It will take months for Russia to find ways to evade new U.S. sanctions. But if Iran can keep its energy exports flowing under heavy restrictions, Moscow probably can too.

Brent crude rose by around $5 this week to $66 a barrel after the U.S. sanctioned Russian oil producers Rosneft and Lukoil. The move will disrupt supply to Moscow’s top energy customers, China and India. But the long-term impact on oil prices could be mild.

The premium of Brent futures over Dubai swaps, measured by the Brent/Dubai EFS, has narrowed over the last few days, said Tom Reed, a vice president at commodities analytics firm Argus Media.

This shows sour crudes from the Middle East are now less of a bargain relative to sweet Atlantic Basin oil than before—possibly a sign of more demand from China and India trying to replace Russian barrels by buying from Middle Eastern producers.

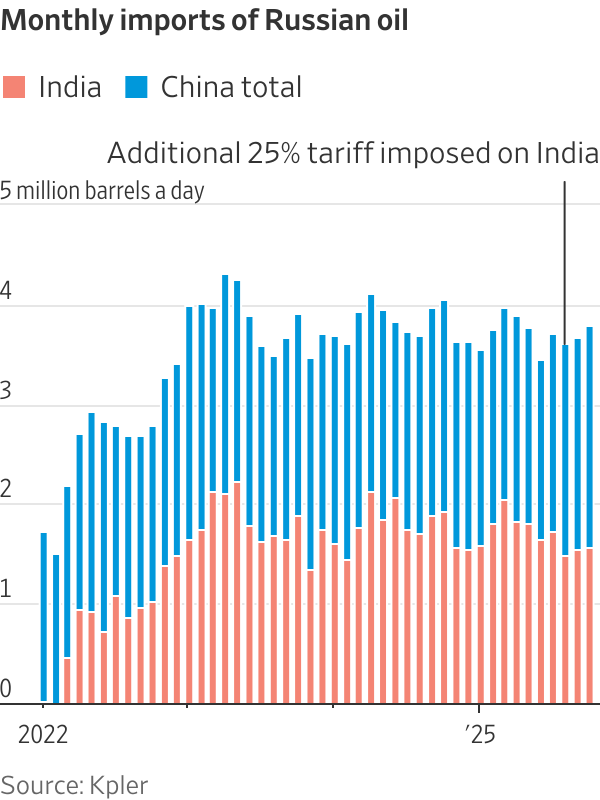

Sanctions should have a more immediate impact on Indian purchases of Russian oil than tariffs did. New Delhi continued buying from Moscow after President Trump put an additional 25% tariff on India’s U.S. imports in August as punishment for its purchases of Russian oil. So far in October, India has bought 1.57 million barrels a day of Russian crude, based on Kpler data. It purchased 1.7 million barrels a day in July, the last month before tariffs were imposed.

Indian refiner Reliance Industries, a big customer of Rosneft, said its purchases of Russian oil are under “recalibration” because of the sanctions. Companies doing business with Rosneft or Lukoil now face the risk of themselves being added to the U.S. Treasury’s Specially Designated Nationals and Blocked Persons List, which makes it hard to do business internationally and limits access to the dollar-based payment system, among other restrictions.

View Full Image

China’s state-owned refineries will also be cautious about handling sanctioned Russian barrels for now, according to oil analysts. Private operators may take riskier cargoes. Most of Iran’s sanctioned oil exports are bought by independent “teapot” refineries in China’s Shandong region.

These private refineries are unlikely to soak up excess Russian barrels in the short term, though. Beijing controls how much crude they can buy through annual quotas that have mostly been used up this year.

The volume of oil now under sanctions has hit 15% of global supply, according to Kpler. Yet unprecedented restrictions haven’t impacted supply. Oil exports from Russia hit a record high last month, and exports from Iran reached their highest level since 2018, according to Claire Jungman, director of maritime risk and intelligence at Vortexa.

That is despite the Trump administration hammering Iran’s energy sector with more than a dozen separate sanction measures this year alone. Evasion tactics have grown sophisticated and the so-called shadow fleet of vessels that transports sanctioned oil has quadrupled in size over the past three years.

Iran has been forced to discount its oil deeply, but has kept exports high under intense sanctions. Russia will probably find ways around restrictions by setting up new supply chains to handle energy deals, and redoubling efforts to disguise where cargoes have come from using ship-to-ship transfers or manipulating ships’ transponders.

A more lasting effect of Washington’s crackdown on Russia could be to reinforce Beijing’s recent strategy of hoarding oil.

The latest disruption to oil imports threatens China’s energy security, a key priority for Beijing. New U.S. sanctions don’t contain a carve-out for pipeline oil. That makes things tricky for China, which imports around 800,000 barrels a day of Russian oil via pipeline. While China is unlikely to stop buying from Russia, the sanctions could further focus their thinking on long-term security.

The Chinese have been buying crude far in excess of their domestic needs this year. The reasons for the stockpiling aren’t clear. Beijing may think the time is right to build its strategic reserves as oil prices have fallen. With geopolitics tense, a large buffer of stored oil can help protect the country from supply disruptions. China has room to build a bigger stockpile as its storage capacity is only around 60% full, based on Rystad Energy estimates.

Trump’s sanctions will make every barrel of Russian oil harder, slower and more expensive to trade but are unlikely to cut the global oil supply. This could be a good result from Trump’s point of view. Russian President Vladimir Putin gets less money to finance war in Ukraine, but consumers are spared a painful spike in energy prices.

Write to Carol Ryan at carol.ryan@wsj.com