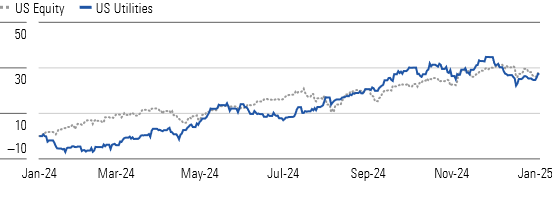

The excitement that utilities saw for most of 2024 appears to be waning. The Morningstar US Utilities Index pulled back slightly in the fourth quarter, relinquishing its position as the top-performing sector. After a nearly 27% total return for the year, utilities ended up slightly beating the market’s return. By comparison, in late September, utilities outperformed the broader market by 10 percentage points.

We think investors should prepare for more pedestrian returns from utilities in 2025 and beyond. The rally in 2024 simply erased these stocks’ losses in 2022-23. The sector’s annualized return during the past three years is 8%, the same as its 40-year average annual return and in line with what we think investors should expect.

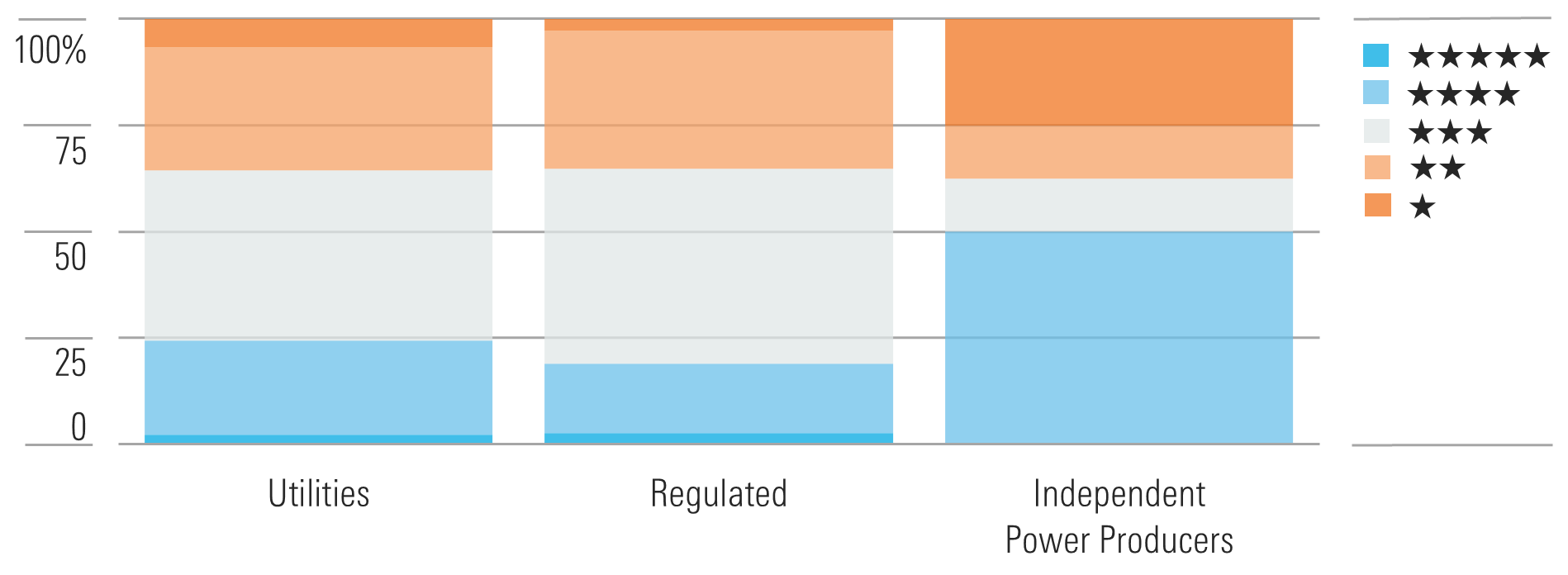

The fourth-quarter pause in the rally has helped cool valuations. We consider the median utility stock to be fairly valued, down from peak valuations midyear. Utilities’ median P/E ratio of 18 is still above the 20-year average. We think this is warranted, since they have better growth prospects and stronger balance sheets than in past decades.

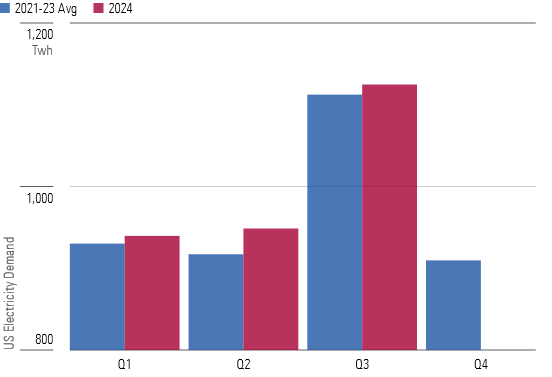

Utilities remain the gatekeepers to the green energy transition and data center buildout. Realizing this growth will depend on overcoming constraints such as regulatory approvals, supply chain shortages, and construction timelines. Successful utilities should be able to increase their dividends and justify their current valuations.

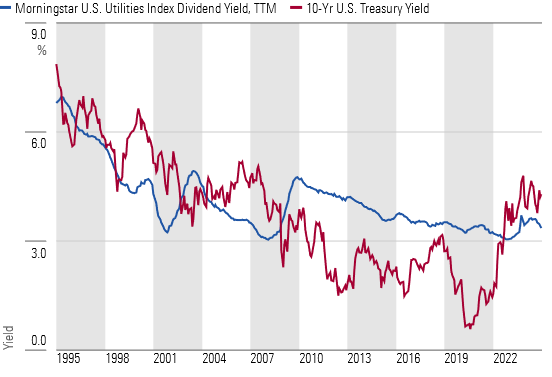

Interest rates and utilities’ dividend yield have converged, similar to the long-term average relationship they had before the 2008 financial crisis. Utilities’ strong underlying fundamentals, such as energy demand growth and capital investment, should support continued dividend growth, protecting investors from the full impact on returns if interest rates climb higher. We think most utilities’ dividend yields will remain above 3% into 2025, even if these stocks start climbing again.

Top Utility Sector Picks

Duke Energy

Duke DUK has a clear pathway to achieving the high end of management’s 5%-7% annual earnings growth target. The firm’s $73 billion capital investment plan for 2024-28 is focused on clean energy, infrastructure upgrades, and increasing electricity demand. Legislation in North Carolina supports Duke’s investment in the region with above-average returns. Highly constructive Florida offers opportunities for significant solar growth. Duke’s dividend yield is above the sector median, but dividend growth will lag earnings growth until the company’s payout ratio comes down.

Evergy

Evergy EVRG trades at one of the lowest valuations (16 P/E) and highest dividend yields (4.4%) of any US utility. Although the market seems concerned about the company’s growth prospects, we forecast 6% annual earnings growth, in line with most other utilities. Management recently raised its five-year investment budget by 29% and we think it could go higher, based on electricity demand growth in the Midwest and power generation needs. Major tech companies have announced large development plans in Evergy’s service territory. Positive legislative and regulatory developments also could boost earnings and dividend growth.

WEC Energy Group

WEC Energy WEC combines best-in-class management and above-average growth opportunities, supported by constructive regulation across most of its jurisdictions. The company’s new five-year capital investment plan totals $23.7 billion, a nearly 20% increase from its prior plan. WEC will increase investments in renewable generation, natural gas generation, and transmission due to significant economic development, particularly in Southeastern Wisconsin. This supports our growth estimate at the high end of management’s 6.5%-7.0% guidance.