Global financial stability is facing an unprecedented threat due to the escalating frequency and sophistication of cyberattacks. According to a recent report by the International Monetary Fund (IMF), the financial sector continues to be a prime target for cybercriminals, resulting in increased risks of significant financial losses. These cyberattacks are becoming more complex and destructive, putting the financial sector in a uniquely vulnerable position due to its reliance on vast amounts of sensitive data and high-volume transactions.

The consequences of a cyberattack on financial institutions can be severe, potentially leading to funding challenges, reputational damage, and even insolvency. The interconnected nature of the global financial system means that a major cyber incident in one institution can quickly ripple through the entire sector, undermining confidence, disrupting critical services, and causing broader economic instability.

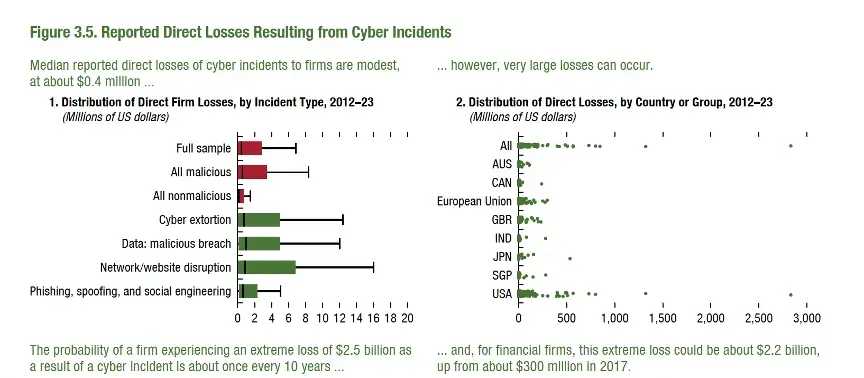

Over the past two decades, the impact of cyber incidents on the financial sector has been significant. The IMF’s Global Financial Stability Report highlights that nearly 20% of reported cyber incidents have directly affected financial institutions, leading to a staggering $12 billion in direct losses. Since 2020 alone, direct financial losses from cyberattacks have amounted to an estimated $2.5 billion.

Source: Global Financial Stability Report

One of the most concerning trends is the sharp increase in ransomware attacks targeting financial institutions. Between 2021 and 2024, the proportion of financial organizations experiencing ransomware attacks has risen dramatically. In 2024, approximately 65% of financial institutions worldwide reported being targeted by ransomware, a significant increase from 64% in 2023 and 34% in 2021.

Share of financial organizations worldwide hit by ransomware attacks from 2021 to 2024

.webp)

Source: Statista, 2024

Top tips for a hardened security posture

Acutely aware of rising risk, and driven by regulatory measures, financial institutions are at the forefront of cybersecurity, employing advanced tools and strategies. However, even sophisticated defenses can have blind spots. At Morphisec, we’ve identified five critical issues that might be flying under your radar.

1. Rogue Software in High-Stakes Environments

Trading floors and analysis departments are hotbeds for unauthorized software. Traders and analysts, in their quest for an edge, often install tools that bypass normal vetting processes. Our high-risk software detection specifically targets this issue, identifying potential threats that could lead to data leaks or regulatory violations.

2. The ATM/POS Security Gamble

ATMs and point-of-sale (POS) systems are the forgotten frontier of financial cybersecurity. These distributed endpoints are prime targets for both physical and cyber-attacks. Morphisec’s lightweight solution combines vulnerability management, configuration checks, and control validation to ensure critical security measures are not just installed, but actively running on these systems. This comprehensive approach, coupled with our pioneering Automated Moving Target Defense (AMTD) technology, provides robust protection without impacting system performance.

3. M&A: The Cybersecurity Due Diligence Gap

During mergers and acquisitions, cybersecurity often takes a backseat to financial considerations. Traditional assessments are too slow and shallow for the rapid pace of M&A. Morphisec’s comprehensive Adaptive Exposure Management provides a quick yet thorough evaluation of a target company’s security posture, potentially saving millions in post-acquisition remediation costs.

4. The Illusion of Active Security Controls

It’s dangerous to assume that installed security tools are always running. Morphisec’s continuous validation process verifies that critical security measures on core banking and trading systems are functioning as intended, providing an extra layer of assurance.

5. Precision in Threat Detection and Response

Unlike traditional detection and response solutions that overwhelm security teams with a flood of alerts, our approach focuses on precision — and prevention. By generating very few, highly accurate alerts, we dramatically reduce alert fatigue. This allows security teams to respond swiftly to genuine threats without wasting time on false positives.

The AMTD Difference

At the core of our solution is Morphisec’s Automated Moving Target Defense (AMTD) technology.

Unlike other endpoint protection solutions which must first detect an attack to stop it, our AMTD prevents advanced attacks from executing by dismantling their delivery mechanisms and kill chain. We use patented Automated Moving Target Defense technology to morph the memory space layout, preventing adversaries from finding an entry point or the resources required to execute an attack without impacting regular operations. This real-time, one-way randomization stops highly sophisticated attacks, including the most advanced exploits and fileless malware, before they can gain a foothold.

This innovative approach offers unique benefits crucial for financial institutions:

- Prevention of unknown attacks, providing protection against zero-day threats.

- Offline protection ensures security even for remote work and when your network is under attack and systems are disconnected.

- Minimal performance impact, allowing for deployment on critical, high-performance trading systems, ATM and POS.

- Reduced operational overhead, freeing up security teams to focus on strategic initiatives.

- Compliance support, helping meet regulatory requirements for security measures.

One of Morphisec’s key strengths is its user-friendly design. The solution is intuitive and straightforward to implement, making it an ideal choice for organizations of all sizes and security maturity levels.

Whether you’re a large institution with a dedicated security team or a smaller company with limited IT resources, Morphisec offers robust protection without the need for constant fine-tuning or complex management. This accessibility ensures that even organizations with leaner teams can achieve enterprise-grade security, leveling the playing field in the fight against cyber threats.

As cyber threats continue to evolve, the financial sector must prioritize robust cybersecurity measures to protect itself from these growing risks. The stakes are high, not just for individual institutions but for the global financial system. Ensuring the resilience of financial institutions against cyberattacks is crucial for maintaining confidence and stability in the global economy.

By addressing often-overlooked areas and leveraging Morphisec’s unique AMTD technology, financial institutions of all sizes can significantly enhance their security posture. Our approach not only prevents advanced attacks but also streamlines security operations, allowing for more efficient resource allocation regardless of your organization’s scale or security expertise.