As red states like Florida, Indiana and Missouri pass laws banning their state investment boards from involvement with Chinese funds, Minnesota Gov. Tim Walz has allowed his state’s backing of Beijing to grow.

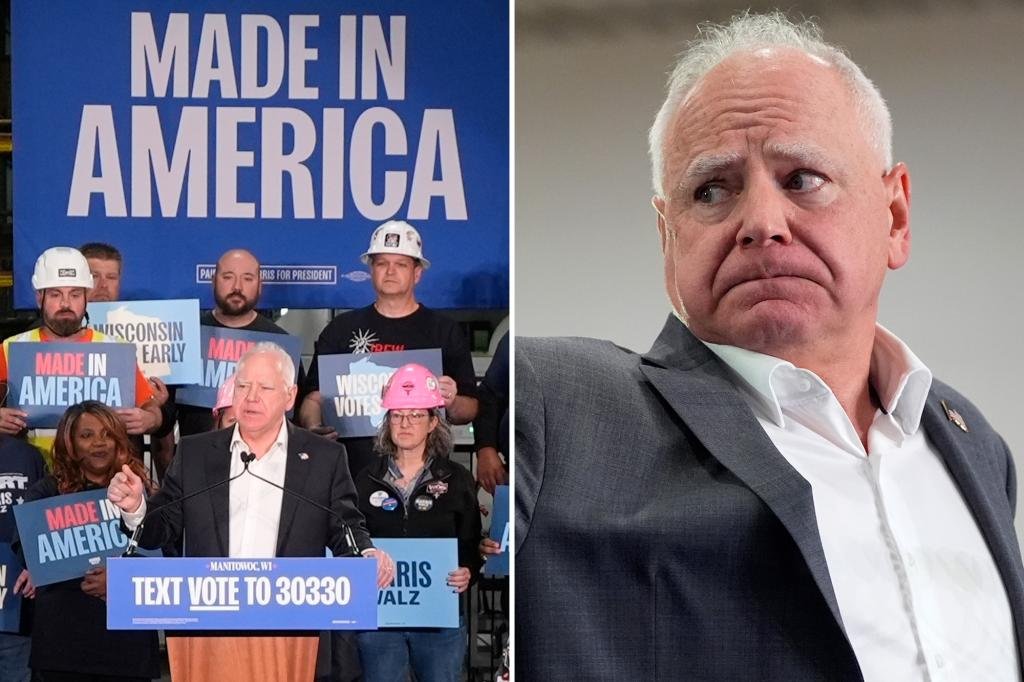

As governor of the Land of 10,000 Lakes, Walz — the Democratic vice presidential candidate — has significant authority over the selection of members of the Minnesota State Board of Investment (SBI), who are typically either elected or appointed by a comptroller or treasurer in other states.

Since Walz became governor in 2019, SBI appointees have directed roughly 70% of the approximately $1.3 billion moved into Chinese funds, according to a data analysis by the nonpartisan watchdog group Future Union.

“The governor selects and appoints the members of the board of directors that oversee the pension. It is not an elected board,” Future Union executive director Andrew King told The Post. “Simply stated, Gov. Waltz is the most significant elected person in government with personal responsibility and accountability to control investments.”

While the board has claimed it has not made any new investment into Chinese funds since the year Walz took office, King said that is misleading because it continued existing investments — even in TikTok parent company ByteDance — throughout the governor’s tenure.

Investments in Chinese funds represent a national security risk for a number of reasons, King said. While US dollars fueling the Beijing economy is concerning on its own terms, it’s often the “relationship elements and knowledge that are far more impactful — and dangerous — if transferred to an adversary.”

“States need to make smart decisions and protect the interests of their pensioners by pursuing secure investments in the US,” King said. “We are not only putting capital at risk, but moreover the transfer and loss of irreplaceable — and priceless — intangible know-how and leading-edge technology through pressuring companies and cyber theft that China is notorious for.”

Minnesota’s $1.3 billion in China investments represent a little more than 1% of the state’s total investment budget — which King said was considerable, given that Minnesota has “one of the largest pension amounts of a smaller state” investing in Beijing.

While some money has gone to Chinese-owned funds that invest exclusively in America, King said even those are a problem because “the quid pro quo requires giving up technology and getting access and influence to be able to gain approval to invest in startups in China.”

X / Andrew Charles King

States and other investors can be tempted to engage with Chinese funds due to their often substantial returns. However, those are “largely due to the Chinese Communist Party [CCP] putting their thumb on the scale of which companies are the Party’s preferred winner,” according to King.

“The problem is that in the rigged system of China, the CCP is the gatekeeper of which fund wins the government’s favor to invest, meaning funds are incentivized to one-up each other and sacrifice ever more lucrative know-how, treating America’s most critical technologies as mere pawns,” King said.

The news comes as Republicans have raised concerns about Walz’s deep ties to China — a country he’s visited repeatedly over the previous three decades. The House Committee on Oversight and Accountability in August began investigating Walz’s connection with government officials in the adversary nation.

“It is highly concerning that Governor Walz has heavily invested Americans’ tax dollars in Communist China, which is controlled by a regime seeking our nation’s destruction,” committee Chairman James Comer (R-Ky.) told The Post. “This revelation underscores the importance of the Oversight Committee’s investigation into the CCP’s efforts to influence and capture Governor Walz.”

“The Oversight Committee’s government-wide investigation into how federal agencies are addressing CCP political and economic warfare has also revealed just how dangerous unfettered engagement and investment in China has been,” he added. “Yet the Harris-Walz campaign has proved wholly uninterested into strengthening the American homeland in the face of the cold war the CCP is waging.”

While Minnesota is not alone in having state funds invested in China, there has been a recent push in several states to ban the practice. Florida, Indiana and Missouri have each recently enacted legislation to restrict future state investments in Chinese funds. Kansas passed a bill in April to limit such investments and Oklahoma Gov. Kevin Stick has directed relevant agencies to create plans to divest from China.

“Recently the pushback against China … has become much more mainstream,” King said. “… This is not a time for words, it is one for action — and far too many governors and states continue to eschew leadership permitting these investments to continue.”

“States should prioritize the long-term interests of pensioners, which are best served by ensuring that investments remain liquid, don’t suffer from onerous contractual burdens designed to prevent the free movement of capital, and fundamentally work to advance the interests of the United States instead of an adversary dedicated to tearing us down.”