- Fed cut pricing, influencing moves

- U.S. data return may spark volatility

- Watch 1.1550 support and downtrend resistance when assessing directional risks

Summary

EUR/USD remains tightly linked to , with correlations near extreme levels. With U.S. data flow still restricted and both central banks in wait-and-see mode, the pair may tread water until major releases return. Price action near key resistance suggests potential for a breakout, but until clearer signals emerge, traders should treat short-term moves with caution.

Fed Pricing Tightens Grip

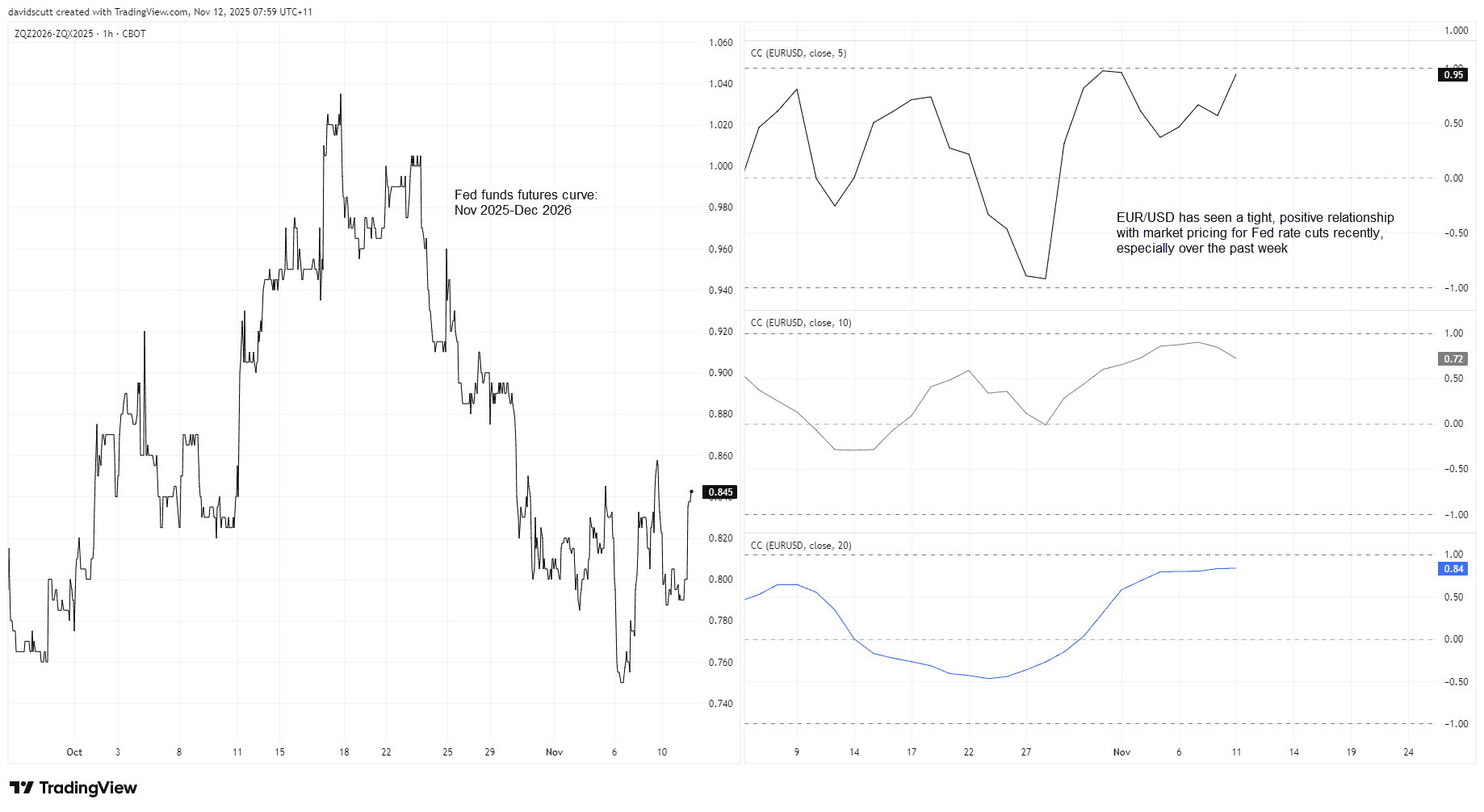

EUR/USD has been highly correlated with shifts in market pricing for Fed rate cuts out to the end of 2026 over the past month, especially the past week. That can be seen in the rolling correlation coefficients in the right-hand pane of the chart below, with scores over the past five, 10, and 20 days sitting at 0.94, 0.72, and 0.84, respectively.

That’s a strong and significant relationship between the two variables, and a far stronger one than for U.S. yields further out the curve or outright yield differentials between Europe and the U.S. over the same period. That means for anyone trading EUR/USD, any event that can meaningfully move Fed pricing deserves ample attention.

Source: TradingView

While an end to the U.S. government shutdown means top-tier U.S. economic data could start to arrive as soon as next week, before those volatility events hit, there’s very little on the U.S. calendar to influence Fed pricing other than a raft of FOMC speakers.

And given they, like us, don’t have access to any official data to give an informed view on the likely path for rates, you have to question whether they’ll deliver any true surprises. With ECB policy seemingly on autopilot for the time being, an equally busy speakers’ calendar in Europe could easily deliver far more noise than signal.

The broader assessment therefore suggests we could enter a holding pattern until the big U.S. data events arrive, unless we receive some unscheduled headlines that meaningfully shift the Fed outlook. It also hints that price signals should be treated with extra caution until clarity is restored.

EUR/USD Bulls Eyeing Breakout

Source: TradingView

Looking at EUR/USD on the daily chart, the pair is now wedged hard up against downtrend resistance running from the highs set in September. It took a look above the level earlier in the session, but the break didn’t stick, with bears forcing it back beneath for now. However, with horizontal support at 1.1550 just over 30 pips below, there’s a sense we may see a decent move soon.

Having delivered a three-candle morning star pattern last week and an engulfing candle on Tuesday, recent price signals have been bullish, pointing to the risk that if there is to be a move, it may be a topside breakout rather than a move lower. The signals from RSI (14) and MACD back this up, with the former now pushing back towards the neutral 50 level while the latter has already crossed over from below and is also starting to push higher. It’s not an outright bullish message on momentum, but more a warning sign for bears that downside momentum is diminishing fast.

If we see a break and close above the September trendline, longs could be established above the level with a stop beneath for protection, targeting either 1.1650, the 50-day moving average or 1.1780.

Alternatively, if the price reverses and closes beneath 1.1550 support, it would allow for shorts to be established with a stop above, targeting the November low at 1.1455 or the August 1 swing low of 1.1400.