Mt. Gox repayment is in its final stage now. The insolvent exchange has tied up with 5 crypto exchanges to process the repayments for creditors since the 2011 hack. These exchanges include Bitbank, BitGo, Bistamp, Kraken and SBI VC trade, a Japanese exchange. Out of these 4 have already received and paid to most of the creditors. BitGo is the last one to receive. Let’s explore what is happening with Mt. Gox repayment.

BitGo received last installment

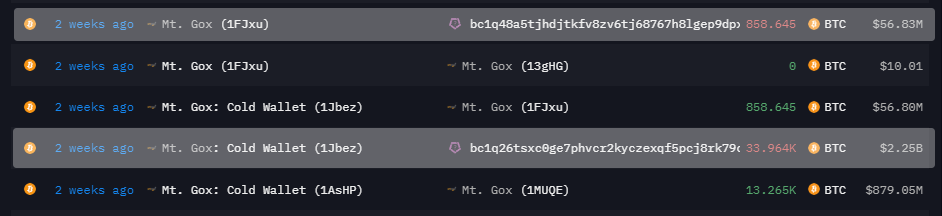

Two weeks ago, Mt. Gox has made a payment of 34,822 BTC towards two bitcoin wallet addresses bc1q4…ft36 and bc1q2…mw3f. These wallets received 858.645 BTC and 33,964 BTC respectively. According to the Arkham platform, these wallets might belong to BitGo crypto exchange. However, there is no confirmation of this information as of now. The wallets are dormant after doing test payments.

Creditors broke market speculations

On July 5, when Mt. Gox announced its plan to start repaying to the creditors the market was filled with fear. Experts believed the receivers will start to sell off right away. These thoughts in the market cause a semi bearish trend in Bitcoin, which in turn caused panic in the market. Along with the German government selling the seized bitcoin, the creditors selling speculation was the major reason the market plummeted. Around $3.2 billion in Bitcoin has been paid back to the creditors, almost 127,000 people did not sell off.

The Repayment Plan

Mt.Gox has to repay around $9.2 Billion worth of Bitcoin to its 2011 creditors. This repayment is made in the form of Bitcoin and Bitcoin Cash. The court appointed trustee looking over Mt. Gox bankruptcy case announced this information on July 5. The creditors are posting confirmation of received repayments on Reddit. Some people have even published issues regarding crypto exchanges not releasing their payments. Those exchanges have cited verification reasons for their actions.

Looking Ahead

With this last payment of around $2 Billion, Mt. Gox is going to be debt free. It took them 11 years to reach this stage. The market is now relaxed as the creditors are not selling their BTC. As per industry experts, most of these people have learnt the real value of Bitcoin after waiting for a decade to get back their investments. It would not be wrong to say that these creditors are the real diamond hands even though they did not have their investments in self custody. It would be interesting to see the actions of upcoming payment receivers. Will they hold their Bitcoin or do a sell off?