The U.S. stock market has recently experienced its best week of 2024, with major indexes such as the S&P 500, Nasdaq Composite, and Dow Jones Industrial Average posting impressive gains. This surge in optimism is fueled by renewed confidence in the economy and expectations that the Federal Reserve may soon cut interest rates. In this favorable market environment, identifying undervalued stocks becomes crucial for investors looking to capitalize on potential growth opportunities. Among these are Cadence Design Systems and two other stocks that are estimated to be trading below their intrinsic value.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

|

Name |

Current Price |

Fair Value (Est) |

Discount (Est) |

|

Kaspi.kz (NasdaqGS:KSPI) |

$126.54 |

$252.58 |

49.9% |

|

Owens Corning (NYSE:OC) |

$159.58 |

$316.40 |

49.6% |

|

Coupang (NYSE:CPNG) |

$22.45 |

$43.47 |

48.4% |

|

Afya (NasdaqGS:AFYA) |

$18.26 |

$36.15 |

49.5% |

|

Oracle (NYSE:ORCL) |

$137.47 |

$268.55 |

48.8% |

|

Vitesse Energy (NYSE:VTS) |

$24.86 |

$48.50 |

48.7% |

|

MaxLinear (NasdaqGS:MXL) |

$12.55 |

$24.95 |

49.7% |

|

BILL Holdings (NYSE:BILL) |

$49.12 |

$95.66 |

48.6% |

|

PACS Group (NYSE:PACS) |

$38.79 |

$76.32 |

49.2% |

|

Cytek Biosciences (NasdaqGS:CTKB) |

$5.49 |

$10.62 |

48.3% |

Let’s explore several standout options from the results in the screener.

Overview: Cadence Design Systems, Inc. offers software, hardware, services, and reusable integrated circuit (IC) design blocks globally and has a market cap of $76.94 billion.

Operations: Revenue from CAD/CAM Software amounts to $4.16 billion.

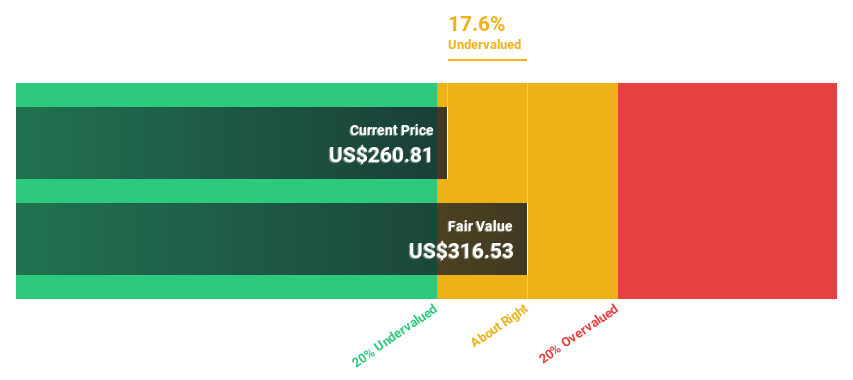

Estimated Discount To Fair Value: 11%

Cadence Design Systems is trading at 11% below its estimated fair value of US$315.77, indicating potential undervaluation based on cash flows. The company’s earnings are forecast to grow at 18% per year, outpacing the US market average of 15.1%. Recent buyback activity and strong quarterly earnings support this outlook, with Q2 revenue reaching US$1.06 billion and net income at US$229.52 million, showcasing robust financial health and effective capital allocation strategies.

Overview: The Estée Lauder Companies Inc. manufactures, markets, and sells skin care, makeup, fragrance, and hair care products worldwide with a market cap of approximately $34.05 billion.

Operations: The company’s revenue segments are comprised of $7.62 billion from skin care, $4.46 billion from makeup, $2.55 billion from fragrance, and $629 million from hair care products.

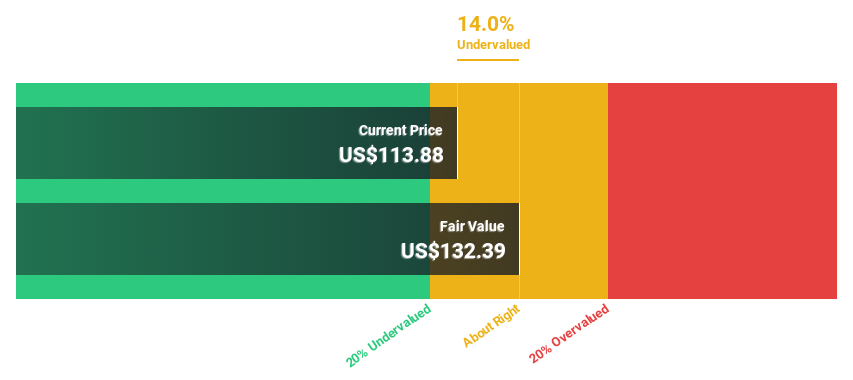

Estimated Discount To Fair Value: 38.2%

Estée Lauder Companies is trading at US$94.97, significantly below its estimated fair value of US$153.60, indicating it may be undervalued based on cash flows. Despite a high level of debt and lower profit margins compared to last year, the company’s earnings are forecast to grow at 26.9% per year, outpacing the broader US market’s growth rate of 15.1%. Recent executive changes aim to strengthen leadership, potentially supporting future financial performance and strategic initiatives.

Overview: Eli Lilly and Company discovers, develops, and markets human pharmaceuticals worldwide with a market cap of $830.30 billion.

Operations: Eli Lilly’s revenue from the discovery, development, manufacturing, marketing, and sales of pharmaceutical products totals $38.92 billion.

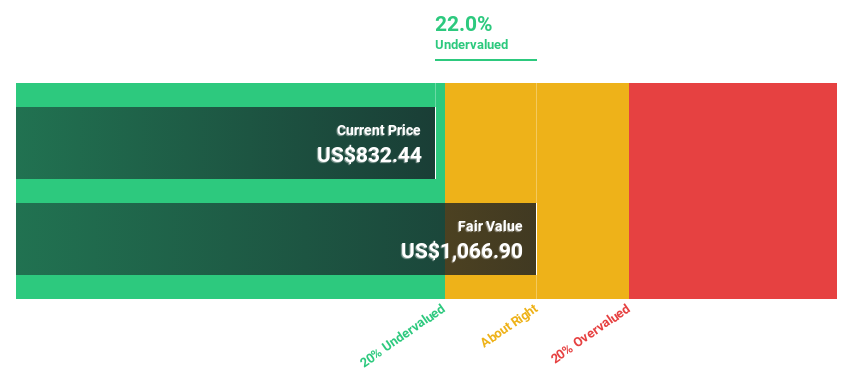

Estimated Discount To Fair Value: 16.2%

Eli Lilly, trading at US$922.12, appears undervalued relative to its estimated fair value of US$1,100.83 based on discounted cash flow analysis. Despite recent executive changes and significant fixed-income offerings totaling over $5 billion, the company maintains strong financial health with robust earnings growth forecasted at 28.9% per year, outpacing the broader US market’s 15.1%. The opening of the Lilly Seaport Innovation Center and increased revenue guidance further bolster its promising outlook in RNA/DNA-based therapies and other key areas.

Summing It All Up

-

Unlock our comprehensive list of 176 Undervalued US Stocks Based On Cash Flows by clicking here.

-

Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio’s performance.

-

Discover a world of investment opportunities with Simply Wall St’s free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NasdaqGS:CDNS NYSE:EL and NYSE:LLY.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com