Spot Bitcoin exchange-traded fund inflows shot up more than 580% this week, as one analyst pointed out that whales were loading up on Bitcoin at a pace akin to the lead-up to the 2020 rally.

Over the past week, inflows into the 12 spot Bitcoin ETFs reached $2.13 billion, following six consecutive days of positive inflows. This marks the first time weekly inflows into Bitcoin ETFs have surpassed the $2 billion mark since March 2024.

Total net inflows across Bitcoin ETFs have hit a record $20.94 billion. That’s a milestone that took gold ETFs years to achieve, according to Bloomberg’s Eric Balchunas. Bitcoin products took less than a year.

Weekly inflows hit their high on Oct. 14, with $555.86 million flowing into the ETFs, but by Oct. 18, the pace slowed down, dipping to $273.71 million, according to SoSoValue data.

None of the funds saw negative flows on the last trading day, with ARK 21Shares’ ARKB leading the pack. The inflows recorded were as follows:

- ARK 21Shares’ ARKB, $109.86 million, 7-day inflow streak.

- BlackRock’s IBIT, $70.41 million, 5-day inflow streak.

- Bitwise’s BITB, $35.96 million.

- VanEck’s HODL, $23.34 million.

- Fidelity’s FBTC, $18.0 million, 6-day inflow streak.

- Invesco’s BTCO, $16.11 million.

- Franklin Templeton’s EZBC, Wisdom Tree’s BTCW, Grayscale’s GBTC and BTC, and Hashdex’s DEFI saw no flows.

Whale accumulation intensifies

This week’s inflows into Bitcoin (BTC) products signal strong demand among retail and institutional investors and came alongside an interesting accumulation pattern noted among whales.

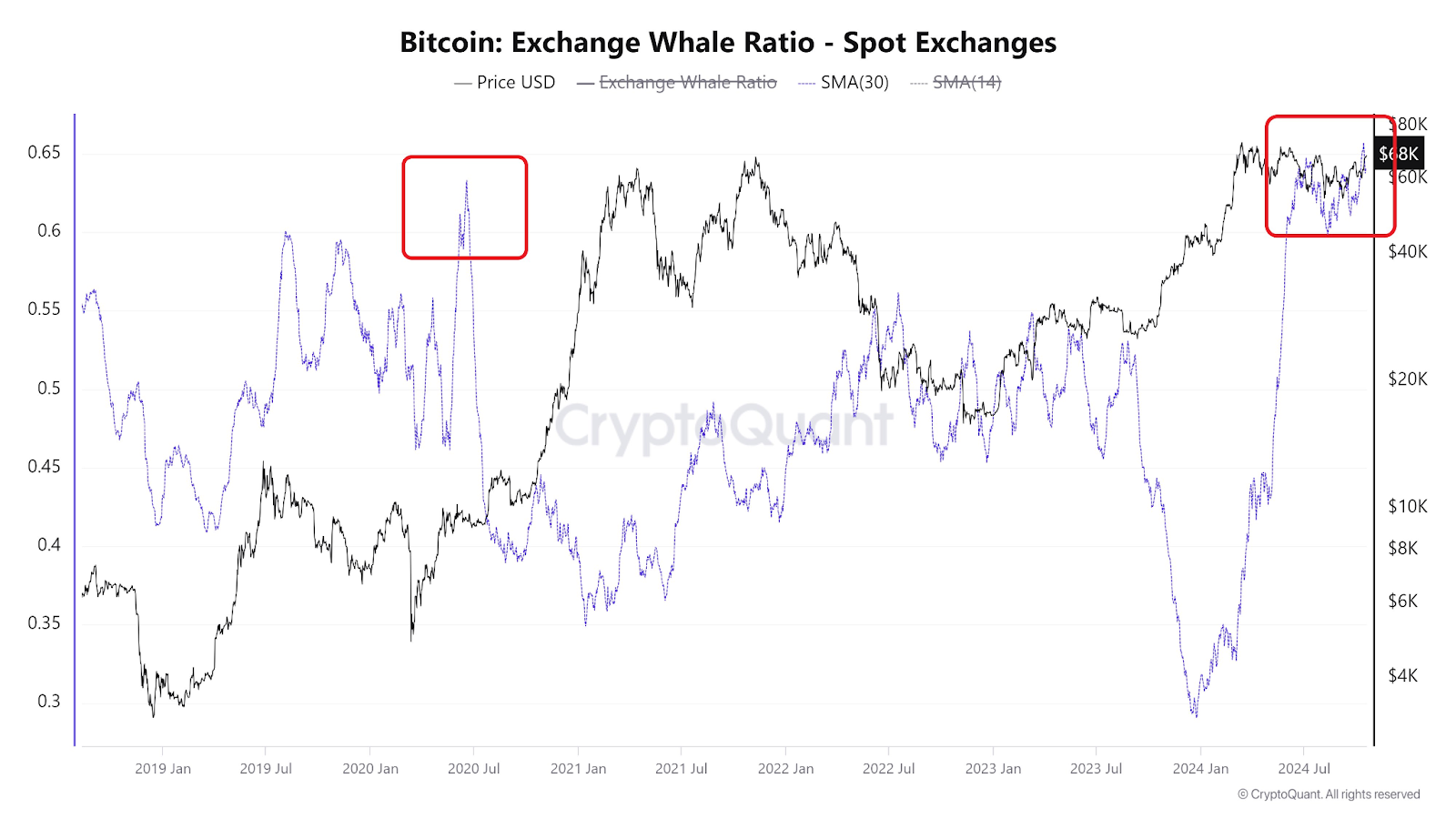

On X, CryptoQuant author Woominkyu pointed out that the Bitcoin whale ratio on spot exchanges is looking a lot like it did back in July 2020, right after the COVID crash. According to the chart he shared, that’s when a major Bitcoin rally took off — hinting that whales might be gearing up for another long-term price surge. (See below.)

A similar accumulation pattern was also observed among newer whales by fellow analyst and CryptoQuant CEO Ki-Young Ju, who wrote in an Oct 16 X post that new whale wallets with an average coin age of under 155 days reached a new high of 1.97 million BTC. (See below.)

Whales are often referred to as “smart money” because they tend to buy during market dips and hold through the ups and downs, using their deep pockets and strategic timing to make calculated moves. Their actions can often signal where the market might be heading next, as they usually position themselves ahead of big price shifts.

While the uptick in whale accumulation has ignited hopes of a forthcoming rally, several market analysts are also expecting the bellwether to reach a new all-time high soon buoyed by the upcoming U.S. presidential elections as a potential catalyst.

Pseudonymous trader Crypto Raven pointed out that polls show increasing odds for Republican candidate Donald Trump winning the November elections, which could be just the push BTC needs to hit new highs. As Raven put it, “everything goes this smooth, we could aim for the moon.”

On a more bullish note, Bitwise CIO Matt Hougan predicts Bitcoin will hit six figures, driven not just by the upcoming elections, but also by a surge in institutional demand and other macroeconomic factors.

At press time, the flagship cryptocurrency was trading at $68,280, up 8.5% over the past week.