Investors rarely get an opportunity to buy this high-flying stock at reasonable valuations — so on a dip like this, take a look!

Investors have a rare opportunity to scoop up shares of Ferrari (RACE 0.16%) at a discount after the stock shed roughly 17% of its value over the past month. The driving force behind the spiral lower wasn’t current issues — the company just posted a strong third quarter and raised 2025 guidance–– but rather the fact that the company set lower-than-expected growth through 2030. It’s a classic overreaction by the market, and while the decline only brings Ferrari’s price-to-earnings ratio down to a lofty 38 times, it’s still a rare buying opportunity. Let’s briefly cover Ferrari’s strong third quarter and why it’s still a strong buy.

Brief recap

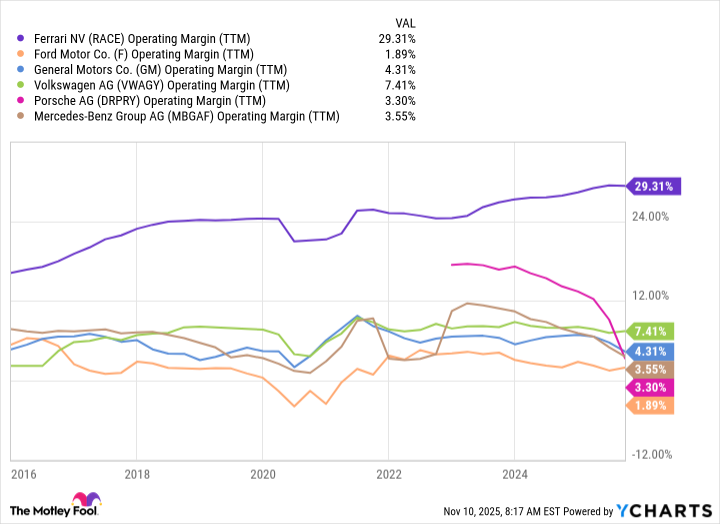

Ferrari only needed 3,401 total shipments during the third quarter to generate strong results. Net revenue jumped 7.4% to 1.77 billion euros during the third quarter, compared to the prior year, driving a 7.6% gain in operating profit (EBIT) of €503 million; margins remained a strong 28.4%. Investors would be wise not to take those margins for granted, as they are incredibly rare in the automotive industry. Ferrari’s pricing power is elite.

RACE Operating Margin (TTM) data by YCharts

“We continue to advance with conviction and strong visibility on our development path. At our Capital Markets Day, we have defined a clear trajectory in the long-term interests of our brand, setting the floor for sustainable growth toward 2030,” said Benedetto Vigna, the CEO of Ferrari, in a press release.

Part of Ferrari’s success during the third quarter was driven by its lucrative product mix that reflected strong deliveries of the SF90 XX and the 12Cilindri families, as well as an uptick in expensive options on personalization, which helped offset U.S. import tariffs that added to the cost of Ferrari’s imports to its most valuable U.S. market.

Today’s Change

(-0.16%) $-0.65

Current Price

$417.16

Key Data Points

Market Cap

$74B

Day’s Range

$413.84 – $419.53

52wk Range

$372.31 – $519.10

Volume

572K

Avg Vol

683K

Gross Margin

51.25%

Dividend Yield

0.01%

But wait, there’s more

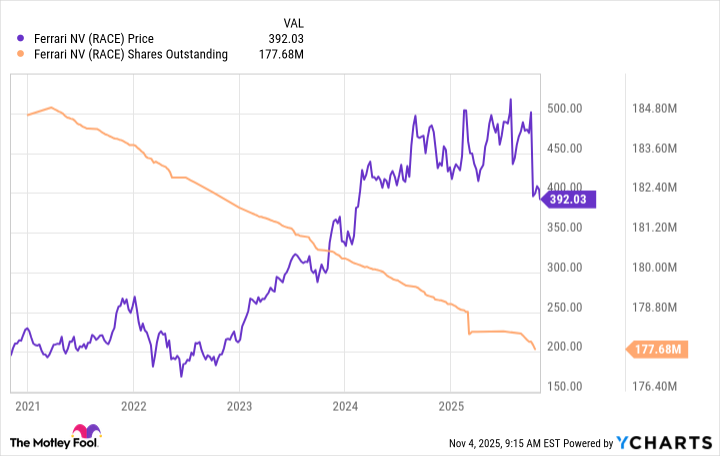

Aside from the core numbers and metrics, there were a few things of interest to investors. First, Ferrari isn’t known for returning value to shareholders through its modest dividend, but it might not get enough credit for buying back shares.

Ferrari is currently in the process of completing its multiyear share buyback program of roughly €2 billion announced in 2022. While investors and companies may sell for a number of reasons, this is a strong signal that Ferrari has confidence in its business and sees long-term upside in its shares.

Second, Ferrari may be doing investors a favor by pumping the brakes on its full-electric future. Ferrari has dialed back its electric vehicle (EV) ambitions and said full EVs will make up about 20% of its lineup by 2030, half of its original goal set in 2022. It comes at a time its Porsche rival posted its first quarterly loss since going public, acknowledged EV setbacks, and took a hit from tariffs and a weakening Chinese market.

Image source: Ferrari.

Third, in a time of economic uncertainty, Ferrari offers investors revenue transparency with the company’s order book sold out through 2027. That sets the stage nicely for Ferrari to introduce its first fully electric model, the Elettrica, next year — a model that could define Ferrari’s capability to break into the EV market.

Ferrari remains a strong buy

It’s a significant challenge to find a better luxury stock than Ferrari. The company possesses a strong economic moat from its impeccable brand image, which is built from racing success, technology, and heritage, incredible pricing power and tight exclusivity on volume. Ferrari offers investors near-term revenue transparency with a sold-out order book and industry-thumping operating margins. For Ferrari, business is good, and it will very likely continue to be great in spite of some skittish investors selling due to slightly lower-than-expected long-term guidance.