Thomas Barwick/DigitalVision via Getty Images

On Friday, July 12, the USDA released its July World Agricultural Supply and Demand Estimates report, the gold standard for fundamental supply and demand data in the agricultural futures markets. I reached out to Sal Gilberte, the founder of the Teucrium Family of agricultural ETFs, including the CORN, SOYB, WEAT, and CANE ETFs that track portfolios of actively traded CBOT corn, soybean, wheat, and ICE sugar futures. Sal told me:

The July WASDE report adjusted the U.S. corn balance sheet to show the rate of increasing corn usage rising faster than the rate of increasing corn supplies, which was enough to motivate short covering in both corn and soybean markets. To be sure, there are currently very healthy levels of corn and soybean supplies, and at this time the vast majority of field crops are in good shape, which is why corn and soybean prices are at multi-year lows approaching their actual cost of production. Given the fact that corn prices are nearing their historical (since 2007) futures equivalent cost-of-production prices lows of between $3.50 and $4.00 per bushel and that corn crops in the U.S. are right now entering the critical pollination stage when the risk of weather-related damage is high (potentially caused by dryness, heat, and nighttime temperatures holding above 75 degrees for too many consecutive nights), it’s no surprise that traders are flattening short positions at this time. From both a seasonal risk and a price perspective, the risk/reward of carrying short positions in corn seems too high for comfort. Long-term traders willing to assume some risk-on positions are no doubt looking to buy dips from this point onwards, with all eyes on the weather the next 4-6 weeks across the corn belt.

The July WASDE’s full text is available through this link. As the agricultural markets head into the end of the 2024 growing season and harvest, grains remain under pressure, while soft commodities have been leading on the upside. While the weather is the primary factor determining the price paths, the demand side of the fundamental equations continues to grow, meaning supplies must keep pace with the rising demand. The world adds around twenty million more mouths to feed and lives to power each quarter.

Grains have lagged the commodities asset class

The commodities asset class composite, including the six leading sectors, precious metals, energy, base metals, soft commodities, grains, and animal proteins, moved 3.38% higher in Q2 2024 and was 10.41% higher over the first six months of this year. Four of the six sectors were higher in Q2, with grains and soft commodities posting losses. Over the first half of 2024, the only losing sector was grains, posting a 12.06% six-month decline.

Grains and oilseeds rose to multi-year, and in some cases, all-time highs in 2022. The continuous CBOT soft red winter wheat futures reached a record $14.2525 per bushel high in March 2022 as supply concerns over the war in Europe’s breadbasket pushed prices to a record peak. CBOT soybean and corn futures came within pennies of the record 2012 highs. Since then, prices have made lower highs and lower lows.

Monthly CBOT Soybean Futures Chart (Barchart)

The chart highlights the bearish price action in the soybean futures market that has made another lower low in early Q3 2024.

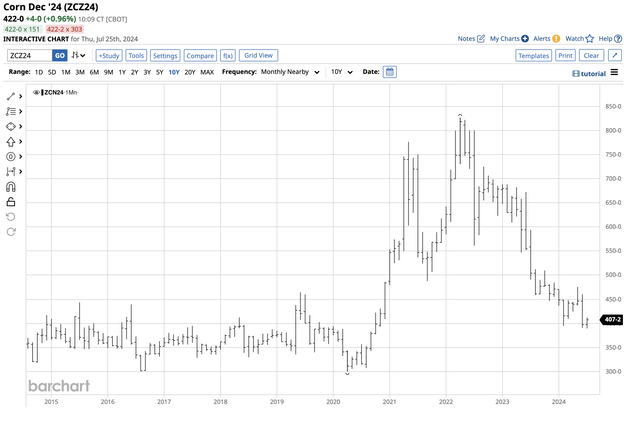

Monthly CBOT Corn Futures Chart (Barchart)

Corn futures have continued declining and dropped to a lower low in July 2024.

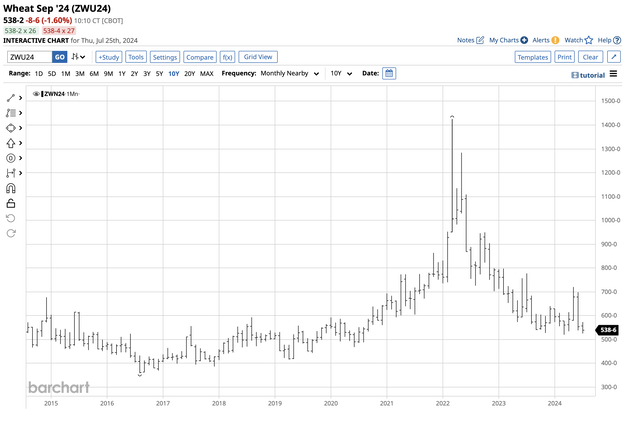

Monthly CBOT Wheat Futures Chart (Barchart)

While the CBOT soft red winter wheat futures have not made a lower low in July 2024, the price remains close to the most recent bottom.

Grains continue to lag the commodities asset class as the bearish trends since the 2022 highs remain firmly intact in early Q3 2024.

Soft commodities have led the commodities asset class – Animal proteins have posted gains

The soft commodities composite, including world sugar, Arabica coffee, cocoa, cotton, and frozen concentrated orange juice futures, led the asset class in 2023 with a 24.04% gain. In Q2, soft commodities pulled back 2.79% even though cocoa and FCOJ futures rose to new record highs. Over the first six months of this year, softs were 26.76% higher, leading the asset class with the most significant gain.

Soft commodities and animal proteins are agricultural products along with grains. In 2023, the animal protein sector edged only 1.74% higher on gains in cattle and losses in hog futures. In Q2, the proteins moved 0.66% higher but were 19.49% above the 2023 closing level at the end of the first six months of this year. In a reversal, hogs have led the animal proteins over the year’s first half, while cattle futures still posted impressive gains, rising to new record highs.

DBA owns grains, softs, and proteins

Three of the six commodity sectors include agricultural commodities, while the others are metals and energy. The fund summary for the Invesco DB Agriculture Fund ETF (NYSEARCA:DBA) product states:

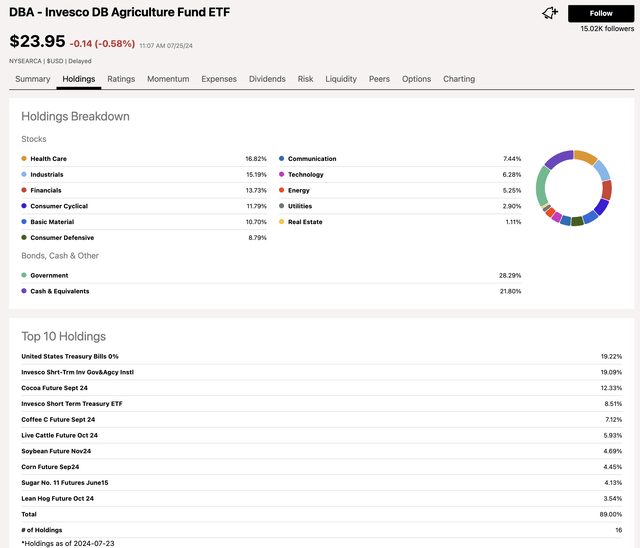

Fund Profile for the DBA ETF Product (Seeking Alpha)

At $23.95 per share, DBA had $701.8 million in assets under management. DBA trades an average of around 336,500 shares daily and charges a 0.85% management fee. Seeking Alpha’s website shows that the ETF has paid a $0.96 dividend, translating to a 4% yield. DBA has exposure to the three agricultural commodity sectors.

A diversified approach to commodities that reflects the weather and global trade dynamics

DBA’s top holdings in July 2024 include:

Top Holdings of the DBA ETF Product (Seeking Alpha)

While DBA’s top holdings have a +9% exposure to corn and soybeans, its soft commodities holdings account for over 23.50% of its assets, and proteins account for 9.47%. DBA’s allocations can change over time, reflecting the price action in the agricultural commodities. DBA’s top exposure to cocoa shows the ETF’s flexibility in investing in “hot” markets experiencing significant price appreciation. Before 2024, cocoa’s all-time high was in 1977 at $5,379 per ton. This year, the price more than doubled from that level to a $12,261 peak in April and remains above the 1977 high at over $7,800 per ton in late July.

The commodities that feed and increasingly power the world depend on the weather in the leading growing areas and global trade and logistical factors. However, with the worldwide population above the eight billion level and rising, the demand for food and energy suggests that production must keep pace with the increasing demand. Moreover, inflationary pressures have caused production costs to increase, putting upward pressure on prices.

A bullish trend since the 2020 lows – The trend is your best friend

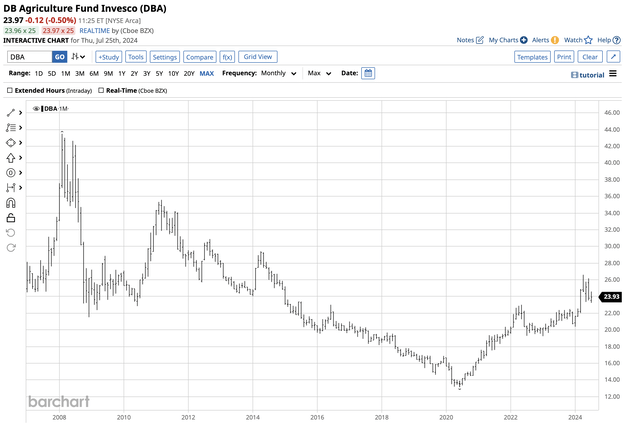

In June 2020, the DBA ETF reached a pandemic-inspired $13.15 per share low.

Monthly Chart of the DBA ETF Product (Barchart)

The chart shows DBA’s bullish pattern of higher lows and higher highs over the past two years, reaching a $26.61 high in April 2024. At just under the $24 level on July 25, DBA remains in a bullish trend, and the trend is always your best friend.

Grain and oilseed prices have declined sharply while soft commodities and animal proteins remain in bullish mode. Price cyclicality and weather suggest that grains will eventually take the bullish baton as prices have dropped to levels where they offer significant value. Moreover, DBA is a flexible product where managers will concentrate investments on the commodities with the most significant odds of higher prices. I expect the bullish trend to continue over the coming months and years. Even the most aggressive bullish trends experience periodic pullbacks. Buying DBA on price weakness could be optimal over the second half of 2024 and 2025.