LiveStockEx, a new, online cattle trading platform likened to a “stock exchange for cows” has completed a seed funding round and will launch in the UK this month.

The “first of its kind” platform is the brainchild of Murray Roos, former head of capital markets at the London Stock Exchange and software engineer Srikrishna Murali. It promised to both reduce the cost of livestock trading and improve transparency throughout the meat value chain, Roos said.

Roos – now a Sussex Beef farmer – was a key player in the modernisation of the LSE over the past two decades and its transition to electronic trading. He raised LiveStockEx’s £1m seed funding in just two days.

The app and web-based platform could save farmers and the wider sector up to 10% on the cost of buying and selling cattle, compared with traditional “open outcry auctions”, he added.

Currently, farmers are charged between 7%-10% per sale at these auctions, with brokers and intermediaries in the direct and contract sale market charging an additional 3% in fees.

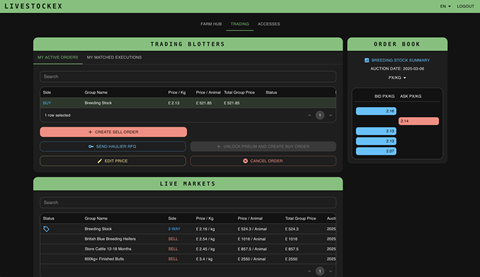

LiveStockEx charges a flat fee of 2% per transaction and gives farmers access to a nationwide marketplace, “creating broader demand and pricing stability”, he said. The service was also linked to the government’s UK Cattle Tracing System (CTS) – “allowing farmers to simply load their livestock inventory to the platform”.

Farmers could then advertise their stock for sale and buyers (typically supermarkets, processors or wholesale butchers) could then raise order requests in real-time for specific requirements, such as breed or weight.

The UK market opportunity was “significant”, Roos said, with approximately 44,000 cattle farms and 1.26 million cattle traded each year, with each cow bought and sold 1.5 times on average in its lifetime. The total turnover of the UK cattle market in 2023 was £5.26bn, according to government data.

LiveStockEx was now hiring salespeople and approaching suppliers, food groups and farmers, while also exploring overseas launches, with a Kenyan platform said by Roos to now be close to going live.

“It will democratise livestock trading, allowing buyers and sellers to get the fairest deal, while cutting out the nefarious behaviour of certain middle men and market manipulation practices,” added Roos. LiveStockEx also reduced food miles [avoiding the need to transport cattle to live marts – which were often a source of animal disease] and allowed buyers to “better understand the provenance of their product”.

Much like the London Stock Exchange’s transition to electronic trading in the 1990s, the platform promised to “revolutionise an antiquated, intermediary-heavy system for buying and selling livestock in the UK”, he said.

“It has been created to give power back to farmers who invest significant energy, time and money into rearing their animals, only to suffer unnecessary costs and uncertainty at the point of sale.”

The launch of the LiveStockEx platform marks the latest attempt to digitise and modernise livestock trading. The Breedr app, described as the “world’s first” fully-traceable livestock marketplace app, launched in 2020, allowing farmers to sell virtually, without the need to move stock to physical markets.

However, Roos said his platform differed from Breedr due to its integration with the CTS, while Breedr also operated more like a classified ad service “such as I have ten cows for sale”, rather than a stock exchange with “real-time order evolution”.