(Bloomberg) — Several major Russian commodity exporters say trade with China has become a gamble as direct payments made in yuan are increasingly being frozen or delayed after the US in June broadened the criteria for imposing sanctions.

It has become very difficult or even impossible to make direct payments from China to Russia after the latest round of US sanctions, even when using yuan, said top executives at three commodities exporters. All three asked not to be identified as the information is sensitive.

Some Chinese buyers of Russian farm goods have also been experiencing issues with payments this month, a person at a Russian agricultural trading firm said.

The problem affects not only commodities like metals and agriculture, but other industries as well. The Association of Russian Automobile Dealers last week warned that imports of vehicles and car parts from China, now the country’s main supplier, may come to a halt due to glitches with settlements.

Those delays come after the US in June widened the parameters for determining whether to impose secondary sanctions by broadening the definition of Russia’s military-industrial base.

The situation illustrates how increasingly draconian penalties against Russia are slowly taking a toll on the country’s economy. The central bank said in a July report on macroeconomic and financial trends that it had observed “a decrease in the degree of openness in the Russian economy, which is reflected in a decline in the share of imports and exports in GDP, and an increase in the role of domestic demand and production.”

Since the end of last year, Russia has also experienced difficulties in operations with other major trading partners, including the United Arab Emirates and Turkey, as US pressure on lenders slows down transactions. Trade with India has also encountered bumps in the road because the rupee is not fully convertible.

The Bank of Russia didn’t immediately respond to a request for comment.

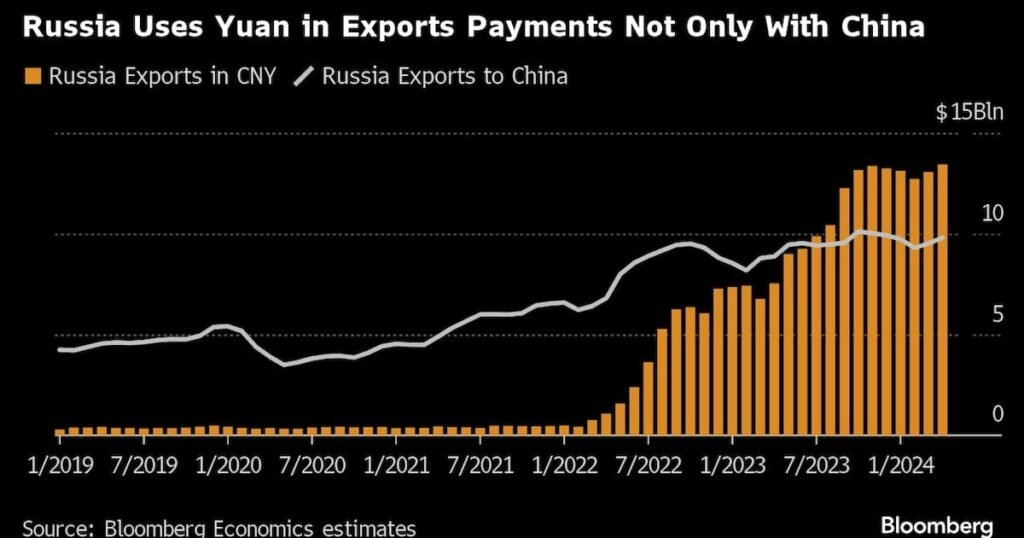

China has become Russia’s main trading partner in the wake of the Kremlin’s February 2022 invasion of Ukraine and the subsequent, sweeping sanctions imposed by the US and European Union against Moscow. Trade between the two countries surged by more than 60% to $240 billion in 2023 since then, with Russia surpassing Germany, Australia and Vietnam on the list of Beijing’s top trading partners, Chinese customs data show. The yuan now accounts for about 40% of Russia’s export and import payments and more than half the value on Russia’s foreign currency market.

While China hasn’t joined the West in imposing sanctions against Russia, payments between the two countries have still faced obstacles since December, when the US threatened to impose secondary sanctions on banks that facilitate trade with Russia’s military-related industries. Russian companies told local media in June that the issue was resolved using small regional banks after President Vladimir Putin met Chinese President Xi Jinping in May, but then the US expanded their sanctions criteria.

“US sanctions and the threat of secondary sanctions have already led to a growing number of banks in China that do not want to make payments and foreign trade settlements with Russia,” said Alexander Potavin, an analyst with Finam in Moscow.

Those who are experiencing problems often are able to find alternative methods for payment, including by using cryptocurrencies or routing the transactions though former Soviet republics like Kazakhstan or Uzbekistan, even though that adds cost, people said.

“A clear collapse in imports due to lags we don’t see yet, but imports in rubles have already begun to decline,” said Dmitry Polevoy, the investment director at Moscow-based Astra Asset Management, referring to delays in processing payments. Imports in rubles as a share of GDP are “noticeably declining after recovering in 2023.”

Some traders are still able to make yuan payment to Russia, but only through a limited number of major state-owned banks. Smaller or local lenders are not an option anymore after sanctions were broadened, according to a person familiar with the matter.

To be sure, some exporters have said they haven’t experienced issues executing payments. A major energy exporter’s yuan-denominated transaction from China this month went smoothly, even though some banks have stopped working with Russia, the firm’s top executive said.

Trade is still happening, but it’s certainly more expensive due to the greatly increased costs of making payments, one of the people said.

–With assistance from Hallie Gu.

©2024 Bloomberg L.P.