Deckers Outdoor has had a disastrous 2025. Can it bounce back next year?

To say 2025 has been a disappointment for Deckers Outdoor (DECK +3.58%) is probably an understatement.

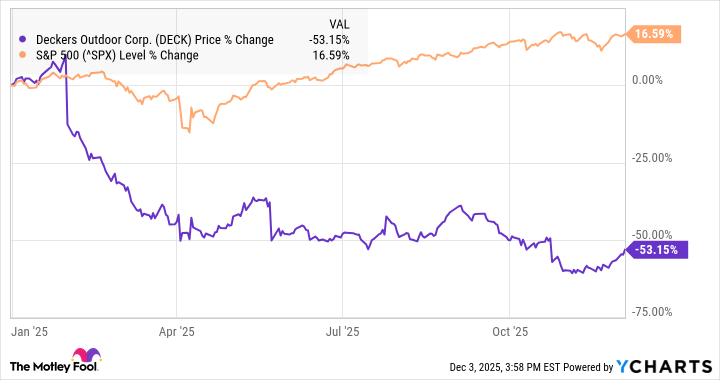

Deckers, the footwear stock that is best known as the parent of Hoka and UGG, came into 2025 flying high, but disappointing guidance early in the year, headwinds related to tariffs, and slowing growth over the course of the year sank the stock, making it one of the worst performers on the S&P 500. As the chart shows, the stock is down 53% year to date.

Despite the poor performance, Deckers has been a long-term winner on the stock market. Can the footwear stock make a comeback in 2026? Let’s take a look at four key factors to watch next year.

1. Will the macro environment be a headwind?

Deckers’ challenges in 2025 can mostly be attributed to weakening consumer spending in the U.S., a problem that has affected peers like Lululemon and Nike, as well as other consumer discretionary companies like Chipotle and Target.

Overall revenue growth slowed to 9% year over year in its fiscal second quarter, its most recent report, but domestic sales were up just 1.7%. International sales, meanwhile, soared 29.3%, and now make up more than 40% of revenue. Growth has been strong in China in particular, but if domestic sales remain weak, a comeback will be difficult.

In its full-year outlook, it called for low-teens sales increase in Hoka, but just low-to-mid-single-digit sales growth in UGG, indicating it’s not expecting a quick rebound after growth slowed to 9%.

Image source: Deckers.

2. Performance in new markets

While the company’s domestic results may be investors’ primary focus, its growth in international markets is also a key part of the long-term growth story.

In the second quarter, management called out improvements in China and the EMEA (Europe, Middle East, Africa) region, and the company opened its first store in Germany, showing it still has significant white space to penetrate.

Management also noted strong performance from Hoka in major European markets, as the brand is gaining market share and seeing strong growth in the direct-to-consumer channel.

3. Margin strength

Deckers has historically generated high gross margins, a sign of the strength of its brands and its reputation for quality products.

Despite the disappointing results in the second quarter, gross margin improved from 55.9% to 56.2%, showing the company didn’t have to resort to markdowns to sell product. Keep an eye on gross margin in 2026 to see how the company is handling any weakness in consumer demand in the U.S. If it can hold gross margins, that should be seen as a positive sign.

Today’s Change

(3.58%) $3.45

Current Price

$99.70

Key Data Points

Market Cap

$15B

Day’s Range

$96.17 – $99.74

52wk Range

$78.91 – $223.98

Volume

4.6M

Avg Vol

3.9M

Gross Margin

56.14%

Dividend Yield

N/A

4. Valuation

Finally, investors should watch Deckers’ valuation over the next year. After tumbling by more than 50% in 2025, the stock now trades at a price-to-earnings ratio of just 14, indicating that significant weakness is already priced into the stock.

At that price, the stock looks like a good buy, assuming the company can stabilize its business and deliver solid growth. If the valuation drifts even lower next year, that should offer a good buying opportunity for long-term investors, provided the business remains stable.

Jeremy Bowman has positions in Chipotle Mexican Grill, Lululemon Athletica Inc., Nike, and Target. The Motley Fool has positions in and recommends Chipotle Mexican Grill, Deckers Outdoor, Lululemon Athletica Inc., Nike, and Target. The Motley Fool recommends the following options: short December 2025 $45 calls on Chipotle Mexican Grill. The Motley Fool has a disclosure policy.