Image source: Getty Images

The past five years have not been kind to the UK stock market and in particular, real estate investment trusts (REITs). These tax-beneficial investment vehicles are very sensitive to interest rate hikes, which ramp up borrowing costs and scare off investors.

That’s why many of them suffered losses through 2023 and 2024. But I think their high dividend yields and commitment to shareholder returns make them great additions to consider for passive income portfolios.

Now, with the industry showing signs of improvement, it may be time to consider some top UK REITs.

Here are two that caught my attention recently.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice.

Target Healthcare REIT

Real estate investment trusts (REITs) are hot again, with many enjoying notable attention this year. One of my favourites, Primary Health Properties, is up almost 10%, while maintaining a juicy 6.9% yield.

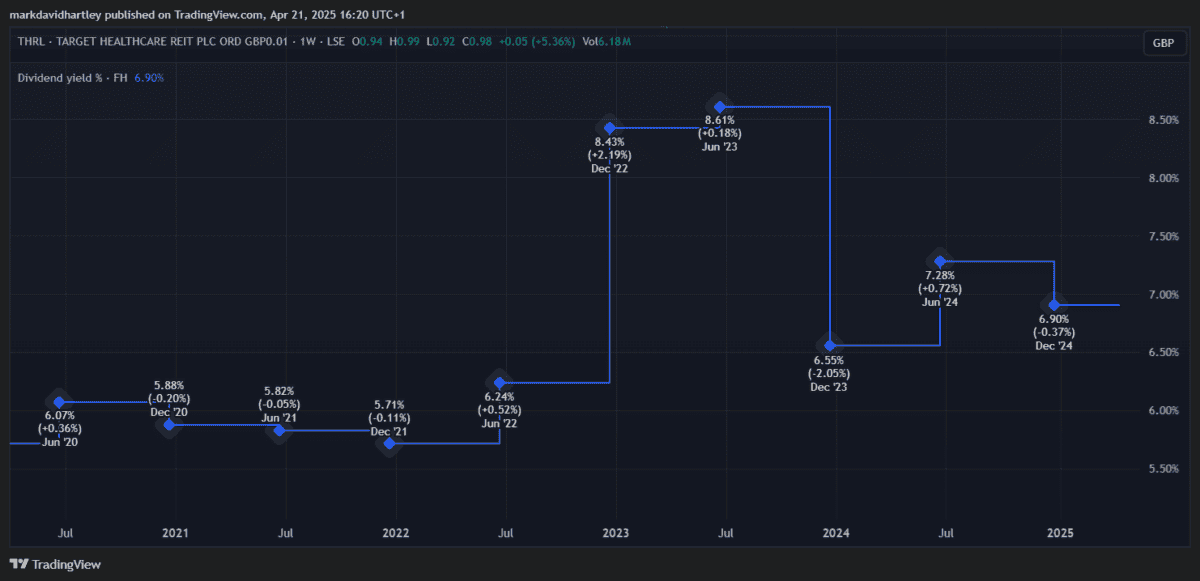

But now I have my eye on a potential competitor — Target Healthcare REIT (LSE: THRL). The stock boasts a 5.9% yield and is up an impressive 16.7% this year already. Yet despite this, its price-to-earnings (P/E) ratio remains low, at 8.45. This suggests it still has a lot of room to grow.

And I’m not surprised — at 98p per share, it’s still 20% below its five-year high set in July 2021.

However, the risk of a return to high interest rates is ever-present, not to mention regulatory and policy changes in healthcare or housing. Both these factors can hurt the share price, compounded by any additional expenses from rising materials costs, maintenance issues or environmental disasters.

It’s worth nothing that REITs tend to enjoy limited capital growth but make up for it with strong and reliable dividends.

What really caught my eye about Target was the company’s market cap relative to revenue, measured by its price-to-sales (P/S) ratio. At 8.48, it suggests investors are willing to pay a high price for the stock. This, combined with a low P/E ratio, suggests strong growth potential.

Sirius Real Estate

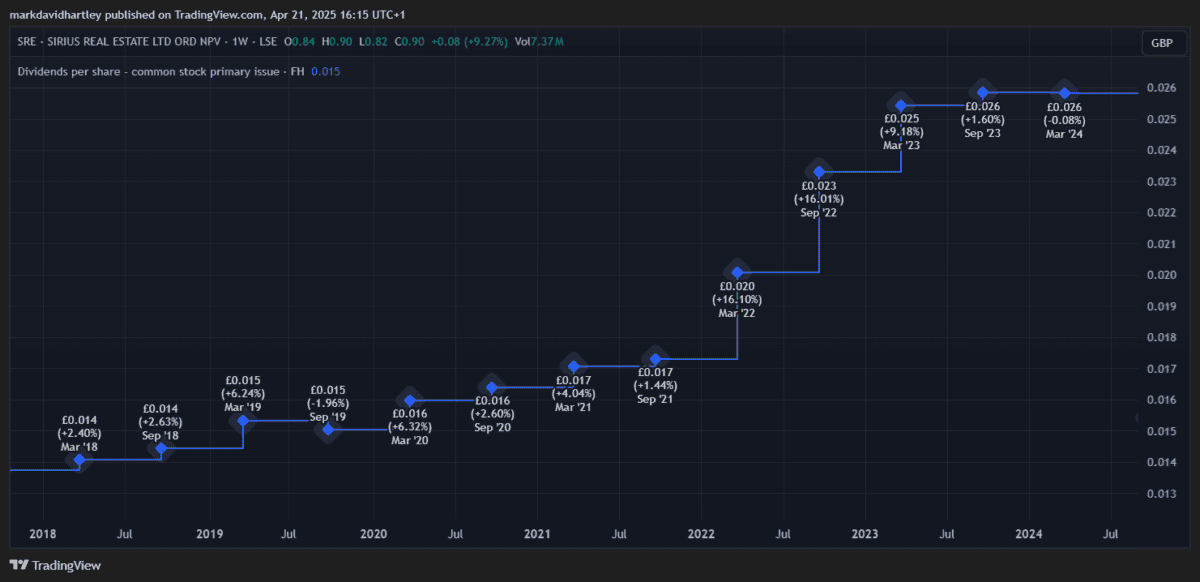

Sirius Real Estate (LSE: SRE) is a property company focused on owning and managing business parks, flexible offices and industrial spaces in Germany and the UK. It has established a reputation for generating stable rental income from small and medium-sized enterprises (SMEs), benefitting from strong operational efficiency and regional diversification.

One of the main attractions of the REIT is its solid revenue growth, which rose 7.2% year-to-date (YTD), reflecting high tenant demand and effective asset management. The company has a respectable dividend yield of 5.6%, appealing to income-focused investors, and its P/E ratio of 10.8 suggests the stock is currently undervalued relative to earnings.

However, there are risks. Like Target Healthcare, Sirius is affected by macroeconomic issues like high inflation and interest rates. This puts pressure on tenant affordability and can lead to reduced property valuations. The company also has exposure to currency fluctuations between the euro and the pound, potentially affecting reported results. Moreover, future rental income growth may slow if SMEs face economic strain.

With a 1.38bn market cap, it’s larger and more well-established than Target. This makes it a more defensive play, adding stability but limiting its growth potential.

Are they the best? Saying so is very subjective and depends on an investor’s individual criteria. But together, I think the two are worth considering as part of an income portfolio aimed at achieving long-term dividend returns.