign investments, was a surplus of ¥41.711 trillion. The surplus widened by 11.7% from the previous year, notching a record for the fourth consecutive year. Revenues from foreign direct investment expanded, namely in the United States, and the yen’s depreciation has also helped increase the amount in yen terms.

The value of the trade balance, which subtracts the value of imports from exports of commodities, showed a deficit of ¥4.048 trillion, with the deficit widening by 9.8%.

The value of imports increased by 4.3% to ¥110.287 trillion, boosted by personal computers, smartphones and medicines.

The value of exports also increased, by 4.1%, to ¥106.239 trillion, boosted by exports of semiconductor-related manufacturing equipment and electronic components.

The deficit in the service balance, which is for transactions other than commodities, fell by 20.2% to ¥2.576 trillion. The surplus in the travel balance rose due to the increase in the number of foreign visitors.