Meme stocks are highly speculative stocks, heavily traded by retail traders, and characterized at times by rapid price surges and equally sharp declines. The extreme volatility is often the result of social media platforms such as Reddit’s WallStreetBets pushing these stocks. Among the most noteworthy meme stocks of the last few years have been and .

While significant volatility can be fascinating for those on the sidelines, meme stock activity can still be a valuable tool for investors. Simply, meme stock returns are a gauge of risk-taking behaviors. Often, speculative trading, like significant volume in meme stocks, is greatest at market peaks. This was true as recently as 2021. More importantly, the tops of 1929 and 1999 were hallmarked by incredibly speculative trading.

UBS maintains a basket or index of meme stocks, comprising approximately 15-20 stocks based on criteria such as popularity driven by online networks, social media buzz, and high short interest. While UBS does not publicly disclose the entire composition of its meme index in detail, recent financial news reports highlight several key components. They are as follows: , , , , , , and

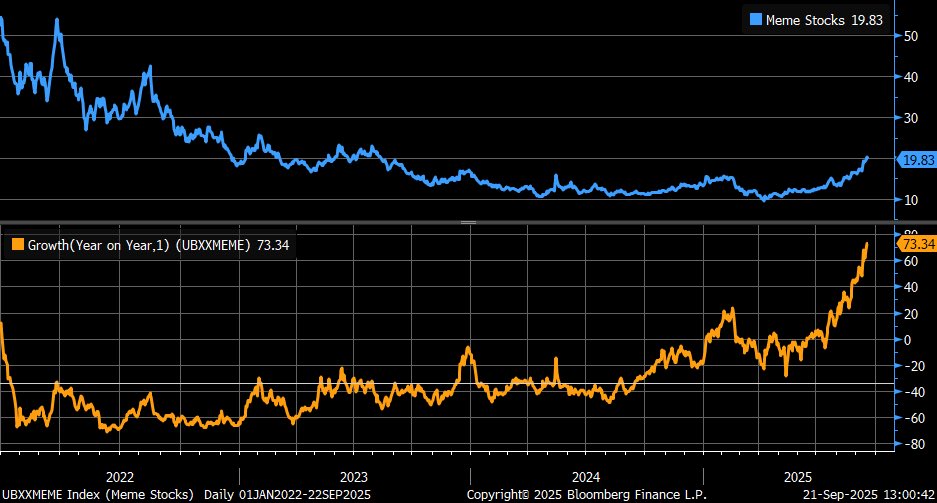

The graph below illustrates that the meme index has generally performed poorly since reaching its peak in late 2021. However, since the start of the year, it has risen 73% or about five times that of the S&P 500! In other words, animal spirits are running hot in the markets.

Looking Beneath The Covers Of The Major Indexes

Recently, there have been significant divergences between the daily changes of major indexes and those of various stock categorizations. SimpleVisor makes it easy to understand the divergences. We present three graphics below showing market activity from midday Tuesday.

The first graphic, the Market Map, shows that the largest stocks by market cap (biggest boxes) were down on the day, while many of the smaller stocks were up. At the time we took the screenshot, the S&P 500 was down slightly.

The second graphic further confirms what the Market Map is showing. Large-cap growth stocks were down by nearly half a percentage point, but large-cap value stocks were up by half a percentage point. Furthermore, note that small-cap stocks, both growth, core, and value, were performing well.

The last graphic displays the performance of various stock factors. We reset the timeframe for one day to align with the first two graphics. Not surprisingly, large-cap growth is performing the worst, while small and mid-cap stocks are among the best performers.

Tweet of the Day