“Never” selling might be aspirational, but these stocks make it easier.

Long-term investors aim to identify and buy great companies, and to never have to sell. Warren Buffett once said his favorite holding period was forever. After all, why not make one great decision and let it reward you for years to come? To be clear, never selling is aspirational — there are certainly valid reasons to sell a stock. But I think setting the default to “never” selling results in better outcomes.

Here are two companies that have earned a spot on my “never” sell list. Each has competitive advantages in its industry, a track record of success, and plenty of room ahead for continued growth and strong financial performance. Let’s look at what makes these stocks long-term holdings in my portfolio.

Amazon

Chances are that if you’ve purchased something online recently, you did so on Amazon (AMZN 1.47%). Put simply, that could be the thesis statement for owning the company. As long as Amazon is the go-to online marketplace for millions of people, there’s a good chance it will remain a winning stock for investors.

That may not have been as believable in early 2023, when the stock returned to its pandemic crash low and investor sentiment was souring on the e-commerce giant. However, in the time since, the stock has been on an incredible run as the company has figured out its cost structure and improved the bottom line.

While online shopping is what comes to mind when people think about Amazon, it’s important to also remember that it’s the leader in cloud infrastructure with Amazon Web Services (AWS). Amazon’s market share lead should be sustained, as the company is seeing increased demand for its services to accommodate the rush toward artificial intelligence (AI).

Interestingly, AWS isn’t the fastest-growing part of Amazon’s business anymore. In first-quarter 2024, AWS’ revenue growth of 17% was outpaced by advertising, which grew by 24% to $12 billion. Advertising revenue is still significantly less than the e-commerce and AWS parts of the business, but its rapid growth is another reason to be bullish on Amazon’s future.

Winmark

While Amazon is one of the best-known companies in the world, Winmark (WINA 2.02%) flies under the radar. Winmark is a franchisor of stores that resell used items. Its brands include Play it Again Sports, Plato’s Closet, Once Upon a Child, and others. Winmark has been a winning stock for a long time, but it’s still relatively small, with a market capitalization of $1.4 billion.

What’s attractive about owning Winmark’s stock is its business model. As a franchisor, most of the costs associated with owning a retail business fall on the franchisees. This provides Winmark with attractive margins.

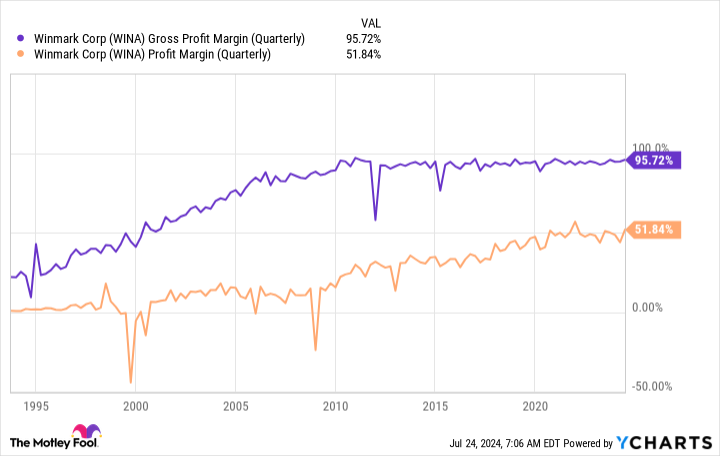

For example, in second-quarter 2024, Winmark’s gross margin was 95.8%. Looking further down the income statement, this led to a net profit margin of 51.8%. These margins have also ticked up slowly and steadily over time.

WINA Gross Profit Margin (Quarterly) data by YCharts

While it’s clear that the economics of being a franchisor work out well for Winmark and its shareholders, there’s evidence that its franchisees are happy as well. In Q2 2024, Winmark had a 100% renewal rate in four out of five of its brands.

Winmark adds new stores throughout the year, but the pace is deliberate. So far in 2024, the company has grown its total store count by 1.2%. The fact that its franchisees renew in such high numbers is a good sign for the future of the business, as it helps supplement the slow but steady store growth.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Jeff Santoro has positions in Amazon and Winmark. The Motley Fool has positions in and recommends Amazon and Winmark. The Motley Fool has a disclosure policy.