Another soft jobs report is intensifying calls for meaningful Federal Reserve cuts. Consumers are already worried about squeezed spending power from tariffs and are now increasingly concerned about job security. Fed doves will intensify their calls for action.

Weak Jobs, Rising Unemployment, Slowing Wages, Falling Hours Worked

The August jobs report is softer than hoped. rose just 22k versus the 75k consensus. There were 29k of upward revisions to the past two months, but even if we add those back in it is still a modest downside miss. ticked up to 4.3% from 4.2% as expected, but underemployment (people who want to work more hours) rose faster to 8.1% from 7.9%, hours worked fell to 34.2 hours and wage growth slowed to 3.7% year-on-year from 3.9% – so it is soft everywhere.

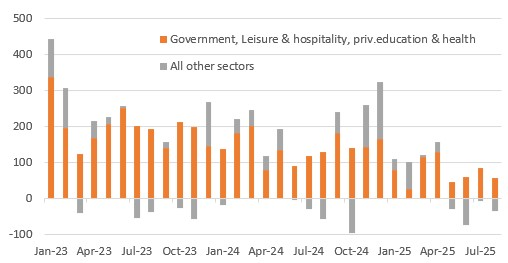

The details show private education and health adding 46k and leisure and hospitality adding 28k with retail up 11k, but everything else is flat to down. We have repeatedly made the point that over the past two-and-a-half years nearly 90% of all jobs added have come from just three sectors – government, private health & education and leisure & hospitality. Strip those three sectors out and payrolls have fallen four consecutive months, showing the problems that the sectors typically associated as being growth engines of the US economy are facing.

Households Think Job Losses Are Inevitable

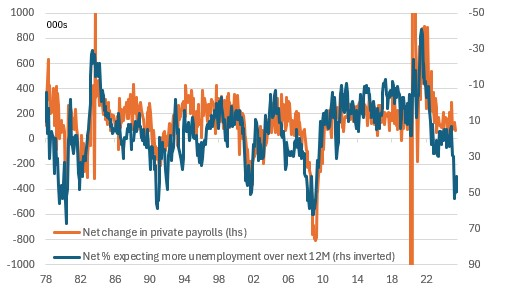

For now the data remains consistent with the view that the jobs market is cooling, but not collapsing. Workers are certainly worried though. One of the key metrics to show that is the University of Michigan measure of consumer confidence. Within that report there is a question on unemployment. Right now 62% of Americans think unemployment will rise over the next 12 months while only 13% think it will fall. This gives a net reading of 49% who expect unemployment to rise. We’ve only seen worse readings on four occasions in the past 50 or so years, as seen in the chart below. People see and feel changes in the jobs market before they show up in the official data – they know if their company has a hiring freeze or the odd person here or there is being laid off. This suggests the real threat of outright falls in employment later this year.

The US economy is dominated by (70% of ). The consumer is already anxious about tariffs hiking prices, leading to squeezed spending power. If we then overlay that with worries about jobs then this suggests downside risks for economic activity are growing. That justifies the Federal Reserve taking early action even if some members are not fully comfortable with the inflation story. We look for 25bp rate cuts in September, October and December with a further 50bp of cuts in early 2026.

A 50bp September Move Is Possible, but Not Our Call

Some investors are questioning whether the Fed could cut by 50bp in September. They could increase in number after next Tuesday’s preliminary benchmark revisions to payrolls for the 12 months to March 2025. The Quarterly Census of Employment and Wages (QCEW), which uses state unemployment insurance tax records – suggest employment in the nine months between March and December 2024 was 857k lower than reported in the payrolls report, implying the possibility of 95k of downward revisions on average each month. We expect to see some narrowing in the figures for first quarter 2025 between payrolls and the figures QCEW will be releasing at the same time, but even if it is a 750k downward revision that is still a big change in the jobs narrative.

Moreover, the Fed’s own made for grim reading earlier this week and that was the catalyst for a 50bp move last year to kick things off in terms of Fed rate cuts. However, the conservative make-up of the Fed (for now) and uncertainty over tariffs on inflation means there probably won’t be a majority, but we could see two or three voting for 50bp.

***

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user’s means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more