- Bitcoin trades below $121,800 on Thursday after reaching a record $124,474 in the early Asian trading session.

- A softer Fed stance as well as rising institutional and corporate demand push BTC to fresh highs.

- The bullish outlook remains intact, but potential profit-taking by long-term holders could trigger short-term dips.

Bitcoin (BTC) faces a slight pullback after setting a new all-time high of $124,474 in early Asian trading on Thursday. This price surge was fueled by rising expectations that the US Federal Reserve (Fed) will cut interest rates soon and by increasing institutional and corporate demand for BTC.

Despite the overall bullish outlook, traders should be cautious as profit-taking by long-term holders could trigger a correction.

Bitcoin hits new record highs

Bitcoin price hit a new all-time high of $124,474 during the early Asian session but faced a pullback, trading below $121,700 at the European session. This price surge comes following the Consumer Price Index (CPI) data, which came slightly softer than expected on Tuesday, strengthening the case for a September Fed rate cut.

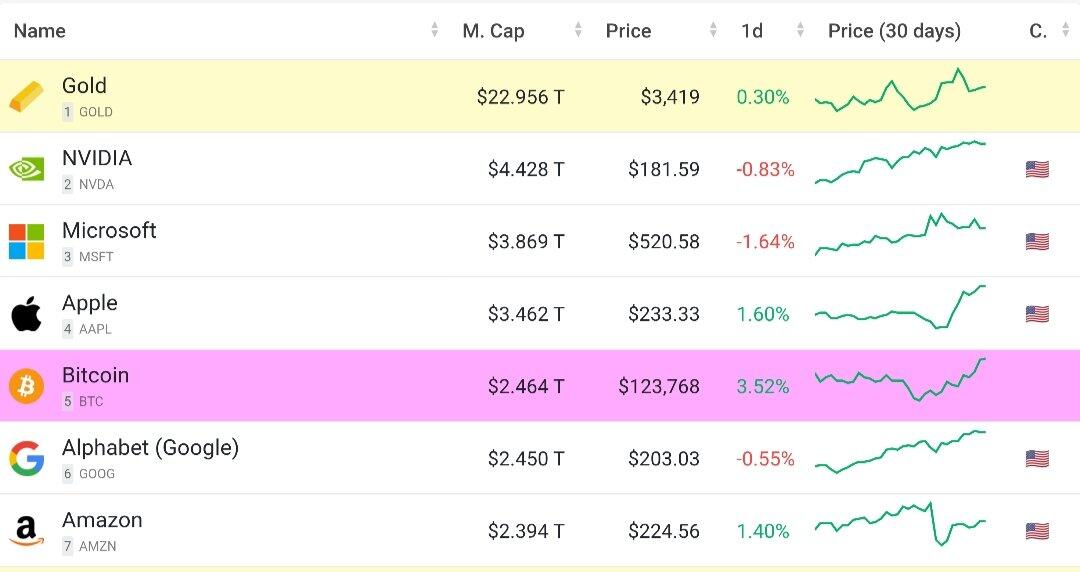

Bitcoin market capitalization exceeded $2.46 trillion. This places it among the top 5 assets in the world, surpassing companies such as Alphabet (GOOG) and Amazon (AMZN).

Rising demand for BTC by corporations and institutional investors in the past few days has also supported Bitcoin to record highs. So far, mid-week, Strategy, Metaplanet, Smarter Web Company, Capital B, and many other companies have added BTC to their treasury.

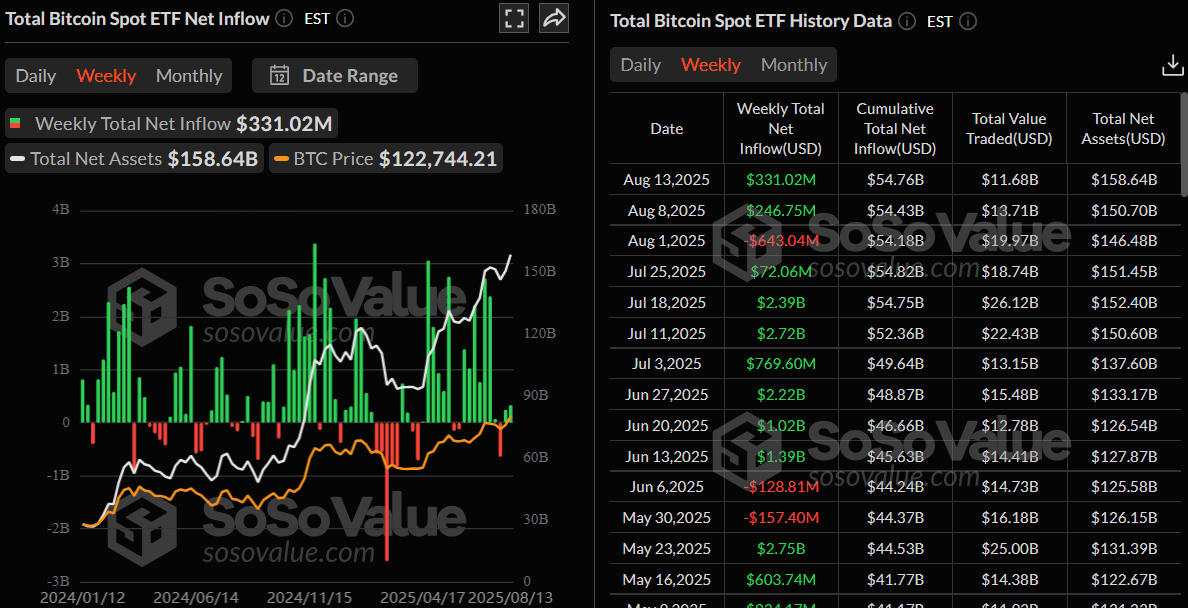

SoSoValue data also shows that institutional investors have recorded a fresh inflow of $333.102 million so far until Wednesday, a little higher than the previous week but still less compared to that seen during mid-July, when BTC price reached a similar level.

Total Bitcoin Spot ETF Inflow weekly chart. Source: SoSoValue

Profit booking could cause minor dips in prices

CryptoQuant’s Net Unrealized Profit/Loss (NUPL) for BTC stands at 0.57, indicating that market capitalization is more than double the realized capitalization. This suggests that most moved coins are in profit, and the large gap between realized and market value could create selling pressure, potentially causing dips in BTC prices.

(1)-1755167021440-1755167021442.png)

Bitcoin NUPL chart. Source: CryptoQuant

Bitcoin Price Forecast: BTC hit record highs of $124,474

Bitcoin price closed above its key psychological resistance level at $120,000 on Wednesday and surpassed the previous all-time high (ATH) of $123,218 set on July 14.

If the $120,000 level holds as support, it could extend the rally toward its 141.40% Fibonacci extension level at $127,493 (drawn from the April 7 low of $74,508 to the May 22 high of $111,980).

The Relative Strength Index (RSI) on the daily chart reads 62, above its neutral value of 50, indicating that bulls still have room for upward momentum. The Moving Average Convergence Divergence (MACD) indicator showed a bullish crossover on Monday, giving a buy signal.

BTC/USDT daily chart

If profit-taking increases and BTC fails to find support around its key level at $120,000, it could extend the decline towards the next daily level at $116,000.