Igor Alecsander

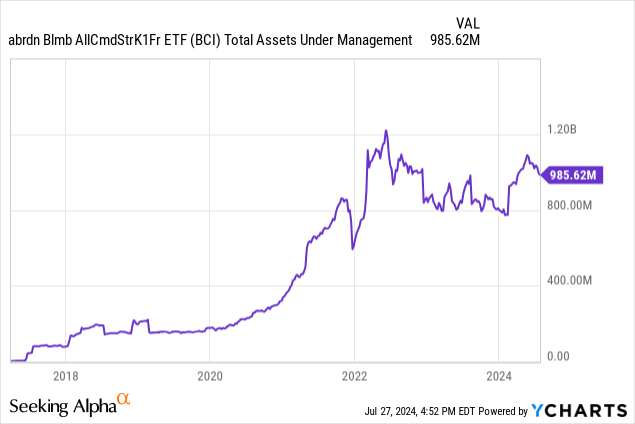

We end up with a hold rating on the abrdn Bloomberg All Commodity Strategy K-1 Free ETF (NYSEARCA:BCI). This ETF has $986 million in assets as of Friday’s close, and has been hanging around the $1 billion mark since it first surged there in early 2022. Yet, we get the idea that few notice it.

What we like about BCI is what any taxable investor is bound to like: it does not deliver a K-1 partnership tax form, like many broad-based commodity ETFs do. That can save some annoyance at tax time for investors.

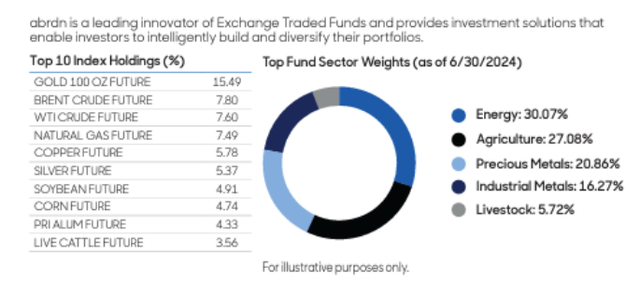

We also like the way the ETF is structured. As shown below, it is not overwhelmed by energy exposure, with that part of the commodities business limited to about 30% here. ETFs like this are all about how they are constructed. Once that is set up by the issuer, it is left to market forces to determine how it does.

BCI also has a strong agriculture component, and precious metals like gold, silver and copper are an important part (21% of assets as of the June 30 chart below) but again not so excessive that this becomes just another gold or energy play in a fund that calls itself “commodities.”

Commodities are an asset class that can help in times of inflation, US dollar weakness (for US investors) and when the economy’s strength increases demand for some or many commodities. And within ETFs like BCI, there is some diversification, since different parts of the commodities markets don’t always move in sync.

Here’s a chart showing that. And, while precious metals and livestock have been booming compared to the other 3 sub-sectors of commodity space, at different times, different parts of that market, and thus BCI’s price trend, can vary. That built in diversification can be helpful.

This helps justify why many investors seek to have some exposure to commodities in their portfolio. When the dollar strengthens, commodities become more expensive in other, non-dollar currencies, and demand is reduced. When the dollar falls, commodities become less expensive in other, non-dollar currencies, and demand increases.

The Federal Reserve has dramatically raised the Fed Funds rate over the past few years to combat inflation. At some point in the not too distant future, the Fed is expected to start cutting rates. When they do, the dollar is more likely to fall. That could increase the attractiveness of commodities, and BCI could do well.

But we are not there yet, and while BCI is well off its all-time high price, it is still falling and might need to get a bit cheaper, even washed out in price, to move us to lift it from a hold rating.

What is BCI?

BCI tracks the Bloomberg Commodity Index combined with the return of 3-month T-bills. The index includes up to 25 commodity futures contracts in the agriculture, energy, livestock, and metals sectors. Futures positions are weighted 2/3 by trading volume and 1/3 by world production.

The index rebalances each January, with weight-caps applied at the sector level. Contract tenor selection is determined by a set roll schedule that varies by commodity. The fund manages its commodity exposure through a wholly owned Cayman Islands subsidiary, a common structure in the commodity ETF space.

What does the category of commodities include? Commodities are hard assets you can touch. They include energy related products, agricultural related products, and metals. These products are traded daily on commodity exchanges, and this trading can cause the prices of commodities to fluctuate daily. Sometimes the changes in pricing can occur simply because of the changes in supply and demand.

Peer group comparison

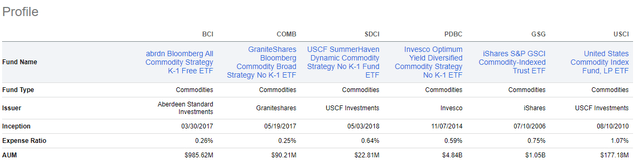

There are many commodity ETFs, including BCI’s peers shown below. This group includes no K-1 style ETFs such as Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF (PDBC) as well as the iShares S&P GSCI Commodity-Indexed Trust ETF (GSG), which is the largest in the group.

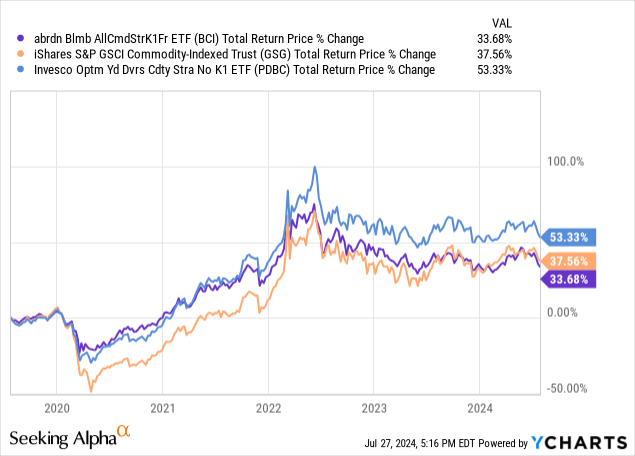

When looking that set of ETFs, BCI comes in near the low end when it comes to expense ratio, which is one big reason it has reached the $1 billion asset range. And in looking below at BCI’s return the past 5 years versus GSG and PDBC, it is competitive but has lagged after leading for a bit back in 2020.

But this has everything to do with asset mix. The other ETFs have different exposures than BCI, and emphasize energy more. While energy has been in a slump more recently, it had a surge in price during this time that lifted the prices of these other ETFs that have bigger allocations to that part of the commodities world.

The yield on BCI is 3.9%, which is very competitive with the stock market and perhaps soon with bonds if rates continue to fall. But with all the above considered, the headwinds on commodities, when diversified as BCI does, is still not at the price where we’d consider it a major buying opportunity.

It is just within 3% of its 2024 low price, but 15% above 2020’s low. So, there’s still some downside risk from a purely technical standpoint right now. We should always remember that cheap can get cheaper.

Summary

Commodities are an intriguing allocation, and they are getting closer, given the recent weakness. We can’t argue with a small allocation, but a major move into this segment is not very interesting to us just yet. So we issue a hold rating, and watch and wait.