The lending environment should soon become more favorable for Realty Income.

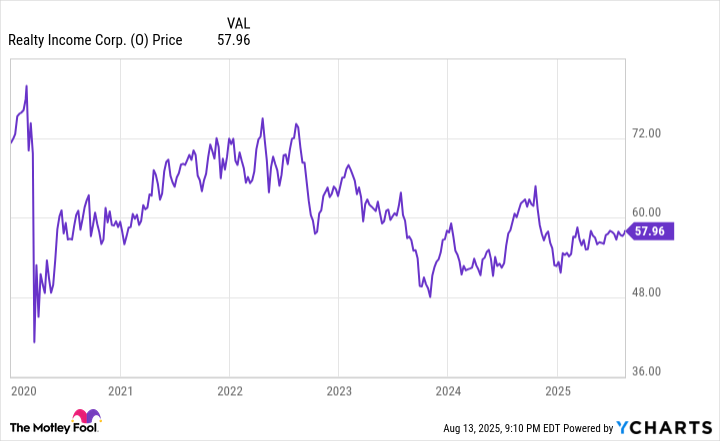

Realty Income (O 1.09%) may finally be getting the catalyst it needs. The company specializes in single-tenant net-leased properties and has built a massive property portfolio in its 56 years of existence. Still, despite that growth, the stock continues to trade well below its high just before the pandemic in early 2020.

However, it may finally be getting the catalyst it needs this fall. If a particular, widely expected event takes place in September, the long-overdue recovery in Realty Income stock could finally begin.

Image source: Getty Images.

The factor that should finally boost Realty Income stock

Over the next year, Realty Income may finally be getting its savior in the form of a September interest rate cut.

According to the CME Group, rates futures traders have priced in a 95% chance of a rate cut in September, and those odds rose after the U.S. Bureau of Labor Statistics released a cool Consumer Price Index (CPI) report. For July, the CPI came in at 0.2%, translating into a 2.7% inflation rate for the year.

Additionally, Treasury Secretary Scott Bessent speculated that the rate cut could come in at 0.5%, a notable change since most analysts had expected a 0.25% rate cut. Bessent also believes rates should ultimately be 150 basis points lower or more.

Interest rates are critical to Realty Income, considering its dependence on capital. The stock reached its all-time high in February 2020, and despite rising steadily since late 2023, Realty Income sells at nearly a 30% discount from its peak.

Data by YCharts.

Nonetheless, its business and financial performance stand in contrast to the stock’s behavior. As of the end of the second quarter of 2025, it owned or held an interest in more than 15,600 properties. When the stock peaked in 2020, its portfolio was barely above 6,500 properties, and it grew by buying competitors and developing additional properties internally.

Moreover, during that time, it increased its monthly dividend several times per year, including during the pandemic. Now, its yearly dividend of nearly $3.23 per share amounts to a dividend yield of 5.5%, far above the S&P 500 average of 1.2%.

The opportunity over the next year (and beyond)

Additionally, the current interest rate levels have not deterred growth. In the first half of 2025, its revenue of $2.8 billion rose 7% compared to the same period in 2024.

In comparison, its expenses grew by 6%, and its second-largest expense category was also interest payments. Since those rose by 13%, investors understandably want to see some relief in that area and may get it if Realty Income can refinance some debt or borrow more at lower rates.

Still, it earned nearly $447 million in net income attributable to common shareholders in the first two quarters of 2025, rising 16% yearly despite higher interest rates.

Furthermore, lower interest rates could persuade investors to take a closer look at its valuation. Its P/E ratio of 56 is slightly above the 54 average over the last five years.

However, Realty Income is a real estate investment trust (REIT), meaning funds from operations (FFO) is a more critical metric than net income. FFO income for the trailing 12 months was over $3.65 billion. That gives it a price-to-FFO ratio of just under 15, a level that could make Realty Income stock even more attractive in an environment of falling interest rates.

Realty Income in one year

Amid likely interest rate cuts beginning in September, the recovery in Realty Income stock could begin in earnest over the next year, increasing the likelihood of market-beating returns.

Indeed, its stock is in a long-term slump, likely because of interest rates. Although it probably would have earned a larger profit with lower interest rates, Realty Income still grew the size of its property portfolio and its dividend during that time.

Assuming the forecast interest rate cut occurs, the company will likely have more ability to refinance some of its debt and acquire or build additional properties, which should boost its profits. When also considering its 5.5% dividend yield and a price-to-FFO ratio of 15, the long-awaited recovery in the stock price could accelerate if lower rates serve as a catalyst for the stock.