Tesla (TSLA) has faced setbacks in the past. Its stock has dropped more than 30% within a period of under 2 months 8 times across different years, erasing billions in market value and negating significant gains in a single correction. If history serves as a reference, Tesla (TSLA) stock is not shielded from abrupt and steep declines.

The Risk That Is Brewing

- Market Share Erosion – BYD has overtaken Tesla in global BEV sales through Q3 2025, reporting 1.61M units compared to Tesla’s 1.22M, giving a 388K advantage. Tesla’s operating income for Q3 2025 decreased by 40% YoY, with market share declining from 49% in Q3 2024 to 41%, despite record deliveries of 497K units.

- FSD Regulatory Risk – The NHTSA probe initiated in October 2025 involves 2.88M Teslas concerning FSD traffic violations, with 6 accidents resulting in injuries. The rollout for FSD in Europe has been postponed until 2028. FSD (Supervised) has accumulated over 6 billion miles; Q3 2025 Autopilot recorded 6.36M miles per crash.

- Raw Material Costs – The price of lithium increased by 4.62% YoY to 74,800 CNY/T by October 2025. Nickel is priced at $15,328 USD/T (October 2025) and is experiencing oversupply. Tesla’s 4680 cells represent the lowest cost per kWh, with a lithium refinery in Texas anticipated to begin operations in Q4 2025.

Investing in a single stock can be precarious, but there is significant value in adopting a broader diversified strategy. If you are looking for potential gains with reduced volatility compared to holding a singular stock, consider the High Quality Portfolio (HQ) – HQ has surpassed its benchmark, which combines the S&P 500, Russell, and S&P midcap index, delivering returns greater than 105% since its inception. Effective risk management is essential – consider what the long-term performance of a portfolio might look like if you included 10% in commodities, 10% in gold, and 2% in crypto alongside HQ’s performance metrics.

Is Risk Showing Up In Financials Yet?

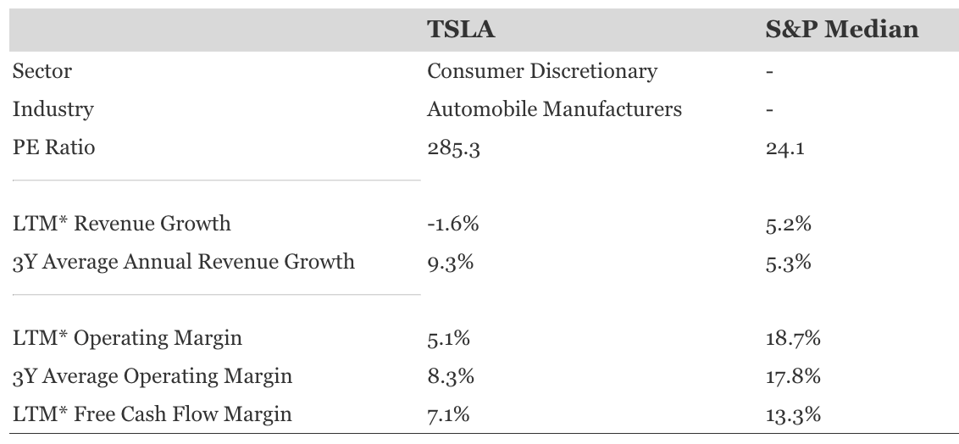

It certainly helps to alleviate risk if the fundamentals are robust. For insights on TSLA, read Buy or Sell TSLA Stock. Below are some pivotal numbers.

- Revenue Growth: -1.6% LTM and 9.3% average over the last 3 years.

- Cash Generation: Approximately 7.1% free cash flow margin and 5.1% operating margin over LTM.

- Valuation: Tesla’s stock trades at a P/E ratio of 285.3

- Opportunity vs S&P: When compared to the S&P, Tesla offers a higher valuation, higher average revenue growth over 3 years, and lower margins.

Comparison with S&P500 Median

Trefis

*LTM: Last Twelve Months

How Bad Can It Really Get?

Examining Tesla’s previous market declines provides context for its risks. The correction in 2018 resulted in a 53.5% reduction from its peak, while the Covid pandemic witnessed an even greater decline of 60.6%. The shock from inflation was the most severe, with a drop of 73.6% from peak to trough. Despite having solid fundamentals and significant interest surrounding the brand, Tesla has not been insulated from considerable sell-offs under difficult market conditions. This serves as a reminder that no stock, irrespective of its popularity, is completely protected against substantial declines.

However, the risk extends beyond just major market crashes. Stock prices can decline even in favorable market conditions – consider events such as earnings reports, business updates, and changes in outlook. Read TSLA Dip Buyer Analyses to understand how the stock has bounced back from significant dips historically.

The Trefis High Quality (HQ) Portfolio, featuring a selection of 30 stocks, boasts a history of consistently outperforming its benchmark, which includes all three indices – the S&P 500, S&P mid-cap, and Russell 2000. What contributes to this? Collectively, the stocks in HQ Portfolio have delivered superior returns with reduced risk compared to the benchmark index; it has proven to be less volatile, as reflected in HQ Portfolio performance metrics.