The ongoing geopolitical realignment and escalating trade tensions are sending shockwaves through global commodity markets, reshaping long-established trade routes and supply chains. From copper to cocoa, and even the U.S. trucking industry, these shifts are creating both challenges and opportunities for businesses and investors alike.

The most visible impact of the trade wars has been on major freight flows, particularly in the crucial eastbound trans-Pacific ocean container lane connecting Chinese exporters to U.S. importers. This vital artery of global commerce has seen weaker volumes and falling rates, with the Freightos Baltic Daily Index showing rates at $2,188 per forty-foot equivalent unit, the lowest since December 2023. This decline reflects the uncertainty and disruption caused by protectionist policies and retaliatory measures between the world’s two largest economies.

However, the ripple effects of these trade tensions extend far beyond container shipping, touching various commodity markets in profound ways. Perhaps nowhere is this more evident than in the copper market, where the threat of U.S. import tariffs has created unprecedented arbitrage opportunities and is reshaping global supply dynamics.

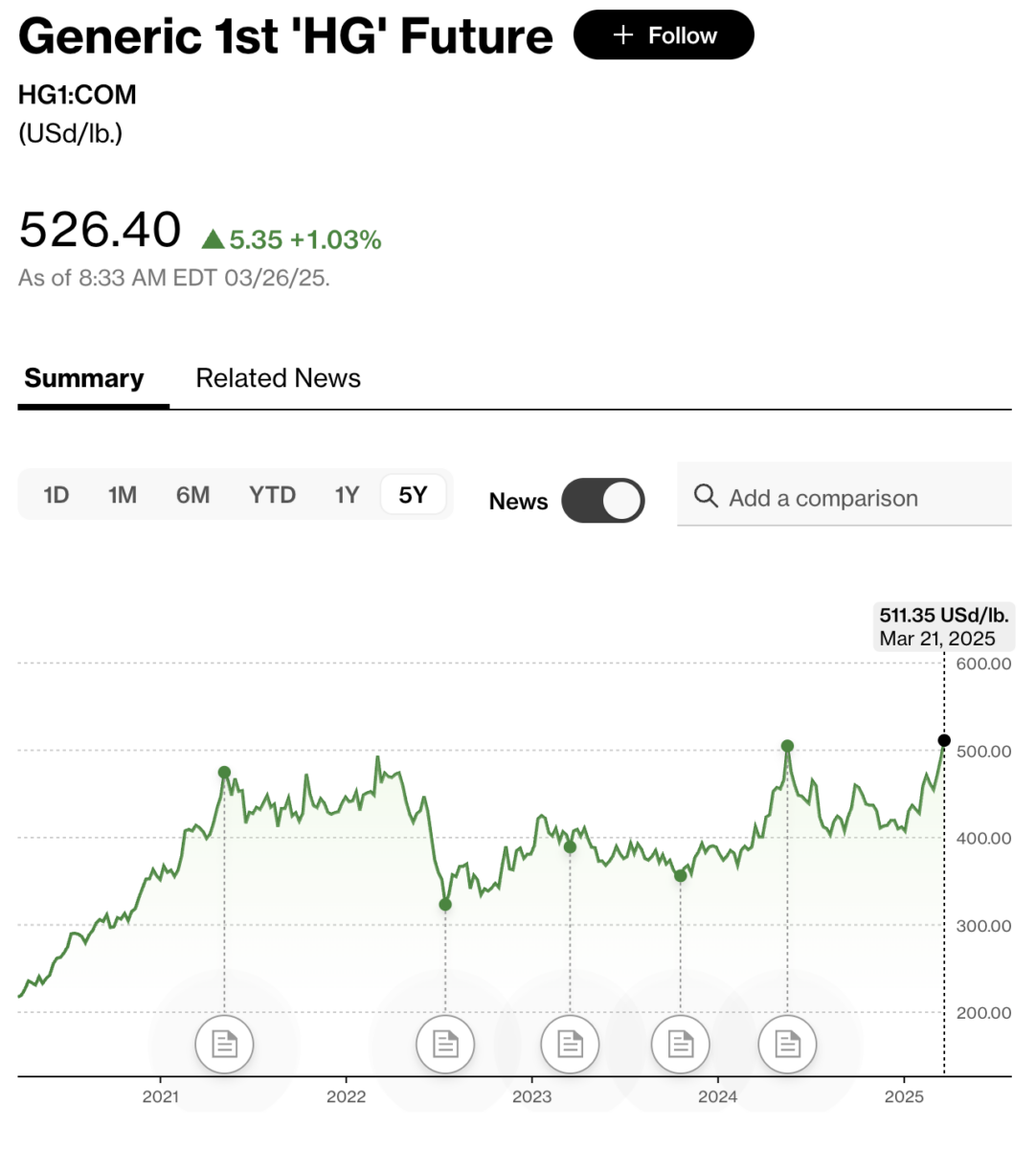

Copper, often referred to as “Dr. Copper” for its ability to predict economic trends, has seen its U.S. futures prices surge to record highs on the Comex exchange. This dramatic price action is driven by traders pricing in the possibility of hefty tariffs on the crucial industrial metal. The price gap between U.S. copper futures and the global benchmark on the London Metal Exchange has widened to record levels, creating a powerful incentive for traders to shift copper into the United States.

Copper futures prices have reached a new record on tariff fears. (Chart: Bloomberg)

Kostas Bintas, head of metals trading at Mercuria Energy Group Ltd., estimates that 500,000 tons of copper is heading to the U.S. in March, compared to normal monthly imports of around 70,000 tons. This massive inflow is leaving the rest of the global market, particularly top consumer China, facing a potential shortage. Bintas predicts that this unprecedented situation could drive LME copper prices to over $12,000 or $13,000 per metric ton.

The copper market’s dislocation highlights how trade policies can create unintended consequences and market inefficiencies. While U.S. manufacturers may face higher input costs, traders with the ability to navigate these complex dynamics stand to reap substantial profits. Meanwhile, the global copper supply chain is being reshaped, with potential long-term implications for producers, consumers and investors worldwide.

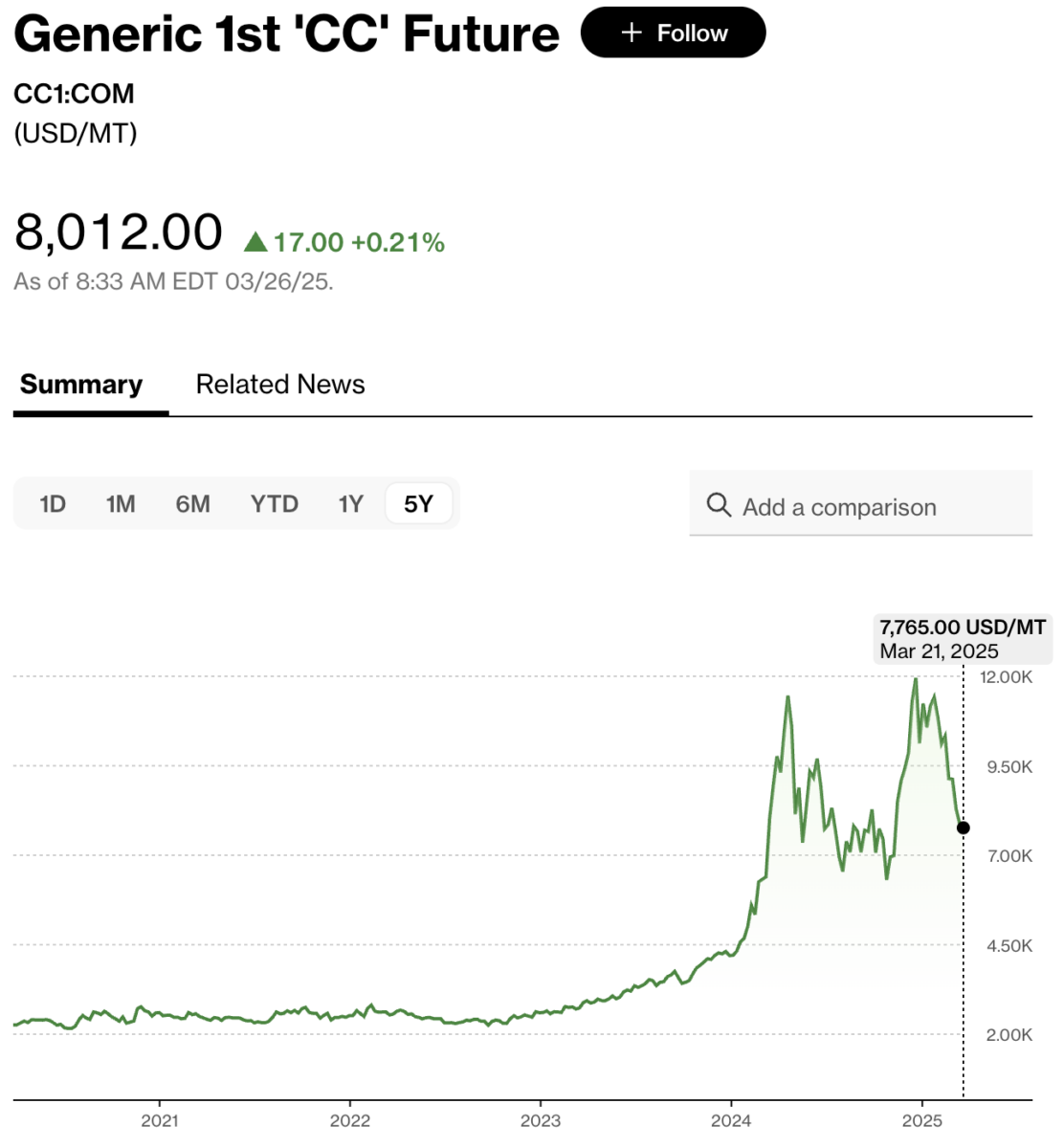

While the copper market grapples with potential shortages, the cocoa market faces a different set of challenges stemming from historically high prices. Cocoa futures nearly tripled last year due to supply concerns from West Africa and are currently trading near $10,000 a ton in New York. These sky-high prices are having a significant impact on chocolate manufacturers and consumers alike.

Cocoa futures have experienced extreme volatility. (Chart: Bloomberg)

JPMorgan Chase & Co. analysts have trimmed their deficit estimates for the current 2024-25 cocoa season to 40,000 tons, down from their earlier forecast of 108,000 tons. This revision is primarily due to an expected 1.8% fall in demand as historically high cocoa prices deter consumption. Chocolate makers are feeling the squeeze, with recent earnings reports suggesting that previously resilient demand is weakening.

Cocoa price volatility is being driven by a mix of supply-side challenges and market dynamics. Extreme weather, particularly in West Africa, which produces about 70% of the world’s cocoa, has hammered yields. Droughts, heat waves and erratic rainfall – linked to climate change and events like El Niño – have stressed cocoa trees, while diseases like the Cocoa Swollen Shoot Virus have wiped out significant farmland, especially in Ghana and Ivory Coast. Aging tree stocks and underinvestment in farms compound the problem, keeping supply tight.

On the demand side, global appetite for chocolate remains strong, but recent data shows grinding (processing) hasn’t fully offset deficits, with three consecutive years of shortfall. The 2024/25 season might see a slight surplus, but inventories are still low, leaving little buffer. Market mechanics amplify this: Low liquidity in futures trading, driven by speculative funds and algorithmic trading, has led to wild swings – prices hit $12,000 per ton in April 2024 before crashing 27% in a single day due to margin hikes and position unwinding.

Structural issues, like concentrated supply from just a few countries and regulatory shifts (e.g., the EU Deforestation Regulation), add uncertainty, keeping volatility high. High prices might eventually spur more planting, but that takes years to pay off, so the roller coaster isn’t stopping anytime soon.

Turning our attention to the United States, we find that the trucking industry, often considered a commodity itself, is also feeling the effects of these broader economic shifts. The U.S. trucking market has experienced significant volatility in recent years, with the pandemic creating unprecedented challenges in securing transportation capacity.

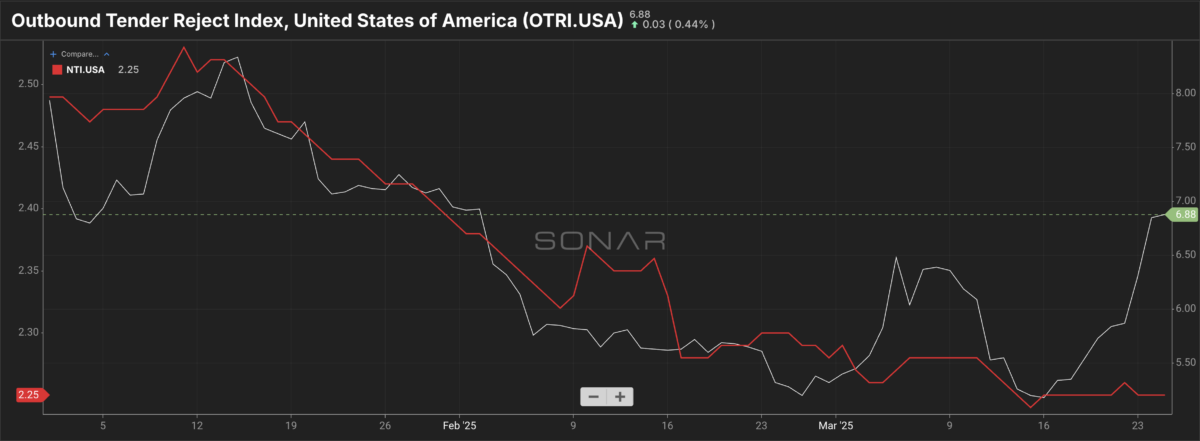

Current data indicates that the U.S. truckload market is nearing a state of equilibrium between supply and demand, a balance not seen since 2022. This shift is exemplified by the Outbound Tender Reject Index (OTRI), which tracks the percentage of truckloads that carriers reject. Since May 2023, this index has displayed a gradual but consistent upward trend, signifying a move away from the oversupply that previously characterized the market.

Rejections have outpaced spot rates, suggesting that spot rates will likely increase. (Chart: SONAR. To learn more about SONAR, click here.)

The national outbound tender rejection rate (OTRI.USA), which measures the percentage of truckloads that are electronically tendered by shippers and rejected by carriers, has climbed to 6.88%, near the level that we consider to be inflationary for spot rates.

Meanwhile, the National Truckload Index (NTI.USA), SONAR’s national average truckload spot rate inclusive of fuel, stands at $2.25 per mile, continuing its downward trend since its most recent peak at $2.53 per mile on Jan. 11.

In other words, tender rejections have diverged upward from the spot rate trend, opening up a gap. Typically, after tender rejections move (either up, when capacity is tightening, or down, when capacity is loosening), spot rates follow in the same direction. When capacity is tightening relative to demand, rates go up; when capacity is loosening relative to demand, rates go down.

For that reason, we believe that truckload spot rates are set to go up.

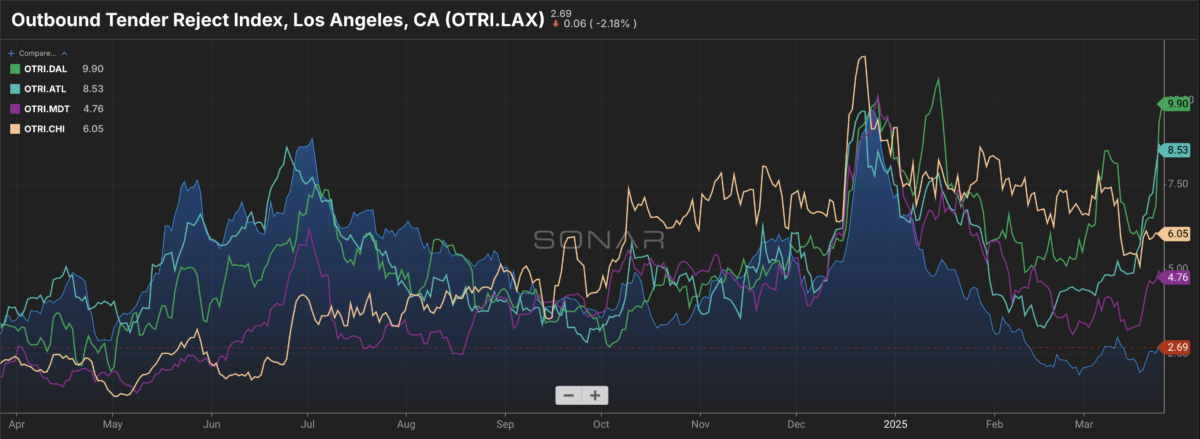

The Outbound Tender Reject Index shows the percentage of truckloads rejected by carriers. (Chart: SONAR. To learn more about SONAR, click here.)

In regions like Dallas and Atlanta, the OTRI figures have surpassed the national average, at 9.9% and 8.53%, respectively. This indicates tighter capacity, with carriers in these areas more frequently rejecting tenders. The underlying reasons for this increase can be traced back to a convergence of reduced capacity and shifting priorities among carriers who now favor loads offering better financial returns. The focus has been on maximizing operational efficiency amid fluctuating demand.

Furthermore, specific areas like the Pacific Northwest have seen a notable rise in the Flatbed Outbound Tender Reject Index (FOTRI), driven in large part by strategic cross-border timber and lumber shipments to Canada in anticipation of impending tariffs. This increase highlights the targeted manner in which capacity is being allocated according to market conditions and anticipated economic pressures.

The truckload market’s incremental move toward equilibrium displays a restrained but deliberate tightening as capacity adapts to the current economic landscape. While this realignment presents challenges, particularly in securing optimal loads and building density in desirable lanes, it also underscores the market’s ability to adjust and respond to prevailing economic conditions.

Notably, while tender volumes have declined significantly in recent months, rejection rates have remained relatively stable. This suggests that the truckload market has tightened more than many realize, with carriers becoming increasingly selective about which loads they accept. Large fleets have been parking and selling trucks over the past year, with enterprise carriers like Werner and Marten Transport reporting significant reductions in tractor counts.

The ongoing geopolitical realignment and trade tensions are reshaping global commodity markets in profound and often unexpected ways. From the copper market’s unprecedented arbitrage opportunities to the cocoa industry’s struggle with record-high prices, and the U.S. trucking market’s delicate balance, these shifts are creating a new landscape for businesses, investors and policymakers to navigate.

Perhaps the only safe bet to make right now is on more volatility, for longer.