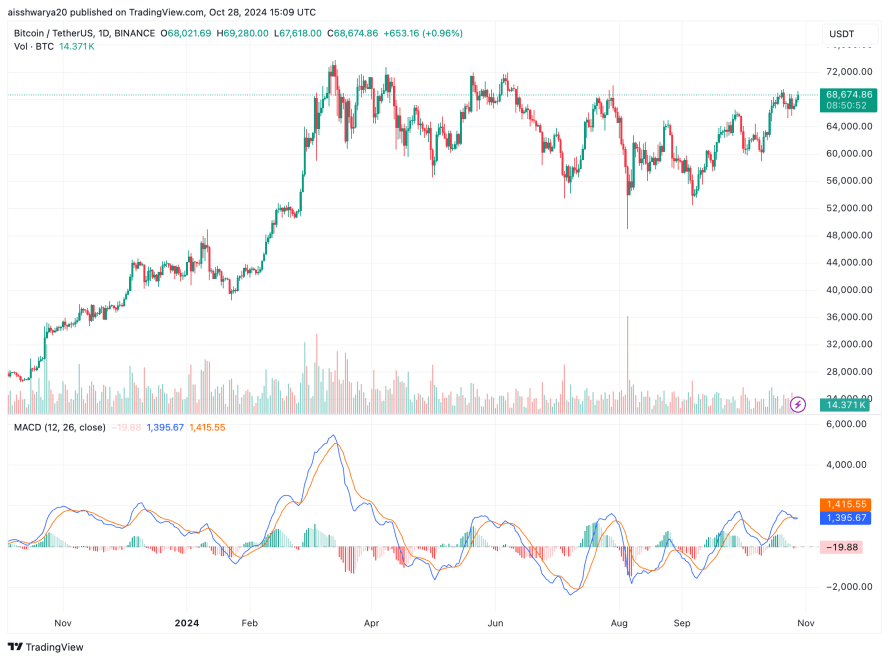

Today, Bitcoin (BTC) briefly traded above $69,000, coming close to its all-time high (ATH) value of $73,737 recorded earlier this year in March.

Bitcoin ‘Bullish Setup’ Reminiscent Of 2020 Rally

After months of sideways price movement since March, BTC is continuously attempting to reach a new ATH as the US presidential election draws near. The digital asset briefly touched $69,000 before slipping to $68,674 at the time of writing.

During an interview with CNBC, Matthew Sigel, Head of Digital Assets Research at VanEck, said:

Our bet is that this is a very bullish setup for Bitcoin into the election. We saw the exact same pattern in 2020 where Bitcoin lagged with low volatility and then once the winner was announced, we had a high volume rally as new buyers come into this market.

Sigel added that once the election results are confirmed, Moody’s is expected to downgrade US sovereign debt, which could catalyze a BTC rally in the fourth quarter of 2024.

Crypto analyst Michael van de Poppe also noted that despite Bitcoin’s relatively subdued performance in October – a month traditionally strong for the asset – BTC is well-positioned to reach a new ATH soon.

He pointed out that, despite recent Federal Reserve interest rate cuts, rates remain high enough to favor risk-off assets like US Treasury bills (T-bills), drawing liquidity away from riskier assets.

The Dutch crypto analyst brought attention to the rising M2 money supply, saying that the metric’s strong positive correlation with BTC could suggest that the digital asset might be on the cusp of a big rally. He said:

As long as the M2 supply increases, bitcoin’s price is going to follow… so it’s just a matter of time until bitcoin price is going to pick up momentum.

Notably, van de Poppe also mentioned that a potential Donald Trump presidency could spark optimism in the crypto sector, possibly igniting a bull run for digital assets in the months ahead.

Trump Continues To Lead In Prediction Markets

Data from Polymarket – a decentralized prediction market platform – indicates that Trump is favored to win against the Democratic candidate Kamala Harris.

At press time, Trump’s probability of winning the election has surpassed 66%. In comparison, Harris’ odds stand at about 34%.

A recent survey found that the influence of the crypto voting bloc on election results is likely understated. The survey found that close to 16% of voters believe the candidate’s stance on cryptocurrencies will influence their voting choice.

While most in the crypto industry lean toward Trump due to his pro-crypto stance, Harris has been actively courting some of his crypto-supporting base.

An analyst recently opined that a Harris-led administration might arguably be better than Joe Biden’s for the digital asset industry. BTC trades at $68,674 at press time, up 1.2% in the past 24 hours.

Featured Image from Unsplash.com, Chart from TradingView.com