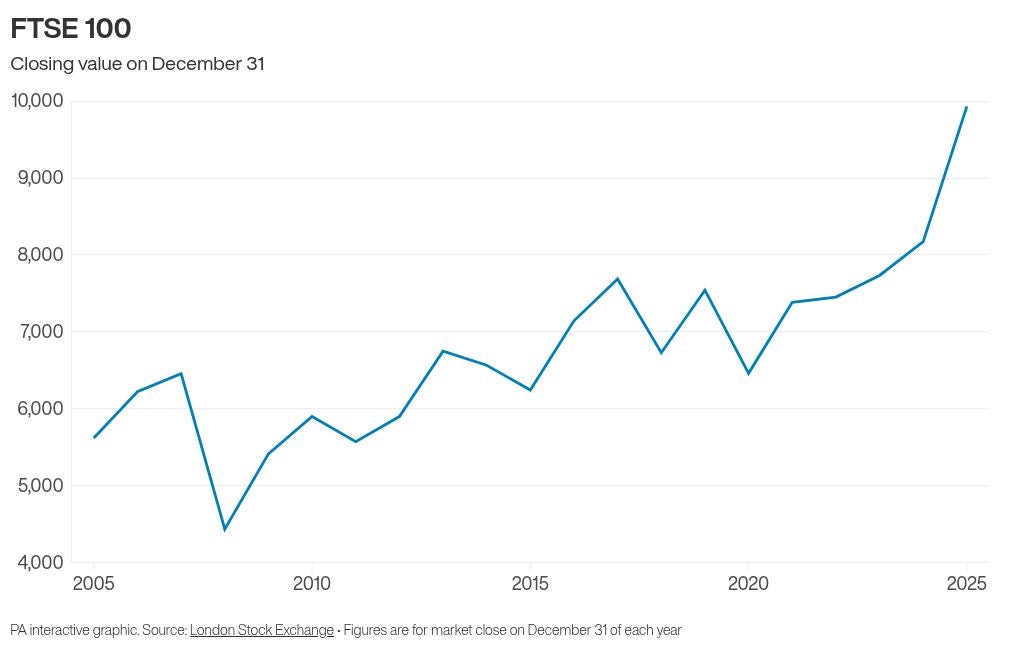

The government want more British people to start investing and could hardly have had a better advertising campaign handed to them, as the FTSE 100 – the index of the biggest firms listed on the London Stock Exchange – posted the best annual returns across 2025 since the rebound from the financial crisis.

In total, the UK’s biggest stock market index gained 1,758.36 points, or 21.5 per cent, from the last trading day of 2024 to December 31 2025.

That’s in comparison to the 16.7 per cent gains made by the collection of Europe’s biggest firms, the Stoxx 600, America’s S&P 500 which gained 17 per cent, and the tech-focused Nasdaq Composite which rose 21 per cent across the year.

The strong gains realised by the British-listed contingent in the FTSE 100 were particularly notable among many mining corporations, defence firms and finance businesses.

That came despite the backdrop of political and economic uncertainty on both a domestic and global landscape all year, which included the dramatic stock market drops from Trump tariffs being announced, the oil price shock as Iran threatened to close the Strait of Hormuz, Rachel Reeves’ delayed Budget and a worryingly stagnant British economy.

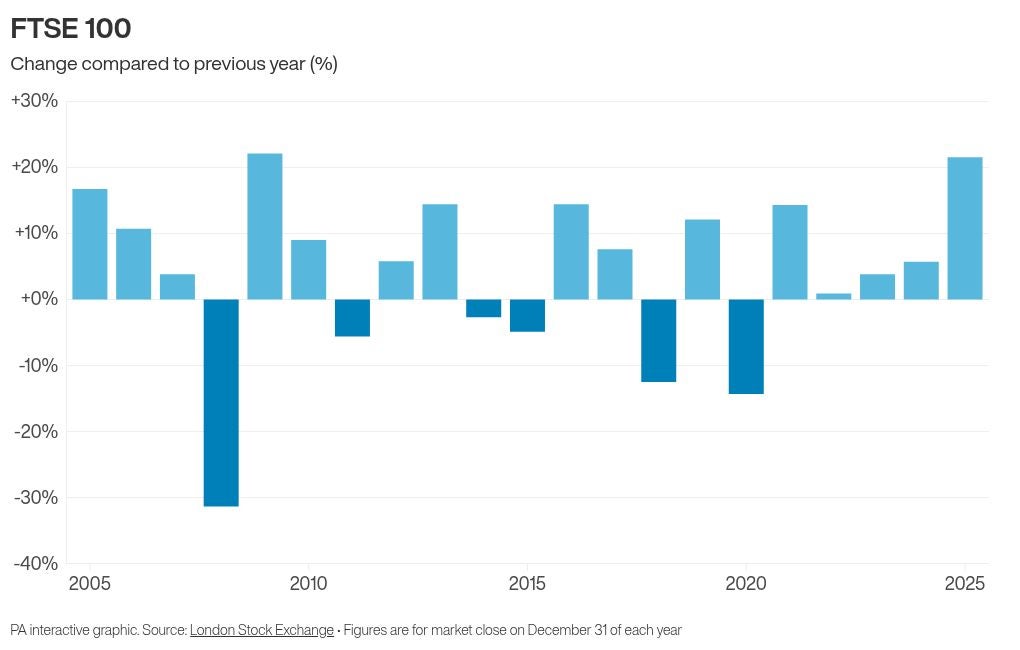

It marks a fifth-straight year of gains for the FTSE 100 and means the index has risen in eight of the last ten years, though the usual gains are rarely this outsized, as evidenced by this being the best year since 2009 when it rose 22.1 per cent in the aftermath of the global financial crash.

Over the last decade the FTSE 100 has averaged around 9 per cent gains, a far higher return for money than savings accounts will typically offer – and a notable difference when interest rates are in lowering cycles, as is the case now.

Closing 2025 at 9,931.38, the index shot past record high levels on multiple occasions through the year and teetered close to surpassing the 10,000 mark for the first time.

The year’s success for the blue-chip index has meant it has outperformed European and US peers, including France’s Cac 40 – while the gains were more or less on par with Germany’s Dax.

Get a free fractional share worth up to £100.

Capital at risk.

Terms and conditions apply.

ADVERTISEMENT

Get a free fractional share worth up to £100.

Capital at risk.

Terms and conditions apply.

ADVERTISEMENT

Investors were drawn to the steady gains of FTSE-listed firms despite broader weaknesses in the UK economy and political uncertainty prompting significant volatility in the global stock markets.

It was a particularly strong year for precious metal producer Fresnillo, whose share price soared by about five-fold over 2025, while gold miner Endeavor Mining’s shares jumped by nearly three-fold.

Defence firms Rolls-Royce and Babcock also strengthened considerably during a year where geopolitical tensions continued to rise, with their share prices roughly doubling.

Bank stocks also rallied amid elevated profits and business progress, with Lloyds Banking Group leading the charge with its share price nearly doubling as a result of steady gains over the course of the year.

Stock market turbulence came to a head in early April when investors were reacting to US president Donald Trump announcing his plans to raise tariffs for countries around the world on US imports. The FTSE 100 suffered its biggest single-day decline since the start of the Covid-19 pandemic, as did Wall Street’s S&P 500 and Dow Jones indexes, before clawing back its losses and returning to growth.

Dan Coatsworth, head of markets at AJ Bell, said the FTSE 100 “has had precisely the right ingredients desired by investors in a year full of political, trade and market uncertainty”.

“This year’s success for the blue-chip index is not a flash in the pan,” he added.

“The FTSE 100 has delivered positive returns in eight of the past 10 years, averaging 9.1% annually over that period including dividends. This kind of performance reinforces the attraction of investing over the long term.

“There may be years when performance disappoints, but history suggests it’s worth pursuing.”

Despite the FTSE 100 strengthening, 2025 has also seen a raft of listed businesses choose to abandon the London Stock Exchange (LSE) for foreign stock markets or to be taken into private hands.

Direct Line was delisted from the LSE after its takeover by rival Aviva in a £3.7 billion deal that created a major force in the UK’s insurance market.

Drinks maker Britvic was also snapped up by Carlsberg at the beginning of the year, taking it off the stock market and into the hands of the Danish brewing giant.

Meanwhile, further setbacks for the London market came as drug maker Indivior announced plans to delist from the LSE after moving its primary listing to the US’s Nasdaq last year, and British fintech Wise said it planned to switch its primary listing from London to New York.

Companies including Royal Mail’s owner International Distribution Services (IDS), Hargreaves Lansdown and industrial group Spectris were among those to be taken private in high-value takeovers completed this year.

Nevertheless, it was also a stronger year for IPO activity with 11 listings on the LSE in 2025, raising total proceeds of £1.9 billion – the most since 2021, according to analysis by PwC.

Additional reporting by PA