Buffett’s appetite for this stock has persisted for five straight quarters now.

It seems that the broader stock market has become quite volatile. That goes both ways — stock prices surge at times and plunge at others.

There has been no shortage of drama over the past 24 months, with elections, geopolitical conflicts, economic concerns, and tariffs all impacting the markets. Billionaire and Wall Street legend Warren Buffett, who invests as CEO of Berkshire Hathaway, has been a net seller of stocks amid the volatility, significantly boosting Berkshire’s cash position.

But there is one stock that Buffett has continued to buy. Berkshire invested in Domino’s Pizza (DPZ +2.54%) in the third quarter of 2024 and has bought shares each quarter since then. Here is why Domino’s Pizza might appeal to Buffett and Berkshire Hathaway, and whether the stock is still worth buying now.

Image source: Getty Images.

Domino’s Pizza is in Buffett’s wheelhouse

Berkshire Hathaway currently holds roughly four dozen stocks in its massive $301 billion portfolio, and Buffett has bought and sold many more throughout his long career.

Buffett has probably invested in companies across every market sector by now. Still, he has built a reputation for his affinity for consumer-facing businesses with strong brand moats. While top Berkshire holdings like Apple, Coca-Cola, and American Express couldn’t be any more different from each other, they all have those traits.

Domino’s Pizza does, too. Pizza is a global food staple that transcends cultures and geography. The broader pizza market continues to grow as consumers grapple with higher living expenses. Pizza excels as a feed-the-masses go-to meal, and it’s highly customizable to appeal to just about anyone’s tastes.

The company has created a finely balanced combination of quality, affordability, and convenience. There is usually at least one Domino’s Pizza location in every notable U.S. town or city, and the company has expanded into a global operation with over 21,000 stores.

Today’s Change

(2.54%) $10.07

Current Price

$407.28

Key Data Points

Market Cap

$14B

Day’s Range

$400.02 – $413.36

52wk Range

$392.89 – $500.55

Volume

21K

Avg Vol

622K

Gross Margin

39.81%

Dividend Yield

1.65%

The company has a long growth runway ahead

Pizza’s broad appeal gives Domino’s Pizza a high ceiling for store expansion. The company has opened stores quickly and aggressively, increasing its total store count to:

- 19,880 in 2022.

- 20,591 in 2023.

- 21,366 in 2024.

- 21,750 through nine months of 2025.

McDonald’s has over 44,000 stores globally, so there’s plenty of room to keep opening stores, even if Domino’s Pizza is never as prevalent as the burger giant. Domino’s Pizza operates on a franchise model. It charges franchisees fees to open a store and royalties on the sales, generating recurring, profitable revenue streams.

Domino’s Pizza still has a long growth runway ahead. Technology, including a smartphone app and restaurant automation, has helped the company expand its U.S. market share from 26% in 2019 to 30% last year. The U.S. still accounts for almost half of Domino’s Pizza’s locations, so there is a tremendous opportunity outside the United States, where Domino’s Pizza has enjoyed 31 consecutive years of same-store sales growth.

A fantastic business trading at a fair price

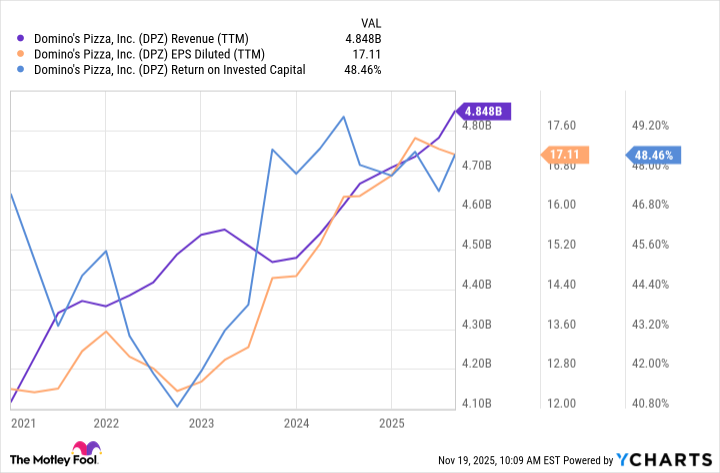

The pizza maker’s business story is compelling, and its financials back it up. Domino’s is highly profitable and efficient with the capital it invests. So, even though sales have grown by just under 18% over the past five years, earnings per share have grown by over 38%. That’s the magic of a company that produces such a high return on invested capital (ROIC).

DPZ Revenue (TTM) data by YCharts

It also makes growth pretty durable. Wall Street analysts estimate that Domino’s Pizza will grow its earnings by an average of 10% to 11% annually over the next three to five years. The stock also pays a dividend with a yield of 1.7%, and management has raised the dividend for 12 consecutive years.

The stock’s current price-to-earnings ratio of 23.6 is near its decade-low, which may explain why Buffett, a notorious stickler for a good deal, continues to scoop up shares. As long as Domino’s Pizza can sustain the success it has had in years past, it’s hard not to like the stock’s long-term investment prospects.