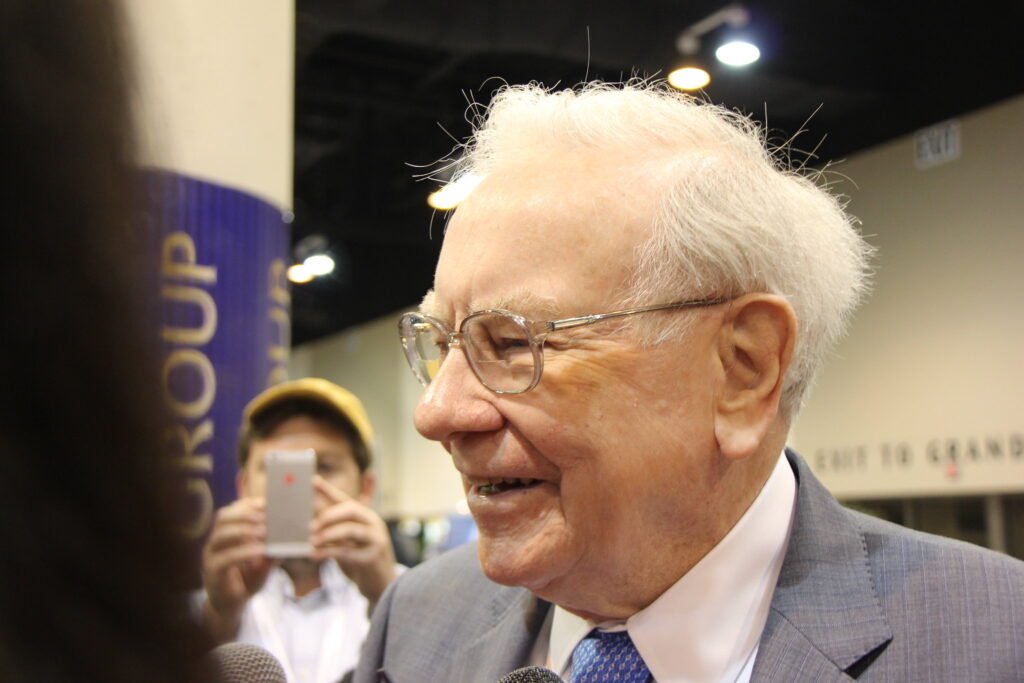

Warren Buffett appears to be on track to go out in style as CEO of Berkshire Hathaway. The legendary investor has outperformed the S&P 500 throughout most of his career. He’s doing it again with only six months or so remaining at Berkshire’s helm.

One stock in Buffett’s Berkshire Hathaway portfolio is performing especially well. It’s crushing the market in 2025 — and Wall Street thinks it could soar 70% higher.

Image source: The Motley Fool.

Not the typical Buffett stock

What is this big year-to-date winner for Buffett? Chinese electric vehicle (EV) maker BYD (BYDD.F -1.82%) (BYDDY). Its shares have jumped roughly 48% so far in 2025 and were even higher in May.

BYD isn’t the typical Buffett stock. He primarily invests in U.S. companies, with Berkshire’s stakes in five Japanese trading houses being notable exceptions. Buffett and electric vehicles generally don’y go together. He hasn’t been a big fan of auto stocks in general. In 2023, Buffett said that he and his longtime business partner, the late, great Charlie Munger, “for long have felt that the auto industry is just too tough.”

However, Munger was a passionate advocate for BYD. He persuaded Buffett to invest in the EV maker in 2008. At Berkshire Hathaway’s 2023 annual shareholder meeting, Munger declared, “I have never helped do anything at Berkshire that was as good as BYD, and I only did it once.”

BYD bulls on Wall Street

Wall Street really likes BYD, too — or at least the lone analyst surveyed by LSEG who covers the stock does. Barclays thinks the Chinese EV maker’s shares trading under the BYDDF ticker could rise by more than 70% over the next 12 months and rates the stock as a “strong buy.”

Barclays isn’t the only analyst that’s upbeat about BYD, though. LSEG surveyed two analysts who provided revenue estimates for the company’s next two quarterly updates. The average estimate is that BYD will deliver year-over-year revenue growth in Q2 of 31.4% and in Q3 of 53%.

A much larger group of 29 analysts weighed in on how BYD might perform in full-year 2025. The consensus estimate of these analysts was revenue growth of nearly 27%.

Two factors stand out as the likely reasons behind the overall bullishness about BYD. First, the company unveiled its new “Super e-Platform” technology that will allow its cars to be driven for around 249 miles (400 kilometers) after only five minutes of charging. Second, BYD plans to double its sales outside China to 800,000 vehicles in 2025.

Is Wall Street right about this high-flying stock?

I’m not convinced that Barclays is right that BYD stock could skyrocket another 70% or so. The company’s EV price war in China is the culprit behind BYD’s pullback from its high set earlier this year. This could hurt BYD’s profitability over the near term.

However, BYD’s expansion beyond China bodes well for its long-term growth prospects. In April, the company sold more EVs than Tesla in Europe for the first time ever. Despite higher tariffs imposed by the European Union, BYD made significant traction in the European market.

BYD’s new charging technology could be a game-changer. Being able to charge an EV in roughly the same amount of time that it takes to fill up a gasoline-powered car should make EVs more attractive to many auto buyers.

I think BYD should have a tremendous opportunity in the autonomous ride-hailing (robotaxi) market, too. The Chinese company’s partnership with Uber to roll out 100,000 BYD EVs in Europe, Latin America, and other regions is significant.

While I’m unsure whether or not BYD will vault 70% higher over the next 12 months, I suspect the stock will keep rising over both the near term and long term. And Munger’s pick is likely to help Buffett step down as Berkshire’s CEO at year’s end on a winning note.

Keith Speights has positions in Berkshire Hathaway. The Motley Fool has positions in and recommends Berkshire Hathaway, Tesla, and Uber Technologies. The Motley Fool recommends BYD Company and Barclays Plc. The Motley Fool has a disclosure policy.