The board of Pinnacle Financial Partners, Inc. (NASDAQ:PNFP) has announced that it will pay a dividend of $0.22 per share on the 30th of August. The dividend yield is 0.9% based on this payment, which is a little bit low compared to the other companies in the industry.

View our latest analysis for Pinnacle Financial Partners

Pinnacle Financial Partners’ Dividend Forecasted To Be Well Covered By Earnings

It would be nice for the yield to be higher, but we should also check if higher levels of dividend payment would be sustainable.

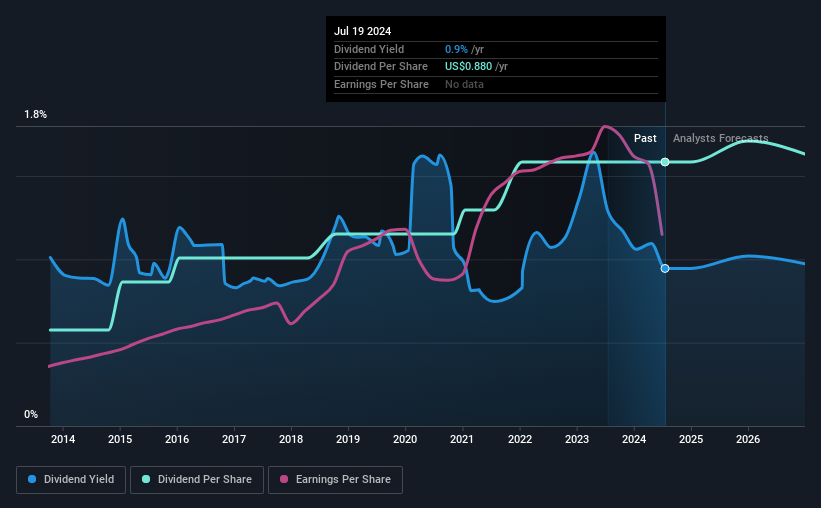

Pinnacle Financial Partners has a long history of paying out dividends, with its current track record at a minimum of 10 years. While past records don’t necessarily translate into future results, the company’s payout ratio of 17% also shows that Pinnacle Financial Partners is able to comfortably pay dividends.

The next 3 years are set to see EPS grow by 103.1%. Analysts forecast the future payout ratio could be 10% over the same time horizon, which is a number we think the company can maintain.

Pinnacle Financial Partners Has A Solid Track Record

The company has a sustained record of paying dividends with very little fluctuation. The annual payment during the last 10 years was $0.32 in 2014, and the most recent fiscal year payment was $0.88. This works out to be a compound annual growth rate (CAGR) of approximately 11% a year over that time. We can see that payments have shown some very nice upward momentum without faltering, which provides some reassurance that future payments will also be reliable.

The Dividend’s Growth Prospects Are Limited

The company’s investors will be pleased to have been receiving dividend income for some time. Although it’s important to note that Pinnacle Financial Partners’ earnings per share has basically not grown from where it was five years ago, which could erode the purchasing power of the dividend over time. While growth may be thin on the ground, Pinnacle Financial Partners could always pay out a higher proportion of earnings to increase shareholder returns.

We Really Like Pinnacle Financial Partners’ Dividend

Overall, we like to see the dividend staying consistent, and we think Pinnacle Financial Partners might even raise payments in the future. The company is easily earning enough to cover its dividend payments and it is great to see that these earnings are being translated into cash flow. All of these factors considered, we think this has solid potential as a dividend stock.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. For example, we’ve picked out 2 warning signs for Pinnacle Financial Partners that investors should know about before committing capital to this stock. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com