The annual Economic Symposium, hosted by the Federal Reserve Bank of Kansas City, is set to take place from Thursday to Saturday, at the Jackson Lake Lodge in Grand Teton National Park, Wyoming.

The highlight of the event, as always, will be Fed Chair Jerome Powell’s on Friday at 10:00 AM ET, titled “Economic Outlook and Framework Review.”

With Powell’s term as Fed Chair nearing its end in May 2026, this speech—likely his final one at Jackson Hole—carries significant weight for markets, policymakers, and analysts seeking clues about the U.S. central bank’s next moves.

Powell’s Jackson Hole speeches have historically been pivotal for signaling Fed policy. In 2022, he adopted a hawkish tone, emphasizing inflation control at all costs. In 2023, he reiterated the need for restrictive policy but acknowledged progress on inflation. In 2024, he signaled the start of rate cuts, stating, “The time has come for policy to adjust,” which preceded a 50 basis point cut in September.

With the near all-time highs and investors expecting the FOMC to cut rates by a quarter of a percentage point at least twice more this year, Powell’s message and tone could send ripples—or shockwaves—across asset classes.

Powell’s Tightrope: ‘Balanced’ or Hawkish?

Bank of America (NYSE:) expects Powell to be “more balanced than markets anticipate,” possibly pushing back on the growing certainty of a September rate cut. The theme—Labor Markets in Transition—means Powell will likely zero in on jobs data volatility and labor supply concerns that have muddied the economic outlook.

BofA calls Jackson Hole a “mini FOMC meeting” for good reason: with a seven-week gap since July’s Fed gathering, this is the market’s only real chance to recalibrate before September.

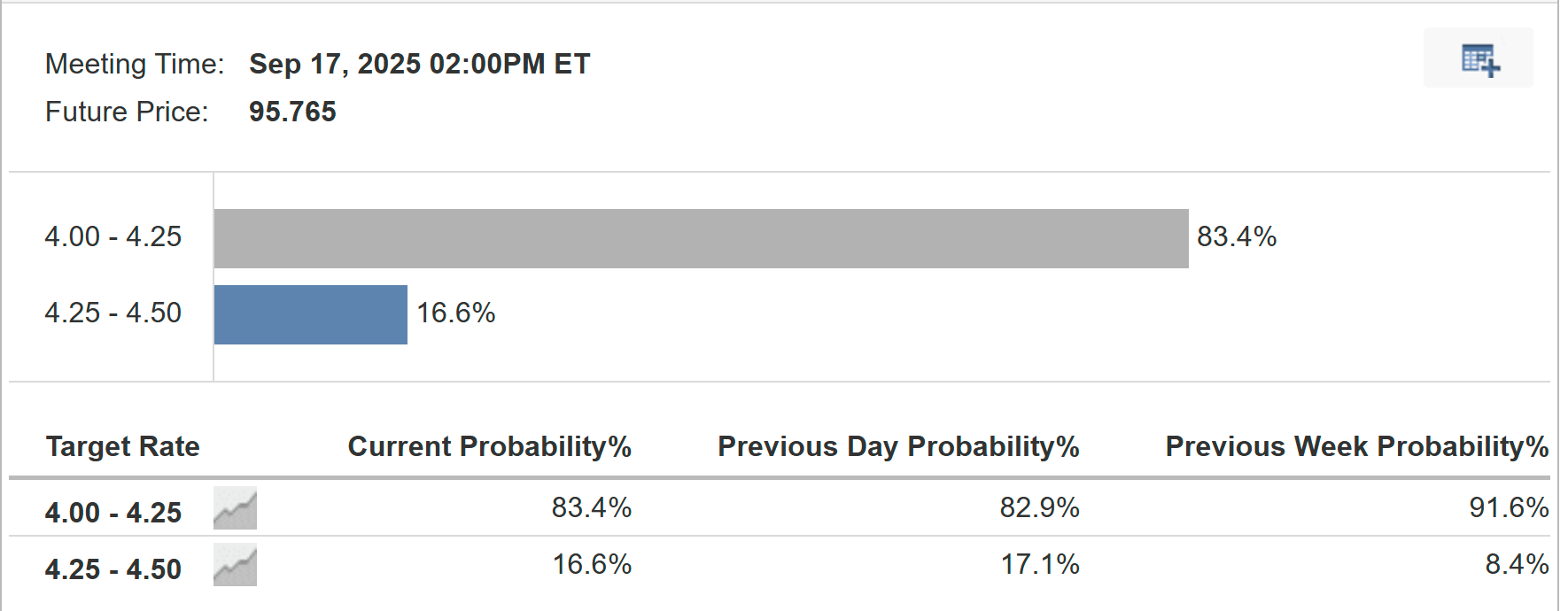

Source: Investing.com

As of Wednesday morning, investors see an 83% chance of the U.S. central bank cutting rates by 25bps next month.

Stagflation Whispers, Tariff Wildcards

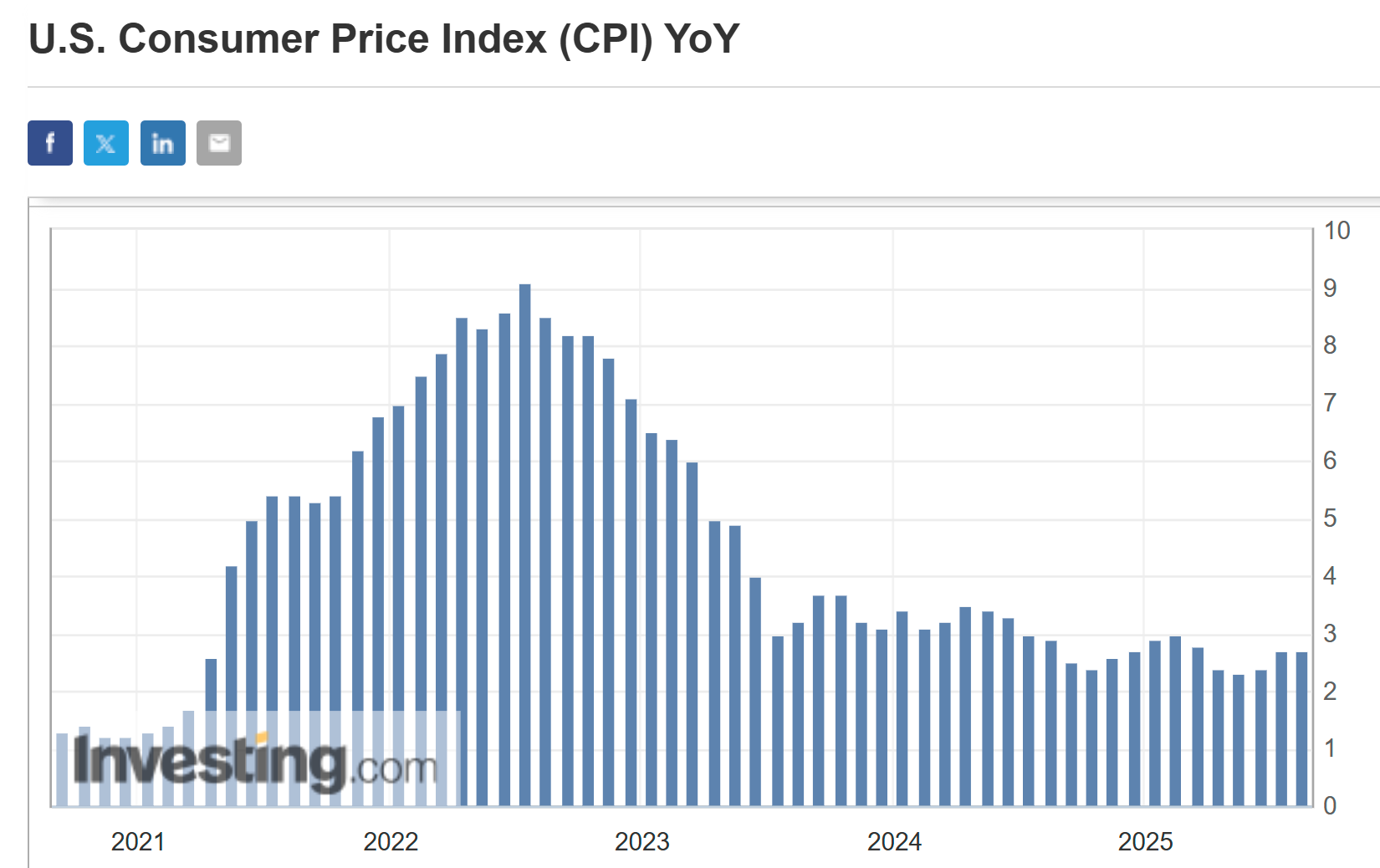

Recent inflation data has overshot the Fed’s 2% target (July CPI forecast: 2.8%, 3.0%), feeding stagflation fears. Add in President Trump’s new tariffs and you have a recipe for policy uncertainty.

Source: Investing.com

Powell will need to address these crosscurrents: does inflation stick, or do labor market “cooling” signals, as Minneapolis Fed’s Kashkari put it, tip the scale toward easing?

Markets Poised, But Not Priced for Perfection

Equities are at all-time highs, with the S&P 500 up 9.1% YTD and the up 10.6%, yet Deutsche Bank (ETR:) warns risk assets aren’t “priced for perfection.” CTAs (Commodity Trading Advisors) are almost max-long in equities, leaving little room for a bullish surprise.

Source: Investing.com

Investor sentiment remains subdued (AAII bull-bear spread -16.3), which, paradoxically, could act as a tailwind if Powell is less dovish than expected.

Bottom Line: All Eyes on the Framework

Expect Powell to walk a tightrope: acknowledge labor market risks, talk tough on inflation, and avoid locking into a September move. His message will shape how stocks, bonds, and the dollar trade for weeks. Whether Powell hints at a new “framework review” or signals a return to data-dependence, both would inject fresh uncertainty and opportunity.

Investors should prepare for potential volatility and keep an eye on Powell’s tone and key phrases for hints about the Fed’s future path.

***

InvestingPro provides a comprehensive suite of tools designed to help investors make informed decisions in any market environment. These include:

- AI-managed stock market strategies re-evaluated monthly

- 10 years of historical financial data for thousands of global stocks

- A database of investor, billionaire, and hedge fund positions

- And many other tools that help tens of thousands of investors outperform the market every day!

Disclosure: At the time of writing, I am long on the S&P 500, and the Nasdaq 100 via the SPDR® S&P 500 ETF (SPY (NYSE:)), and the Invesco QQQ Trust ETF (QQQ). I am also long on the Invesco Top QQQ ETF (QBIG), Invesco S&P 500 Equal Weight ETF (RSP), and VanEck Vectors Semiconductor ETF (SMH).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies’ financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

Follow Jesse Cohen on X/Twitter @JesseCohenInv for more stock market analysis and insight.