Personal finance advice is everywhere, and most of it is overwhelming. Spreadsheets, budget apps, and one-size-fits-all rules never quite worked for me.

I didn’t set out to use NotebookLM as a personal finance coach. I had already been experimenting with it for research and writing when I realized it could utilize my sources and help me build a personalized finance plan.

Here’s how I utilize the research tool to understand my financial goals, identify patterns, and make more informed decisions without adding stress.

I paired NotebookLM with YouTube and learned faster than I ever did with note-taking apps

This unlikely duo upgraded my learning routine

How I set up NotebookLM as my personal finance coach

Before NotebookLM could provide information about my finances, I had to be intentional about what I uploaded.

That setup step turned out to be the most significant part, and also the reason this experiment worked better than I expected.

I started by gathering my bank statements and credit card summaries for the past few months. Most of these were available as PDFs, which I downloaded locally.

Instead of uploading them as-is, you can copy the information into a Google Docs file. Remove all sensitive details, like your card number and other personal identifiers.

After you are certain that no private information remains, upload the file to NotebookLM as a resource.

Next, I added a separate Google Docs file that outlined my personal financial goals. It included objectives like reducing discretionary spending, building a buffer for emergencies, and investing more consistently instead of letting cash sit idle.

Finally, I gave it a learning framework by uploading explanatory sources. I added articles on budgeting methods, investing basics, and debt management.

When it analyzed my data, it could reference those frameworks, point out mismatches, and explain why something might be a problem rather than just flagging it.

NotebookLM helped me see where my money was leaking

After setting everything up, NotebookLM revealed its value in unexpected ways, particularly in identifying financial leaks I had previously overlooked.

Individually, my bank statements and credit card bills felt familiar. I had glanced at them before, reassured myself that nothing looked too outrageous, and moved on.

NotebookLM forced me to look at them differently.

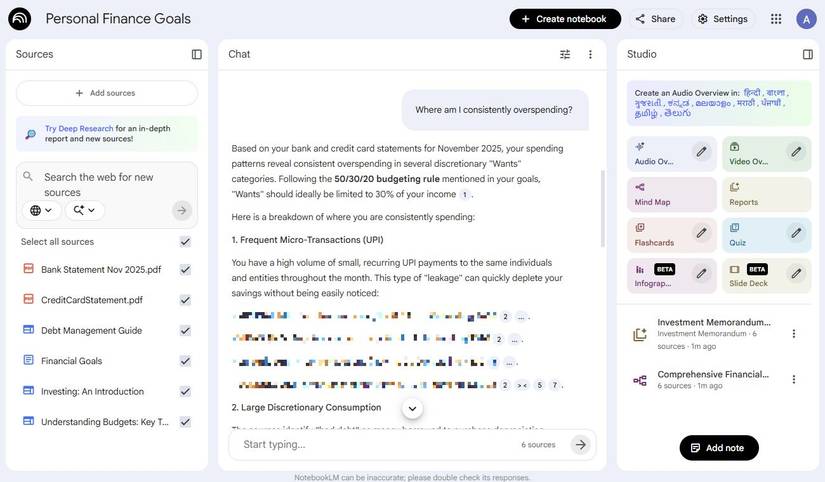

I asked NotebookLM simple questions. Where am I consistently overspending? What categories have crept up over time? Which expenses do not align with my stated goals?

The patterns surfaced almost immediately.

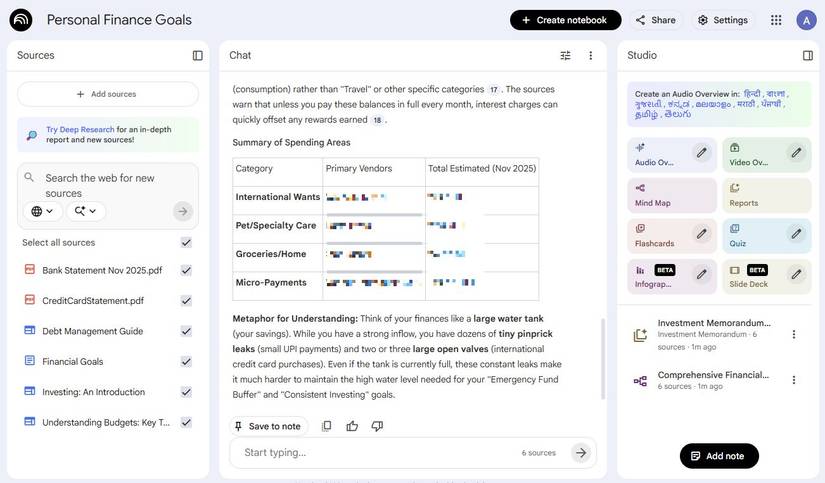

Subscriptions I had previously considered “small” became significant when NotebookLM organized them together.

Food delivery no longer seemed an occasional convenience. Even irregular expenses, like travel or impulse purchases, became easier to contextualize when NotebookLM referenced them against my income and goals.

NotebookLM also explained why something might be a problem, often tying it back to the budgeting frameworks and articles I had added as sources.

Having my spending habits explained to me in plain language made it clear where money was slipping away, and more importantly, which leaks were worth fixing first.

It helped me build realistic financial plans

I also used NotebookLM to assess my financial goals.

After it had my cleaned-up statements, spending notes, and personal goals as sources, I could ask questions that went beyond generic advice.

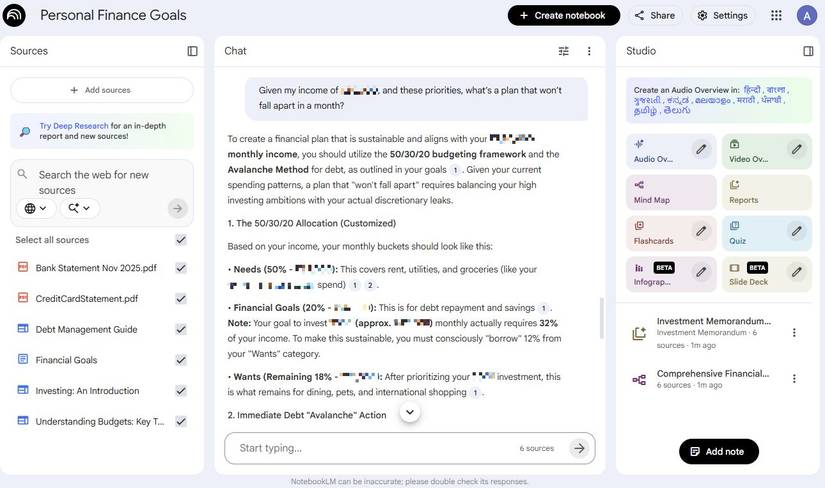

I asked, “Given my income of X, what’s a plan that won’t fall apart in a month?”

Instead of pushing aggressive savings targets or textbook rules, NotebookLM worked within the constraints. It factored in irregular expenses, months when spending spiked, and goals that competed with each other.

If it suggested sinking funds, percentage-based budgeting, or a slower debt payoff, it could explain why and point back to the logic behind it.

That combination of my real data and clear reasoning made the plans doable.

I used NotebookLM for regular financial check-ins

Instead of reviewing my finances only when something felt wrong, I started doing short, financial monthly “check-ins” using the same set of sources.

I’d upload my latest statements or update my notes in Google Docs, then ask simple questions like: What changed since last month? Which category increased the most? Does this still align with my stated goals?

NotebookLM would reference my past data and the financial principles I’d added earlier, and report the numbers back to me.

It became a second pair of eyes that helped me spot drift early, before small leaks turned into bigger problems.

Over time, that habit did more for my financial awareness than any budgeting app I’d tried, because it fit into how I already worked and thought.

To update the Google Docs file added as a source, open the source in NotebookLM from the left sidebar and select Click to sync with Google Drive.

NotebookLM isn’t perfect, but it can be useful with the right prompts

NotebookLM excels at identifying patterns, linking ideas from various sources, and clearly explaining trade-offs in simple language. However, it has a few limitations.

It can sometimes misinterpret figures, draw incorrect conclusions, or make errors in calculations.

I learned quickly to treat its outputs as insights, and not final answers.

What made it powerful was how I framed my questions.

Instead of asking vague questions, I’d ask, “Based on these statements, where might my spending be inefficient?” Or instead of, “Is this a good plan?” I’d ask, “What are the risks or blind spots in this plan, given my goals?”

I also double-checked all totals, projections, and comparisons it provided.

Used this way, its imperfections mattered less. It helped me think more clearly about my money, challenge my assumptions, and spot patterns I would’ve missed on my own.

NotebookLM did not replace judgment or basic math, but with appropriate prompts and a healthy dose of skepticism, it became a beneficial tool for financial reflection.

A surprisingly useful financial sounding board

NotebookLM didn’t magically fix my finances, automate my savings, or replace the hard decisions I still have to make.

By basing its responses on my data and the sources I chose, it enabled me to understand my habits in a way that finally made budgeting feel manageable.

Used carefully, it works best as a thinking partner.

I double-checked numbers, questioned assumptions, and treated the outputs as starting points rather than final answers.

But with the right prompts and sources, NotebookLM helped me stay consistent and intentional about money in a way no generic finance app ever did.