Speaking on the company’s performance, Muthoot said the first two quarters, April-June quarter of 2025 (Q1FY26) and July-September quarter of 2025 (Q2FY26), of the financial year were particularly strong, with assets under management (AUM) rising 23%.

While he refrained from offering a fresh number during the silent period, he acknowledged that momentum has remained intact. “Q1 and Q2 has been very good… We continue to see the momentum in Q3, and we hope to continue the momentum in Q4, January-March quarter of 2026 (Q4FY26), also,” he said, adding that guidance would be formally reviewed after the third-quarter results.

The company had earlier raised its full-year growth guidance from 15% to a range of 30–35%. Muthoot stated that profit growth is tracking AUM expansion, supporting confidence in a strong outcome for the full financial year.

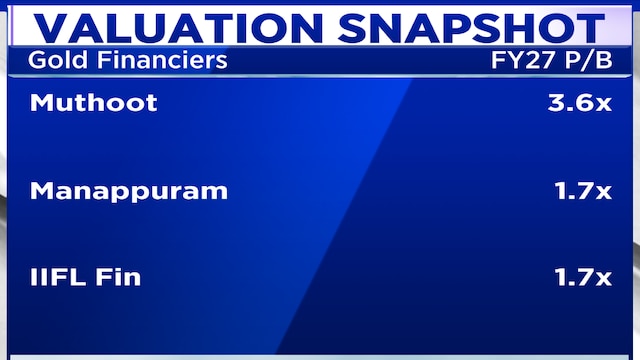

Kerala-based Muthoot Finance currently has a market capitalisation of about ₹1.55 lakh crore, with its shares up nearly 71% over the past year.

A sharp rise in gold prices has emerged as a key tailwind for the business, driving sustained demand for gold loans across both rural and urban markets. Muthoot said tighter access to unsecured lending has pushed borrowers to increasingly monetise their gold holdings. Despite higher prices, the company has maintained a conservative stance, with its net loan-to-value ratio at 57%, well below regulatory thresholds. “People have not borrowed to the hilt, although money is available… They take money only for what they want, actually,” he said, pointing to disciplined borrowing behaviour that helps contain credit risk.

Also Read: Muthoot Finance raises growth guidance to 30-35% as gold loan demand strengthens

On competition from banks and other non-banking financial companies, Muthoot said there is sufficient headroom for all players. He highlighted that banks hold gold loan portfolios of about ₹30 lakh crore, compared with ₹3–3.5 lakh crore for NBFCs, and said established players such as Muthoot Finance benefit from higher AUM per branch and lower operating costs—advantages that newer entrants may struggle to match.

Addressing regulatory concerns, Muthoot said the Ministry of Finance and the Reserve Bank of India appear supportive of the gold loan business. “They are quite supportive of gold loan business because people have now started monetising it,” he said, adding that the short-term nature of gold loans helps mitigate risks arising from gold price volatility.

On diversification, the company has no immediate plans to lend against silver, as gold ornaments remain its core focus. Muthoot also said the company’s microfinance subsidiary, Belstar, has bottomed out and is expected to report “meagre profits” in the coming quarters. Growth in the segment will be calibrated, and an initial public offering could be considered in the future, potentially after three to four quarters of stable performance.

For the entire interview, watch the accompanying video