Sales of distressed commercial real estate in Hong Kong jumped in the first half of the year, accounting for about three quarters of the volume, with the coming months likely to see an unusually high number of such transactions, according to CBRE.

In the first six months of the year, overall commercial property deals amounted to HK$23.1 billion (US$2.95 billion), the second-lowest half-year total since the second quarter of 2008, CBRE said. Fire sales accounted for HK$16.8 billion or 73 per cent of the total investment in the period. The data encompassed commercial property deals each valued at more than HK$77 million.

“In the second half, there will be something like 50 per cent of [distressed sales] because interest rates are still at a high level and a rate cut is unlikely to happen earlier than September,” said Reeves Yan, executive director and head of capital markets at CBRE Hong Kong.

In May, a 5,171 sq ft mansion, 10B at Black’s Link on The Peak, linked to Hui Ka-yan, the founder of the liquidated China Evergrande Group, was sold by creditors to a privately owned company for HK$448 million, 44 per cent less than the HK$800 million that appraisers had estimated the property to be worth. The property, which was mortgaged to banks and owned through a company, was classified as commercial real estate.

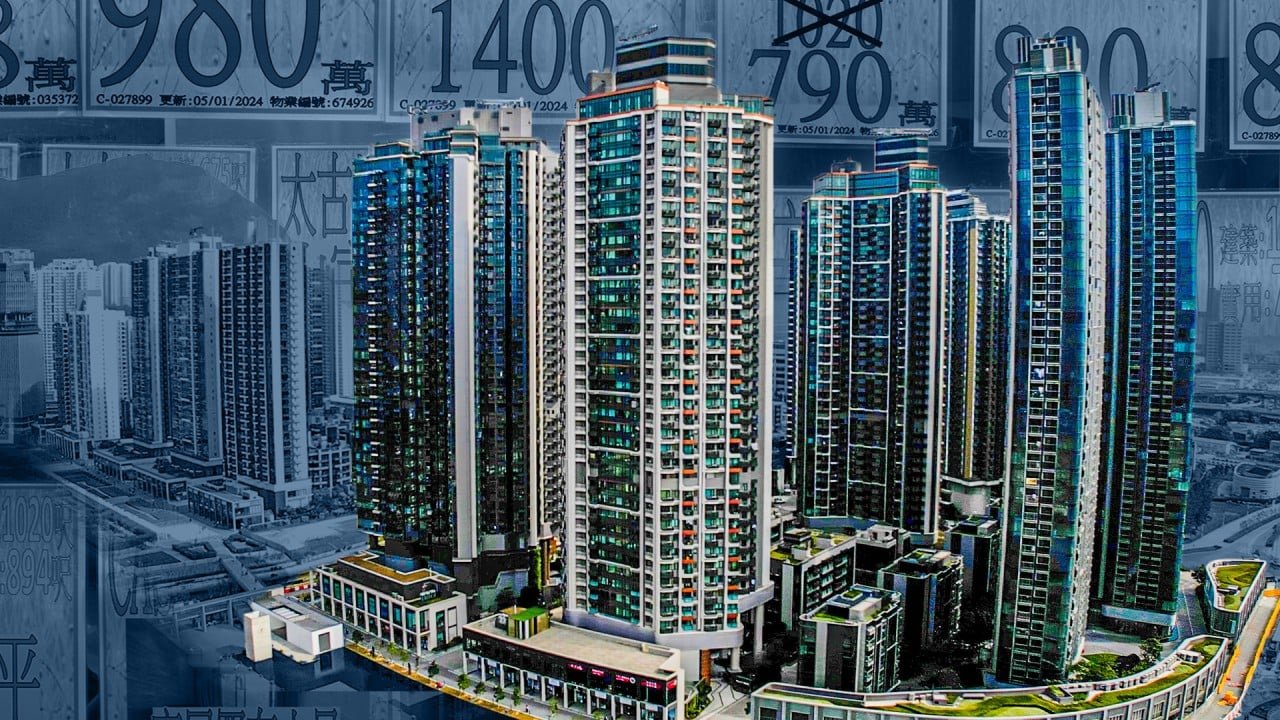

One HarbourGate East Tower in Hung Hom, one of the many assets seized last year from Chinese tycoon Chen Hongtian, has been put on sale for a second time amid weak office market sentiment.

Receivers put the tower back on the market for a new round of bidding, according to a statement last week by Savills, the sole agent for the sale.

The prime harbourfront property was valued at around HK$7 billion in 2022, Savills said when it was first put on the market in May 2023. The property was bought for HK$4.5 billion in 2016.

Even as more distressed assets are put on sale, some investors on the sidelines could soon find the right timing to make their acquisitions.

“We see a lot of dry powder available in the market,” said Eugene Wong, partner at Mayer Brown.

“Investors believe that the property sector could be at the bottom now because we have been at an interest-rate peak period for some time already,” said Jasmine Chiu, another partner at the law firm. “They will decide whether a distressed property is at the right price.”

Additional reporting by Aileen Chuang