Volatility returns

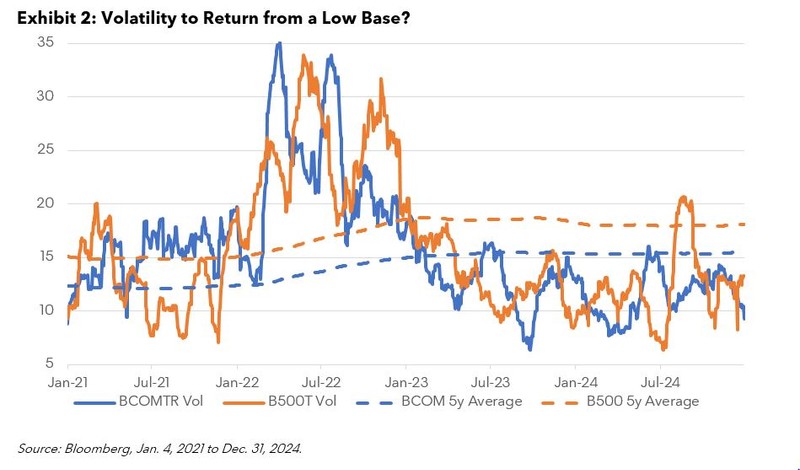

Except for the quick August volatility spike in equities, 2024 was another low volatility year like 2023 for most asset classes. Over the last two years, 30-day volatility for BCOM and the Bloomberg US Large Cap Total Return Index (B500) both averaged under 13%. These averages are a few percentage points below the 5-year averages seen in Exhibit 2. Brent vols declined to 5-year lows in July. Historically, commodities and equities have taken divergent paths when volatility rose like in 2022. When volatility occurs, commodities prices tend to spike higher and equities prices move lower. There are plenty of reasons why this could occur in 2025. Equities outperformed over the last two years and there are potential risks ahead which could hit investor sentiment. A diversified portfolio with an allocation to commodities could help weather a storm if returns mimic what was seen in 2022 when volatility rose. During that year, equities fell 20% while commodities rose 16%.

Peak supply

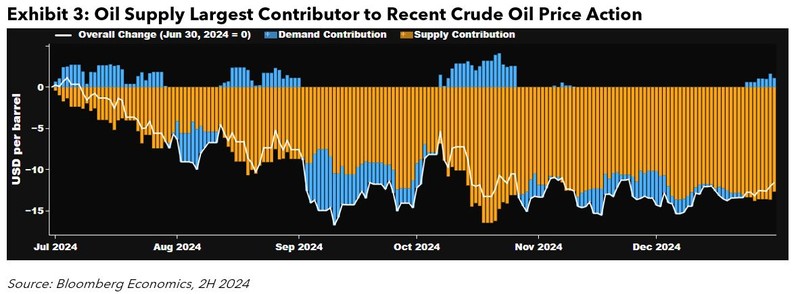

A new theme we are watching involves one of the most important drivers of commodities markets: supply. Several major commodities were in surplus last year and the drop in prices reflected that, especially so with the grains. Corn, soybean, and wheat prices dropped throughout the year on the back of bumper crops and inventories in the US. Prices may be near a bottom and low prices typically incentivize farmers to produce less. Crude oil is a commodity which fundamentally looks to be on a path of increasing supply. Exhibit 3 shows the trend over the second half of 2024 where supply was the main contributor to crude oil price action. Oil market analysts are projecting continued, increased production in 2025 which could continue to weigh on energy prices. But with bearish expectations for crude oil the consensus to start the year, prices may hit an inflection point in 2025 if the opposite of expectations occurs and supply starts to become constrained. Production in the US may start to cool and OPEC+ could become more compliant with stated production cuts.

Reinflation

A scenario we outlined before may be playing out regarding a potential re-acceleration of inflation ahead. Inflation has cooled but it has been simmering underneath the surface and could punch back higher. Inflation during this decade (2020s) spiked and then cooled in a possibly similar head fake manner to the 1970s when an initial move in inflation occurred only to reaccelerate to levels twice the prior peak a few years later. We may be in a similar situation as US economic growth and the US consumer are still strong, yet the FED cut rates three times in 2024. Investors are uncertain about how the FED will react to incoming economic data and whether their recent focus on labor data could pivot back to combatting inflation.

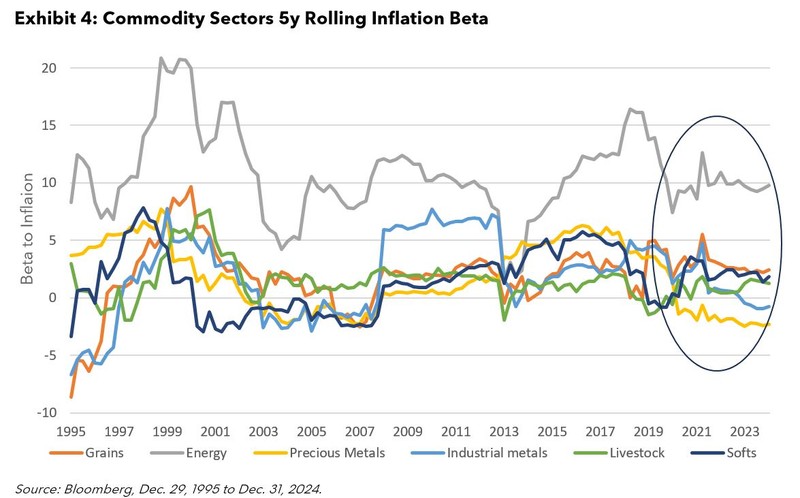

Some commodity sectors tend to perform better than others in high inflation environments. Exhibit 4 shows energy tends to have the highest inflation beta, or sensitivity to changes in inflation, amongst the six commodity sectors of BCOM. In recent years, the other sectors have shown small single digit percentage positive beta, but precious metals have surprisingly shown negative inflation beta. This is counterintuitive to the consensus that gold is used as an inflation hedge. Recent history has proven the hedging narrative on gold has lost significance.

Tariffs effect

In the December FOMC meeting news conference, the U.S. FED chair said they are conducting research on how tariffs might impact inflation. Whether tariffs are being suggested as a negotiating tool, or if they end up happening, consumers are bracing for possible price increases in the future. The types of imports that could be directly impacted have seen stockpiling ahead of potential tariffs in the fourth quarter of 2024.

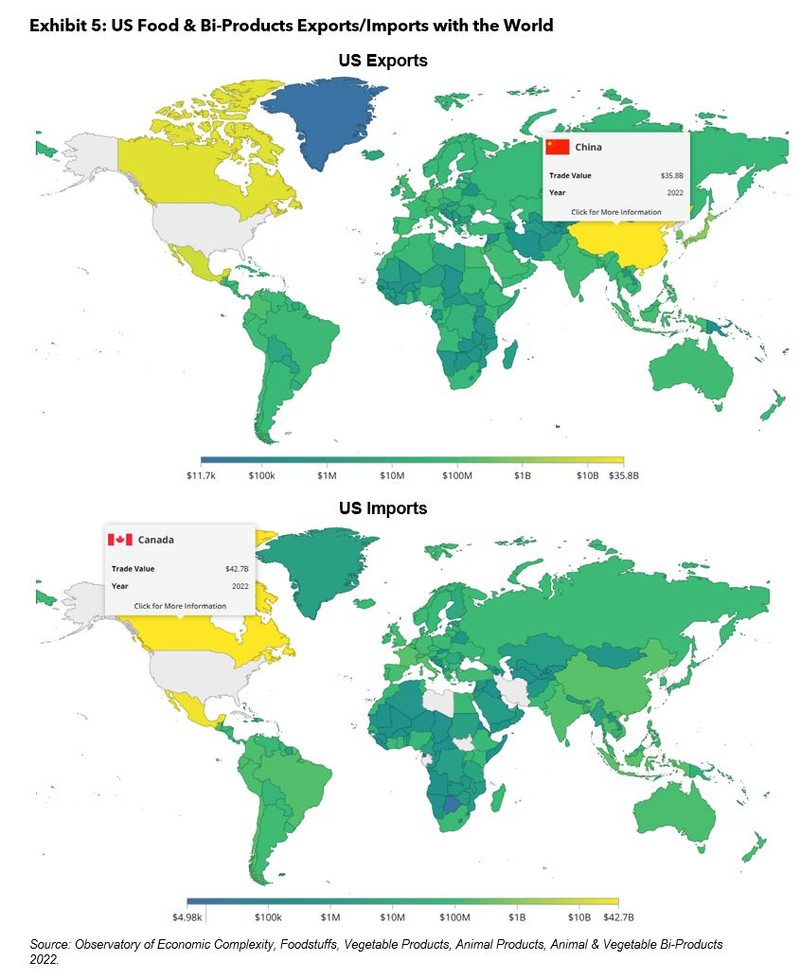

In Trump’s last presidential term, the trade war effected prices of agriculture commodities. Introduction of additional tariffs could impact these commodities prices again if there are shifts in trade balances between the US and key trading partners. Exhibit 5 shows U.S. exports and imports across the world. In terms of exports, China is the location where most food and biproducts are shipped to, from the US with a total trade value in 2022 of $35.8 billion. Looking at imports into the US, Canada is the biggest trading partner with $42.7 billion of trade value with Mexico not far behind at $39.6 billion. China, Canada, and Mexico are the biggest agricultural trading partners with the U.S. It is too early to say if these tariffs would be enacted but the potential for volatility of grains and livestock is high this year.

Laggards mean revert

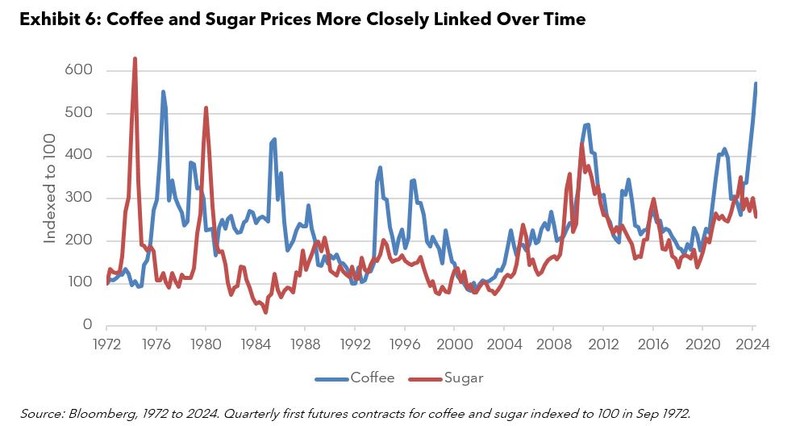

In 2024, major commodities like gold, coffee, and cocoa appreciated the most in price while natural gas and grains fell the most. Gold seems to have tailwinds for further gains and silver tends to lag gold price moves but with greater volatility. The spikes higher in coffee and cocoa seem overdone looking at price action going back to 1970. The recent move in cocoa is unprecedented but we have seen similar spikes in coffee prices going back 50 years and they are now at levels of prior peaks. One laggard beneficiary of the recent spike in coffee prices could be sugar. Exhibit 6 shows prior spikes in these soft commodities where they tend to occur within a few years of each other partly due to their nature as complementary goods. Since 1999, sugar prices are over 20% more closely correlate with coffee then during the prior 25 years and sugar could be in for a laggard move to the upside this year. Coffee and sugar are both grown in the same regions and continued adverse weather events/drought in places like Brazil could lead to upside this year.

In this blog, our key commodities themes for 2025 will be topics of debate amongst market participants looking to understand how to navigate what will surely be a different year from 2024. With risk assets priced for a perfectly rosy scenario, the potential for volatility to pick up is high. After a long period of ample supply across commodities, 2025 could see an inflection point toward lower inventories. Inflation is ever present and could pick up this year after recent moderation. Tariffs are uncertain but key commodities markets will be affected if implemented. Finally, after outperformance from some commodity sectors and individual commodities, the potential for complementary laggards to follow is rising.