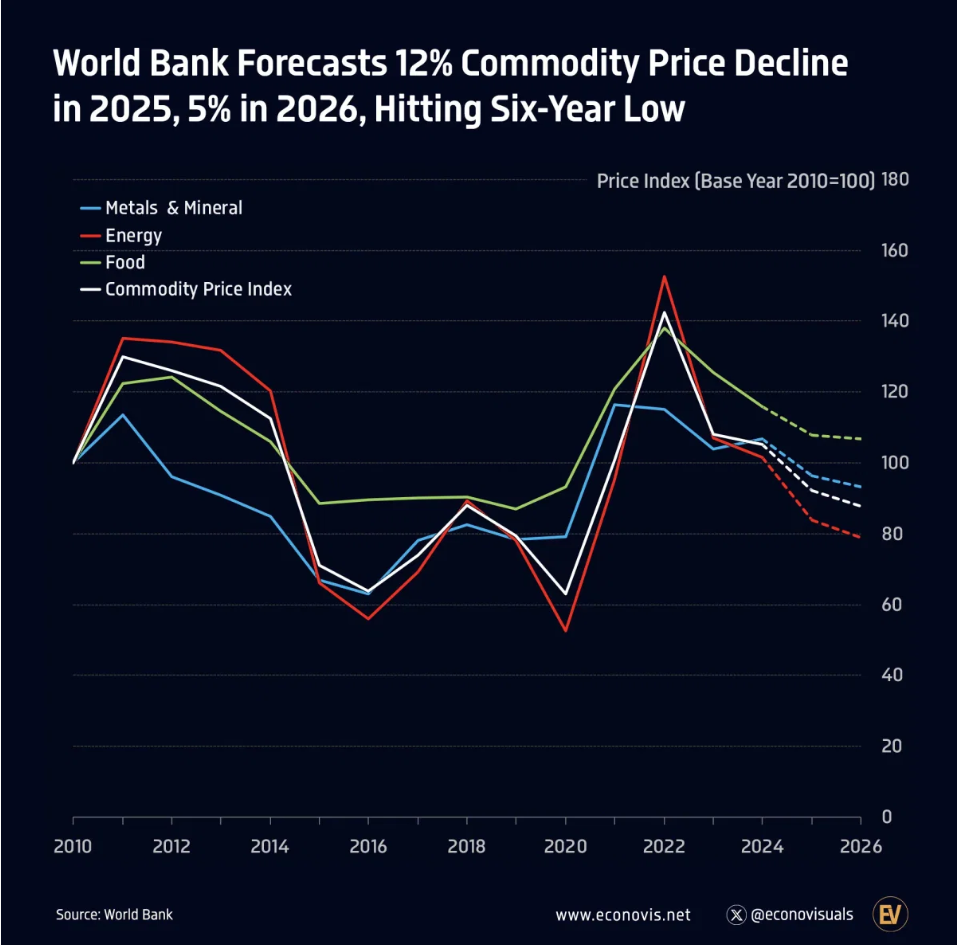

Over the past few months, global commodity markets have shown a sharp downward trend. Prices of , metals, and even agricultural commodities have gradually declined, approaching their lowest levels in six years. According to the latest World Bank report, commodity prices are expected to fall by around 12% in 2025, followed by another 5% in 2026, marking a significant slowdown compared to the post-pandemic era.

This phenomenon represents a major turning point in global economic dynamics, as declining commodity prices are often followed by easing inflationary pressures in many countries. And behind all of this lies a huge opportunity for market participants, especially forex traders to understand how this chain of economic cause and effect shapes the direction of global monetary policy.

Why Are Commodity Prices Falling?

There are three main factors driving this trend:

1. Slowing global demand.

Global economic growth has weakened, particularly in Asia and Europe. Manufacturing activity has declined, international trade is not as strong as before, and global energy consumption is stabilizing in line with the adoption of environmentally friendly technologies. All of this is putting downward pressure on demand for oil, metals, and other raw materials.

2. Oversupply conditions.

Many commodity-producing countries ramped up production during 2023–2024 to take advantage of high prices. Now, as demand weakens, the market is facing an oversupply situation.

3. Structural changes in the global economy.

The green energy transition and increasing industrial efficiency have led to a long-term decline in demand for fossil fuels. This has also driven a rebalancing of prices among commodities for instance, industrial metals such as and remain relatively stable, while fossil energy sources like oil and coal are under pressure.

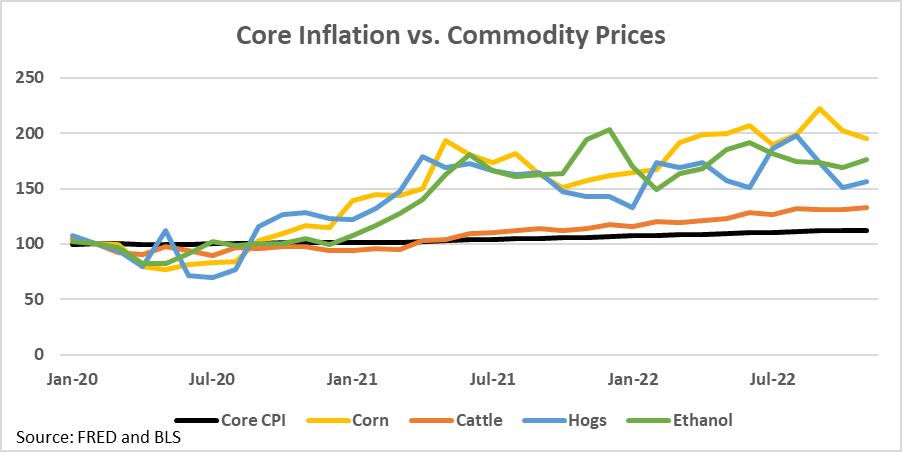

Commodities and Inflation: An Inseparable Relationship

Commodity prices are one of the key components shaping global inflationary pressures. When energy and food prices fall, the production costs of goods and services also decrease. This effect ripples throughout the entire economy, from factories and transportation to consumer-level prices.

This is why central banks around the world pay close attention to commodity price trends. When these prices decline, expectations ease, giving central banks more room to loosen monetary policy. Conversely, when commodity prices surge, inflation rises, prompting central banks to raise interest rates to curb demand.

In the current context, with global commodity prices continuing to fall markets are beginning to speculate that the era of high interest rates may soon come to an end. The (U.S.) and the (ECB) may start considering rate cuts within the next 6–12 months if inflation continues to slow.

Impact on the Forex Market

Falling commodity prices have direct implications for currency values, particularly for commodity-exporting and commodity-importing countries.

Commodity Exporters (Australia, Canada, Indonesia):

When commodity prices fall, export revenues decline, trade balances weaken, and this can put pressure on their currencies.

For example: the (AUD) often weakens when global metal prices fall.

Commodity Importers (Japan, India, South Korea):

Conversely, falling commodity prices are beneficial. The costs of importing energy and food decrease, current account balances improve, and inflationary pressures ease. In such situations, the currencies of importing countries tend to strengthen relatively.

Interest Rate Policy and Yield Differentials:

Forex traders should also pay attention to interest rate expectations across countries. If one country cuts interest rates faster than others, its currency yield becomes less attractive, reducing demand for that currency.

For instance: if U.S. inflation falls but the Federal Reserve delays cutting interest rates while Australia cuts rates earlier then AUD/USD could weaken as the interest rate differential narrows.

How Traders Can Take Advantage of This Trend

Falling commodity prices are not just an economic headline, they are a signal of a major macroeconomic cycle shift.

For forex traders, here are key points to watch:

- Monitor the trends of major commodities such as oil (/WTI), industrial metals (copper, nickel), and global agricultural products.

- Keep track of monthly inflation data from major economies (U.S., Eurozone, U.K., Japan, Australia).

- Pay attention to central bank statements, especially regarding inflation expectations and interest rate policies.

By understanding the relationship between commodities, inflation, and monetary policy, traders do more than react to charts, they grasp the why behind market movements.

Conclusion

The decline in global commodity prices is not just a routine economic cycle.

It reflects the slowdown in global demand, structural shifts in the energy landscape, and the global economy’s transition toward a more efficient era.

For traders, this is not merely information, it is an opportunity to anticipate monetary policy directions before the market reacts.

Because as always, markets do not wait for the news, they move ahead, driven by expectations of the news itself.