“Presidential elections matter, but not so much when it comes to your investments.”

— Vanguard

It’s the election season and, because the focus of my columns is investing, this one is not going to be political.

As Detective Joe Friday of Dragnet used to say, “just the facts, please.”

In addition to the quote above, the Vanguard commentary goes on to say, “presidential elections can of course be hugely consequential in terms of the direction of public policy, they should not dictate your investment decisions.”

I know it can be hard to separate these two important issues, but the data are pretty compelling to do so.

Election Years vs. Nonelection Years

Consider some facts from my research on this issue:

Vanguard notes that, over 41 election-year periods beginning way back in 1850, the annual compound return for a 60% stock/40% bond portfolio was 8.7% — compared to 7.7% for the 122 nonelection-year periods.

Note market results going back that far used some rather obscure data, but I think Vanguard’s well-researched point was fair with little evidence that election years had much impact on stock returns.

Analyzing Market Returns

A recent CNN story remarked, “if the past century is any guide, the long-term consequences of a U.S. presidential election on investor portfolios is minimal at best.”

CNN noted an analysis by retirement planning firm TIAA showing how a moderate-risk portfolio with 60% stocks and 40% bonds fared across all presidential election years since 1928.

Turns out there were only four years with negative returns:

- 1932 (down 1.4%)

- 1940 (down 4.7%)

- 2000 (down 0.8%)

- 2008 (down 20.1%)

Note all of these negative-year returns occurred at times of seismic events, including the Great Depression, World War II, the tech bubble burst and the Great Recession caused by the housing/financial crisis.

TIAA observed that even those negative return years didn’t “move the needle” in terms of long-term average performance, with the 60/40 portfolio having an average annual return of 8.7% across the 24 presidential elections since 1928.

What the Data Reveal

Liz Ann Sonders, managing director and chief investment strategist at Charles Schwab (and someone I have greatly respected over many years), noted, “Between adjustments in Fed policy and a coming presidential election, it’s going to be an emotional year, but historical data show staying invested is the best course for investors.”

It seems worth noting that she put Fed policy ahead of the election in her comment.

With data from Ned Davis Research, Schwab presented some very interesting information going back to the early 1900s using the Dow Jones Industrial Average versus the S&P 500 because the former has a longer history:

- “The stock market has performed slightly better under Democratic presidents.”

- “The best stock market performance has come with Republican control of Congress — the worst coming when Congress was split between the two parties.”

- “The best performance occurred when there was a Democrat in the White House and a split Congress — but full Republican control was a close second.”

- “The two worst (both with negative annualized returns) outcomes historically under Republican presidents and either a split Congress or a Democratically controlled Congress.”

Staying Invested

But in case the above leaves you cheering for one party or the other, as Sonders said, she’d rather have the $5 million by simply staying invested in U.S. large cap stocks (data provided to Schwab by Morningstar) regardless of which party was in the White House.

Me, too!

This is clearly going to be an emotional year with a contentious election and highly divided country.

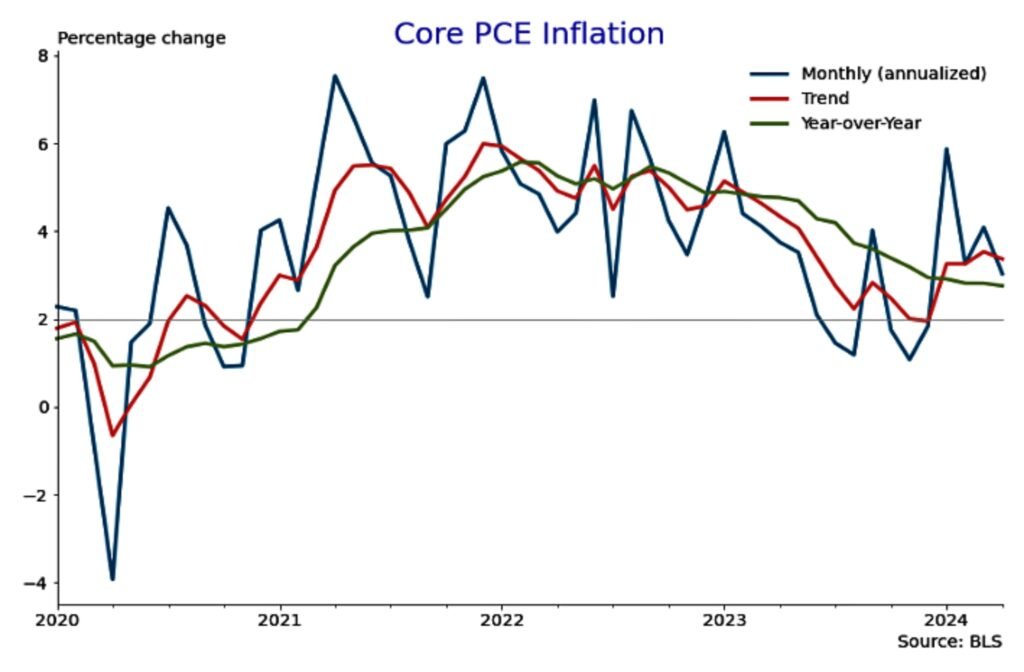

Add to that uncertainty around inflation and Fed policy, and the ingredients for some potentially significant volatility exist.

But there is no more important place to keep emotions out of the mix with regard to investing.

This is a time for discipline, and a good time to revisit your “risk tolerance.”

Fear amid volatile markets can be incredibly powerful and lead to potentially awful investment decisions, so having a plan in place now can help you manage the stress and help you “stay the course.”

Generally speaking, no one can consistently and successfully “time the market” — so now seems like a good time to make sure your portfolio is sufficiently diversified and prudently aligned with your goals, time horizon and risk tolerance.

And then ride through the political storms over the next several months and just watch the show.