Utilities are central to the energy system, but regulation often limits the value they can create for shareholders.

Many of the companies in this space—which includes electric utilities, gas utilities, and water utilities—do everything from producing energy to delivering it.

Here, we outline our expectations for the utilities sector and the companies that are best positioned to succeed amid this environment.

3 Key Themes to Keep an Eye On in the Utilities Sector

Our outlook for the utilities sector is centered on three key industry themes:

- Renewable energy is growing rapidly in the US. Falling costs for wind and solar energy projects along with state renewable energy requirements have led to a jump in investment during the last decade. Renewable energy capacity, excluding hydropower, now totals 270 gigawatts and is on track to top 16% of generation in 2024, surpassing coal generation market share for the first time. We think renewable energy growth will accelerate as costs continue to come down and state requirements stiffen. Solar is positioned to grow the fastest.

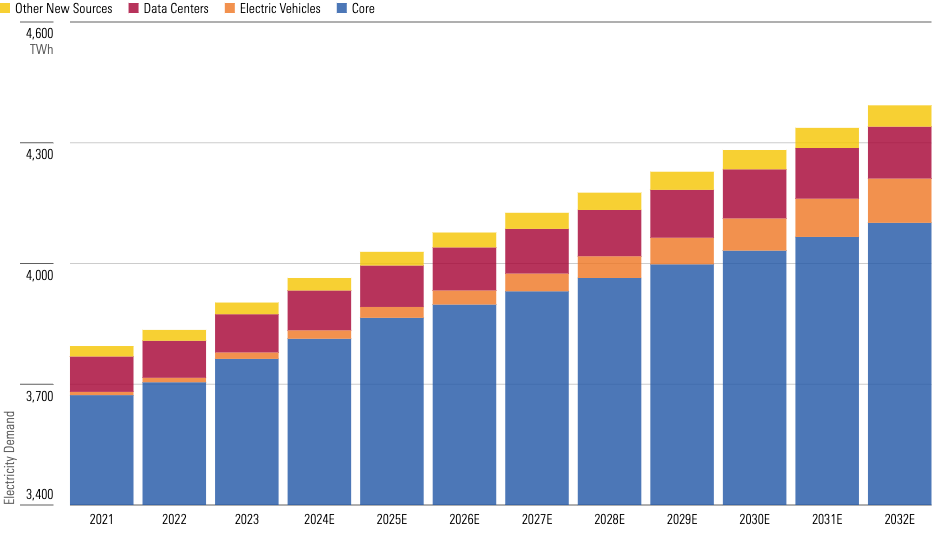

- Electricity demand’s growth revival. Electricity demand growth in the US historically tracked gross domestic product, near 2% annually. That relationship began to decouple in 2000 with a drop in industrial demand and energy efficiency gains that slowed residential and commercial growth. Electricity demand has been mostly flat since 2007. We think electric vehicles, shrinking marginal energy efficiency gains, and new data centers will result in a return to 1%-2% annual electricity demand growth.

- Utilities typically offer attractive yields. Utilities stocks often are considered income investment proxies because of their stable cash flows and high dividend payout ratios. Utilities’ dividend yields generally tracked 10-year US Treasury yields until the 2008 financial crisis. Utilities’ dividend yield premium peaked in mid-2020 as interest rates hit their lows.

Our Utilities Outlook: Profitability and Returns

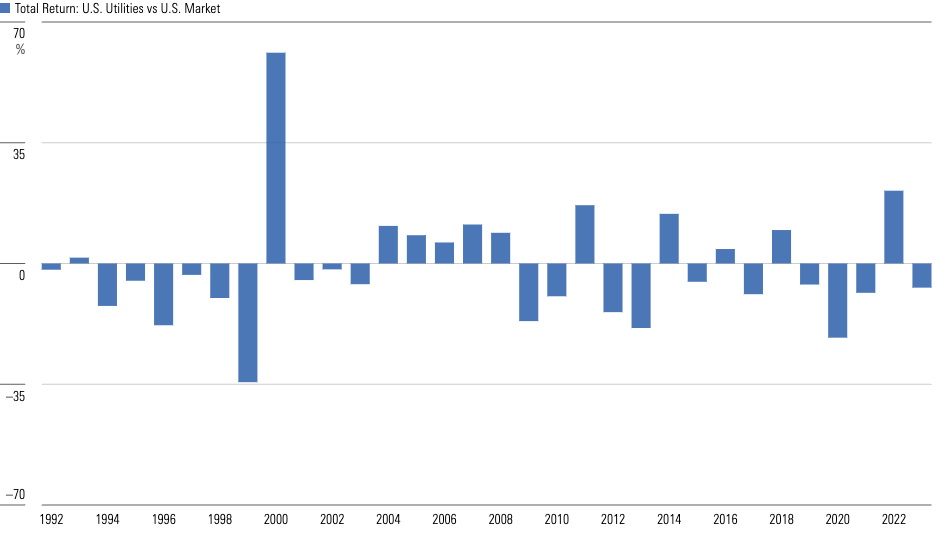

Utilities sector stocks fell 7% in 2023, including dividends, but rebounded sharply in 2024, leading all sectors through nine months.

Despite outperforming the market in 2022 and 2024, the sector has still underperformed the market since the pandemic as valuations moderated. Utilities peaked near a 25 times price/earnings ratio in early 2020, well above an 18 times P/E historical average.

The key factors informing investors’ returns are interest rates, dividends, and regulations.

We think utilities’ dividends are poised for continued growth across the sector, as we forecast dividend growth in line with our median 6% earnings growth estimate. And going forward, we expect utilities’ dividend yields to track interest rates more closely, as they have since 2022.

Key regulatory issues that investors should watch include allowed returns versus interest rates, stranded asset risk, operating cost budgets, and rate freezes. Utilities that work with regulators to reduce these risks should realize the most earnings growth.

Our Utilities Outlook: US Power Generation

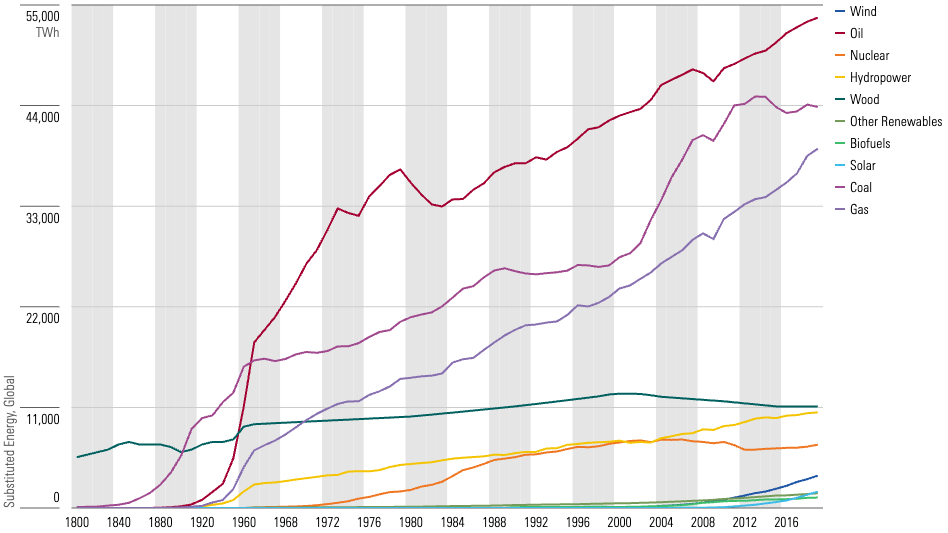

On the renewable energy front, we think the space is growing quickly but won’t overtake fossil fuels anytime soon.

Reaching net zero carbon emissions is historically ambitious. It requires eliminating—not just reshuffling—energy sources that represent nearly 80% of global energy consumption (including coal, oil, and gas). It took nearly two centuries for coal to replace wood as the world’s primary energy source and a century for oil to eclipse coal. Renewable energy, which would have to be the primary energy source to reach net zero emissions, is tiny among the world’s energy sources.

We expect solar generation will be the renewable energy technology of choice for many years to come. In the US, wind energy generation is 3 times larger than solar energy generation. However, we estimate that solar generation will pass wind by the end of the decade based on improving economics for solar, favorable tax policies, greater solar system efficiencies, and battery storage adoption.

Our Utilities Outlook: US Electricity Demand

Our outlook for electricity demand growth varies by region.

- We forecast that core electricity demand will grow the fastest during the next decade in the Southeast and upper Central Plains based on faster-than-average economic growth, population growth, and lagging energy efficiency.

- States in the Northeast face the likelihood of the slowest electricity demand growth primarily due to low population growth and aggressive energy efficiency efforts.

- The four key states to watch are Texas, California, Florida, and New York, which together represent 28% of our 2032 core US electricity demand forecast.

That said, electricity demand is set to grow faster during the next decade than it has in 20 years.

US economic growth and population growth support core electricity demand growth. Rapid data center development to support artificial intelligence is a significant tailwind for demand growth. Electrifying transportation, homes, and businesses to reduce carbon emissions should also accelerate growth.

Where Are All the Moats in the Utilities Sector?

Efficient scale is the primary economic moat source for regulated utilities, which own exclusive rights to deliver energy and water in a certain area.

- In exchange for utilities’ service territory monopolies, state and federal regulators set customer rates at levels that aim to minimize customer costs while allowing utilities to earn fair returns on and returns of the capital they invest to build, operate, and maintain their infrastructure.

- This implicit contract between regulators and capital providers should, on balance, allow regulated utilities to earn more than their costs of capital in the long run. However, realized returns might vary in the short run based on demand trends, investment cycles, operating costs, and access to financing.

- In some cases, less favorable regulation offsets a utility’s efficient-scale competitive advantage, preventing excess returns on capital. The risk of adverse regulatory decisions precludes regulated utilities from earning Morningstar Economic Moat Ratings of wide. However, the threat of material value destruction is low.

We don’t think most independent power producers have economic moats. Returns on capital typically are subject to volatile energy prices and demand. IPPs might create value at times, but this could be fleeting if commodity markets change.

None of the utilities companies we cover earn wide moats, but 29 of them earn narrow moats. As of Oct. 30, 2024, three of those narrow-moat companies are trading in 4- or 5-star territory: Essential Utilities WTRG, Portland General Electric POR, and Evergy EVRG.

That said, our top picks in the utilities space remain:

This article was compiled by Emelia Fredlick.