Vanguard research is bullish on bonds for the next several years — more than U.S. growth stocks.

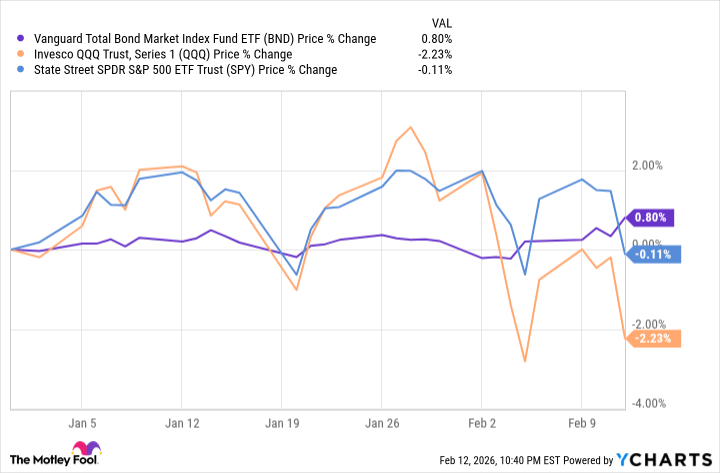

The U.S. stock market is off to a rocky start in 2026. The S&P 500 index is down 0.1% year to date, while the tech-heavy Nasdaq-100 index is down 2.2%. But one exchange traded fund (ETF) has outperformed them both: The Vanguard Total Bond Market ETF (BND +0.00%) is up 0.8% year to date.

Bonds don’t usually beat stocks, at least not for long. According to The Deutsche Bank Research Institute’s Long-Term Asset Return Study, during the past 100 years, U.S. bonds have never outperformed U.S. stocks over any 25-year time frame.

But if you’re feeling nervous about the recent tech stock sell-off, if you want to diversify some of your portfolio away from a few big-name artificial intelligence (AI) stocks, if you want to earn steady income on your investments — buying bonds could be a good choice.

Recent research from Vanguard made a surprising prediction that investors should consider. Let’s see why buying bonds could be a smart strategy.

Vanguard research: Bonds might outperform stocks

Vanguard’s 2026 economic and market outlook is bullish on bonds — less so on U.S. stocks. The company’s research projects 3.8% to 4.8% average annual returns for the next 10 years for U.S. bonds, and only 4% to 5% for U.S. equities. It also says “high-quality U.S. bonds” have the strongest risk-return profile of any public investments for the next five to 10 years — followed by U.S. value stocks and developed market international stocks.

Does that mean the AI bubble is bursting? Not exactly. Vanguard says that tech stocks could continue to perform strongly — but says “risks are growing amid this exuberance” and “more compelling investment opportunities are emerging elsewhere even for those investors most bullish on AI’s prospects.”

No matter what you think about the future of AI stocks, Vanguard’s forecast is a good reminder about the value of diversification. There’s no guarantee that the past few years of high growth in the U.S. tech-heavy stock market will continue. Now could be a good time to diversify into bonds, in a way that’s appropriate for your investment time horizon and risk tolerance.

Image source: Getty Images.

How to invest in bonds right now

Vanguard’s economic and market outlook didn’t recommend a specific bond fund to invest in. But one popular bond ETF that fits the description of “high-quality U.S. bonds” is the Vanguard Total Bond Market ETF. This fund gives you access to 11,444 investment-grade bonds across the U.S. dollar-denominated bond market.

The ETF charges an expense ratio of 0.03%, one of the lowest fees you’ll see for any investment. For the past three years, the fund has delivered average annual returns of 3.6%. It’s one of the easiest, lowest-cost ways to quickly invest in a broadly diversified range of government and corporate bonds.

Vanguard Total Bond Market ETF

Today’s Change

(0.00%) $0.00

Current Price

$74.88

Key Data Points

Day’s Range

$74.85 – $74.89

52wk Range

$71.41 – $75.15

Volume

57K

Fixed income from bonds might not sound exciting compared to the past few years’ returns from the best high-growth tech stocks. But if your goals are to earn income and protect your capital from the risk of a stock market downturn, investing some of your money in bonds can be a savvy choice. And your safe “boring” bonds might even outperform the Nasdaq-100 for the next few years.