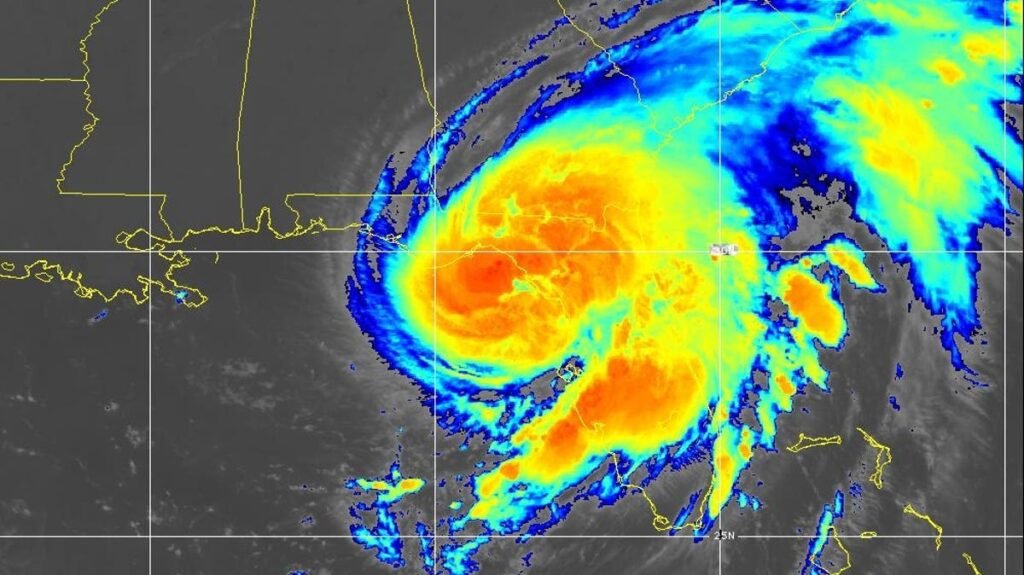

Watch Hurricane Debby’s storm surge flood Fort Myers, Florida

Hurricane Debby is a Category 1 storm that is a significant flood threat for the southeast coast of the U.S.

When Florida’s primary voters head to the polls – if they haven’t already – on Tuesday, many will have property insurance on their minds, a result of skyrocketing rates and Hurricane Debby, which left four dead and caused significant flooding damage across the state.

But candidates for the Legislature have only vague plans to change the system, and few proposals that would cut rates in the short-term.

“The Florida Legislature in so many areas of public policy has no vision for where they want to go,” said former state Sen. Jeff Brandes, a St. Petersburg Republican who pushed for reforms to the market before being term-limited out of office in 2022. He now runs the Florida Policy Project, a think tank.

“They don’t have plans,” he added.

Florida has the highest property insurance rates in the country, with homeowners paying $3,340 per year on average in 2023, according to the Insurance Information Institute. That’s a 37% increase from 2021, or $903.

Florida property insurance rates highest in US

That statewide average, though, can obscure the even higher rates paid in riskier areas of the state.

Citizens Property Insurance, the state-run insurer of last resort that usually has the lowest price, has 96,941 standard homeowners policies in Miami-Dade County paying an average $5,113 yearly. Citizens’ rate hike request of 13.5% would push that to $5,804.

Broward County’s 71,196 policies would jump from $5,385 to $6,112 and Palm Beach County’s 61,357 policies would move from $4,904 to $5,561 on average. The rate request is pending before the state’s Office of Insurance Regulation.

The spike in rates has severely pinched Floridians’ pocketbooks, putting the issue top of mind ahead of the election. An Associated Industries of Florida poll of likely voters released Tuesday found 22% said property insurance costs were the most important issue, the second-most among respondents, behind inflation at 27%.

Few policy plans for lower rates on both sides of the aisle

Democrats are hoping to take advantage of the issue, as they did earlier this year when Rep. Tom Keen, D-Orlando, won a seat previously held by a Republican in a special election – thanks in part his emphasis on lowering property insurance rates.

“Unfortunately for the Republicans, this issue’s not getting better for them and it won’t be better for them before the November election,” said House Democratic Leader Fentrice Driskell of Tampa. Voters “are connecting the dots between who has been in charge and their current bad situation with respect to the property insurance market.”

But Democratic ideas, which would have difficulty passing through the Republican-held Legislature anyway, wouldn’t reduce rates in the short term either.

In a December 2022 special session, Driskell filed a bill to make the state’s insurance commissioner an elected position, create a Property Insurance Commission to evaluate the market, require companies offering auto insurance to offer home insurance too, and study a mediation program aiming to resolve disputes between insurers and homeowners. The bill was never heard.

Another House plan backed by some Democrats, but which was filed by Fort Myers Republican Spencer Roach earlier this year, would make Citizens available to any homeowner. That bill also didn’t receive a hearing.

Republicans point to several actions they’ve taken to address the issue:

- Passing laws to reduce lawsuits, something insurers blamed for much of their losses.

- A $447.4 million tax cut passed on to reduce premiums.

- Putting more money into a program that pays for upgrades to houses to prevent wind damage during a hurricane, with the goal of reducing premiums.

During the 2022 special session, they repealed a law requiring insurance companies to pay the attorney fees of homeowners who successfully sue them in a claim dispute. It also eliminated the practice of assignment of benefits, where a homeowner signs a claim over to a contract who repairs the damage.

This year lawmakers included a reduction of 1.75% of insurance premium taxes on residential home policies and flood policies in a larger tax cut bill and required insurers to pass on the savings to customers. Homeowners are expected to save $447.4 million over the next two years.

The Legislature also put $200 million more into the My Safe Florida Home program, which gives up to $10,000 to homeowners to harden their homes against hurricanes.

Residents receive little relief from soaring insurance rates

Those changes, though, have provided scant relief from skyrocketing rates. A surge of lawsuits filed in the lead-up to the passage of the new insurance law has dulled its immediate effect. The tax cut will provide the average homeowner with $60-$70 in savings, and doesn’t take effect until Oct. 1.

The My Safe Florida Home program was inundated with applications in July when the new money became available and ran out of funds after two weeks. It’s no longer accepting applications.

Still, regulators believe the market has stabilized since the reforms were put in place. Twelve companies went insolvent from 2021-23. But since then, nine new carriers have been admitted to the Florida market.

The Office of Insurance Regulation recently released data showing the average rate increase request for the last six months was 1.2%, with 12 companies filing statewide average decreases. And reinsurance costs, a key factor in rates, fell 1.7% from last year, according to OIR. (Reinsurance is insurance for insurance companies.)

Rates, though, remain stubbornly high for homeowners, spurring candidates at the federal level to offer solutions, even though property insurance is regulated at the state level.

U.S. Sen. Rick Scott, a Naples Republican, filed a bill to allow homeowners to deduct up to $10,000 in premiums from their taxes. Whitney Fox, a Democratic candidate challenging U.S. Rep. Anna Paulina Luna, R-Tampa, proposed creating a federal catastrophe fund, similar to the National Flood Insurance Program.

The lack of concrete policy plans to lower rates in the short term hasn’t stopped insurers from donating large sums to candidates and political committees as they slug it out on the airwaves vying for votes.

Insurance companies donate to Florida candidates, committees

For the 2024 election cycle, the top 20 private insurance companies have donated $1.87 million to candidates and political committees, with the vast majority going to Republicans.

Slide Insurance Co. has given the most, about $579,000, with $110,000 going to the Republican Party of Florida and $115,000 going to the Florida Republican Senatorial Campaign Committee. Slide was started in 2021 and has assumed nearly 150,000 Citizens policies since the start of 2023.

The trial attorney lobby, which fought in vain against recent insurance overhauls and is hopeful of thwarting its intended effects, typically opposes candidates backed by insurers.

The main focal point for that battle this year is the GOP primary in Senate District 7. Rep. Tom Leek of Ormond Beach, is an insurance industry executive supported by property insurers and other big businesses. David Shoar, the former Volusia County Sheriff, is bankrolled by law firms.

The Daytona Beach News-Journal reported at least $10 million has been spent on the race, which also features financial advisor Gerry James. The winner will face Democrat George Anthony Hill II in November.

Gray Rohrer is a reporter with the USA TODAY Network-Florida Capital Bureau. He can be reached at grohrer@gannett.com. Follow him on X: @GrayRohrer.