Since 2021, the Sierra Club has been grading U.S. utilities on their commitment to a clean-energy transition. While most utilities have not earned high marks on the group’s annual scorecards, as a whole they had been showing some progress.

That’s over now. The latest edition of the Sierra Club’s “The Dirty Truth” report finds that the country’s biggest electric utilities are collectively doing worse on climate goals than when the organization started tracking their progress five years ago. This year they earned an aggregate grade of “F” for the first time.

With only a handful of rare exceptions, U.S. utilities have shed the gains they made during the Biden administration. Almost none are on track to switch from fossil fuels to carbon-free energy at the speed and scale needed to combat the worst harms of climate change.

“It’s very disappointing to find we’re at a lower score than in the first year,” said Cara Fogler, managing senior analyst at the Sierra Club, who co-authored the report. But it’s not entirely unexpected.

Utilities had already begun slipping on their carbon commitments last year in the face of soaring demand for electricity, according to the 2024 “Dirty Truth” report, largely in response to the boom in data centers being used to power tech giants’ AI goals. But the anti-renewables, pro-fossil fuels agenda of the Trump administration and Republicans in Congress has pushed that reversal into overdrive.

“We have a new federal administration that’s doing everything in their power to send utilities in a direction away from cleaner power,” Fogler said. “They’re doing away with everything in the Inflation Reduction Act that supported clean energy. They’re straight-up challenging clean energy, as we’ve seen with Revolution Wind,” the New England offshore wind farm that’s now under a stop-work order. “And they’re doing everything in their power to keep fossil fuels online” — for example, through Department of Energy actions that force coal, oil, and gas plants to keep running even after their owners and regulators had agreed on retirement dates.

But utilities also bear responsibility for not doing more to embrace technologies that offer both cleaner and cheaper power, Fogler said. “From a cost perspective, from a health perspective, from a pollution perspective, there are so many reasons to build more clean energy and fewer fossil fuels. Unfortunately, we’re seeing that utilities are much less concerned about doing the right thing for the climate and their customers.”

What’s the score?

For its new “The Dirty Truth” report, the Sierra Club analyzed 75 of the nation’s largest utilities, which together own more than half the country’s coal and fossil-gas generation capacity. The report measures utilities’ plans against three benchmarks: whether they intend to close all remaining coal-fired power plants by 2030, whether they intend to build new gas plants, and how much clean energy capacity they intend to build by 2035.

As of mid-2025, the utilities had plans to build only enough solar and wind capacity to cover 32 percent of what’s forecast to be needed by 2035 to replace fossil fuel generation and satisfy new demand. While 65 percent of the utilities have increased their clean energy deployment plans since 2021, 31 percent have reduced them.

Meanwhile, commitments to reduce reliance on fossil fuels have taken a big step backward as utilities have turned to keeping old coal plants running and are planning to build more gas plants to meet growing demand. As of mid-2025, the utilities had plans to close only 29 percent of coal generation capacity by 2030, down from 30 percent last year and 35 percent in 2023.

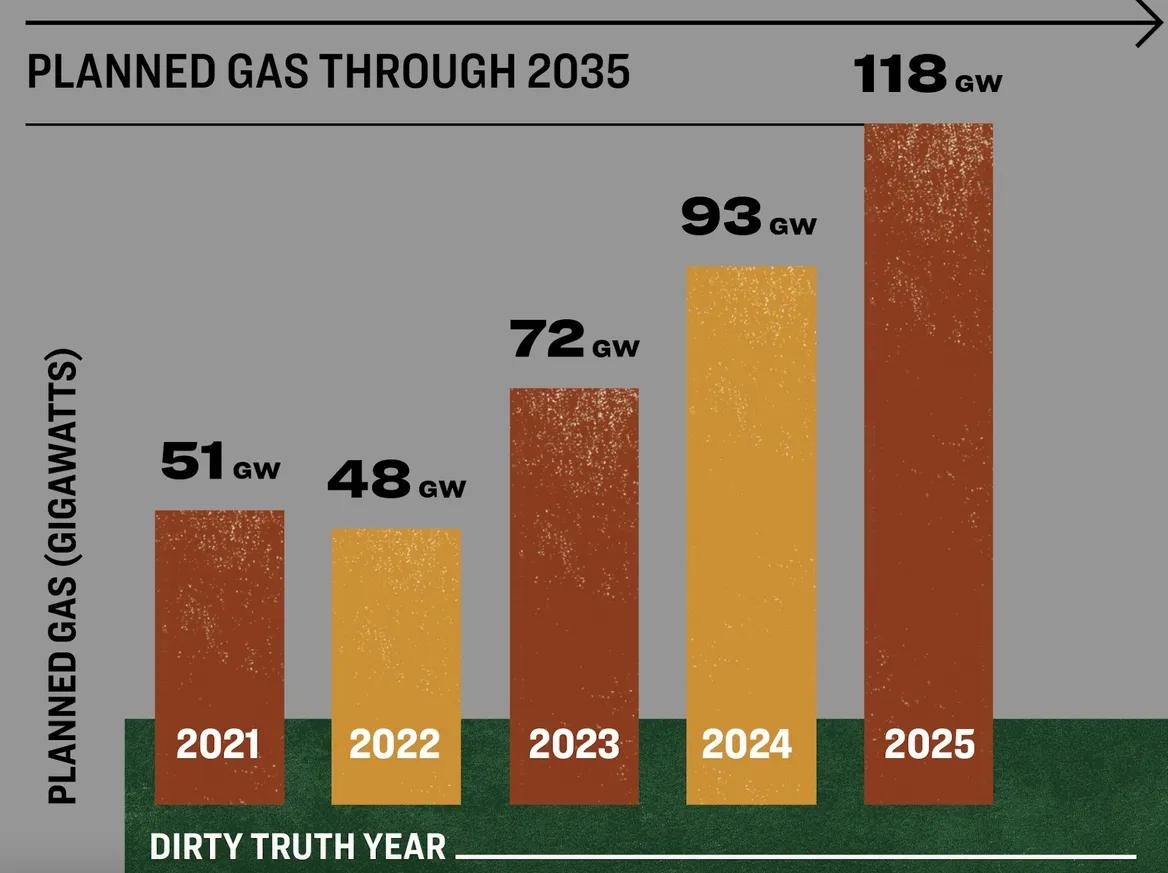

Courtesy of Sierra Club

And the amount of gas-fired generation capacity the utilities plan to build by 2035 spiked to 118 gigawatts as of mid-2025. That’s up from 93 gigawatts in 2024, and more than twice the 51 gigawatts planned in 2021.

That expanding appetite for new gas-fired power has been supercharged by the surge in forecasted electricity demand across much of the country — data centers are the primary driver of that growth. But much of that expected data center demand is speculative. And the lion’s share of it is premised on the idea that the hundreds of billions of dollars in AI investments from tech giants like Amazon, Google, Meta, and Microsoft as well as AI leaders like OpenAI and Anthropic will end up earning those companies enough money to pay off their costs — a risky bet.

The Sierra Club is among a growing number of groups demanding that utilities and regulators proceed with caution in building power plants to serve data centers that may never materialize. Forecasted data-center power demand is already driving up utility rates for everyday customers in some parts of the country, and the new gas power plants now in utility plans aren’t even built yet.

“There is some load we’re naturally going to see — there’s population growth, lots of beneficial electrification we want to see happen,” said Noah Ver Beek, senior energy campaigns analyst at the Sierra Club and another co-author of the report. “But we also want utilities to be realistic about load-growth projections.”

Unfortunately, booming demand growth gives utilities “more cover” to invest in polluting assets, Fogler said. Utilities earn guaranteed profits on the money they spend building power plants and grid infrastructure, which gives them an incentive to avoid questioning high-growth forecasts or seeking out lower-cost or less-polluting alternatives.

Some of the most aggressive fossil fuel expansions are planned for the Midwest and Southeast, including by Dominion Energy in Virginia, Duke Energy in North Carolina, and Georgia Power.

Even the handful of utilities that have previously earned high marks for clean-energy and coal-closure commitments in past “Dirty Truth” reports have slipped. Fogler highlighted the example of Indiana utility NIPSCO, which earned an “A” in the past four reports but only a “B” in the latest, largely due to its plan to rely on gas power plants to meet expected data center demand.

NIPSCO has “no plans to pursue the high-load-growth scenario until they see contracts signed and progress made,” Fogler said — a prudent approach that avoids burdening customers with the costs of new power plants built for data centers that may never come online, she said. “The problem? Their high-load-growth scenario calls for all new gas. There should be more clean options.”

Most utilities are not capitalizing on the solar and wind tax credits that are set to disappear in mid-2026 under the megalaw passed by Republicans in Congress this summer, she said. Only a handful of utilities, such as Xcel Energy in Colorado and Minnesota, are accelerating their clean energy deployments to take advantage of those tax credits. “We want more utilities to take that period of certainty and speed up what they’ve already planned.”

Going big on clean energy is also the only way to quickly add enough generation capacity to meet growing demand forecasts and contain rising utility costs, Ver Beek noted. Utilities and major tech companies are pinning their near-term capacity expansion plans on new gas plants, despite the yearslong manufacturing backlogs for the turbines that power those plants and rapidly rising turbine costs.

“From a cost perspective, from a climate perspective, we want to see utilities advocating for getting as much clean energy online as they can,” he said.