The number of overseas buyers house hunting in Britain has hit a record low thanks to Brexit, stamp duty and changes to non-dom tax rules, according to estate agent Hamptons.

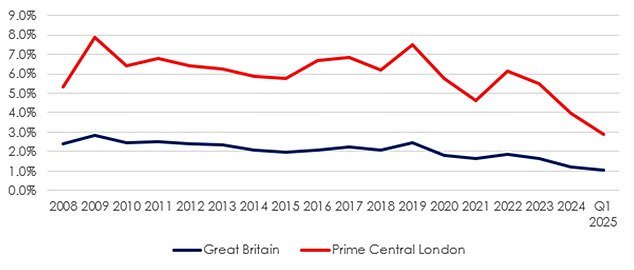

The proportion of overseas buyers registering with Countrywide group estate agents – of which Hamptons is one – to buy a home in the UK fell to 1 per cent in the first three months of 2025, the lowest level on record.

Even in central London, which includes Kensington and Chelsea, Westminster, and the City of London, overseas applicants fell to the lowest share on record.

They made up just 2.9 per cent of all house hunters in the first three months of 2025, down from 4 per cent in 2024 and down from a peak of 7.9 per cent in 2009.

The decline in demand has been predominantly driven by fewer Europeans relocating to Great Britain, according to Hamptons.

Europeans made up 43 per cent of overseas house hunters in the first quarter of 2025, down from 48 per cent in 2008, it said.

Falling numbers: The proportion of international applicants – people registering to buy a home – in Great Britain and Central London fell to the lowest level on record

The lack of demand from overseas buyers is resulting in falling prices all over central London.

Earlier this week, it was revealed that buyers of London‘s poshest homes are enjoying price discounts not seen since 2009.

High end estate agent Savills reported that the average property in prime central London, which includes well-heeled postcodes such as Knightsbridge, Mayfair and Belgravia, is currently priced 21.2 per cent lower than its peak in June 2014.

This means buyers are making a saving of £1.2million on the average prime central London property, which is currently worth £4.6million.

The deep discounts are comparable to those seen in the early 1990s and in the immediate aftermath of the global financial crisis, Savills said.

The drop in demand for property, specifically in prime central London, from Europeans has been stark.

Europeans made up 44 per cent of all prospective buyers coming from overseas in the first three months of 2025, down from 55 per cent in 2008.

The combined effects of Brexit and the pandemic have dampened international buyer interest in Britain’s property market, according to Hamptons.

Labour’s abolition of non-dom tax status, which will affect those domiciled for tax purposes outside of the UK from 6 April, has been an additional factor of late.

It is also likely that some buyers are being put off by higher stamp duty costs, which increased again following the October budget for those buying second homes.

An overseas buyer who owns a property elsewhere in the world faces a 2 per cent surcharge on top of the second home 5 per cent surcharge.

On a £1million purchase they will now pay £113,750 in stamp duty, on a £2million purchase they will pay £293,750 and on a £5 million property they will pay £863,750.

Staying away: Long-term, the decline in demand has been predominantly driven by fewer Europeans relocating to Great Britain

Aneisha Beveridge, head of research at Hamptons, said: ‘Political events worldwide continue to influence demand for UK property from international buyers.

‘But more recently, it’s tax changes that have stemmed the flow of overseas house hunters.

‘Stamp duty increases, particularly for those purchasing second homes, combined with Brexit and amendments to the tax treatment of non-doms, have added to costs and reduced the lure of property in the UK.

‘The case for buying a home, particularly in prime central London, has become increasingly tenuous for some international buyers.

‘For those immigrating for an undetermined period, the cost of buying property and the prospect of little or no capital growth, as seen over the last decade in prime central London, have led many to opt for renting instead.’

More Americans are crossing the pond

Britain appears to still be attracting some overseas buyers.

Prospective buyers from North America have increasingly replaced Europeans, according to Hamptons data.

They accounted for 16 per cent of international house hunters in the first three months of this year, more than double the 6 per cent recorded in 2008. Nearly three-quarters of this group are looking to make a permanent move.

Demand from Middle Eastern buyers has also risen. This year, they made up 14 per cent of all international applicants looking to buy in Great Britain, marking a new high and up from 8 per cent in 2008.

Meanwhile, the number of applicants looking to buy from Hong Kong has declined since peaking at 17 per cent in 2020, just before the launch of the British National Overseas visa.

They were the most common international applicants in 2019 and 2020.

So far this year, they have made up 2 per cent of all overseas house hunters, the lowest proportion on record.

‘Access to all the amenities and culture that London offers, combined with the country’s robust legal system, continues to attract money from overseas from those looking to buy,’ added Aneisha Beveridge of Hamptons.

‘While Europeans used to be the driving force, with many relocating here for job purposes, Brexit has put a pause to that.

‘They have been increasingly replaced by Americans, spurred by the strength of the dollar and potentially influenced by political events at home.

‘A home in the UK that would have cost someone buying in dollars £1million a decade ago, effectively costs them around £825,000 today due to currency changes alone. In most cases, this would offset the rise in stamp duty.’